Pent-up demand remains a key driver for the tourism sector.

As different regions of the world see different recovery levels and travel restrictions remain volatile, using Big Data to track travel patterns and consumer travel sentiment will be key for travel retail brands looking to identify emerging pockets of recovery, or even growth.

UK trailing behind EU recovery

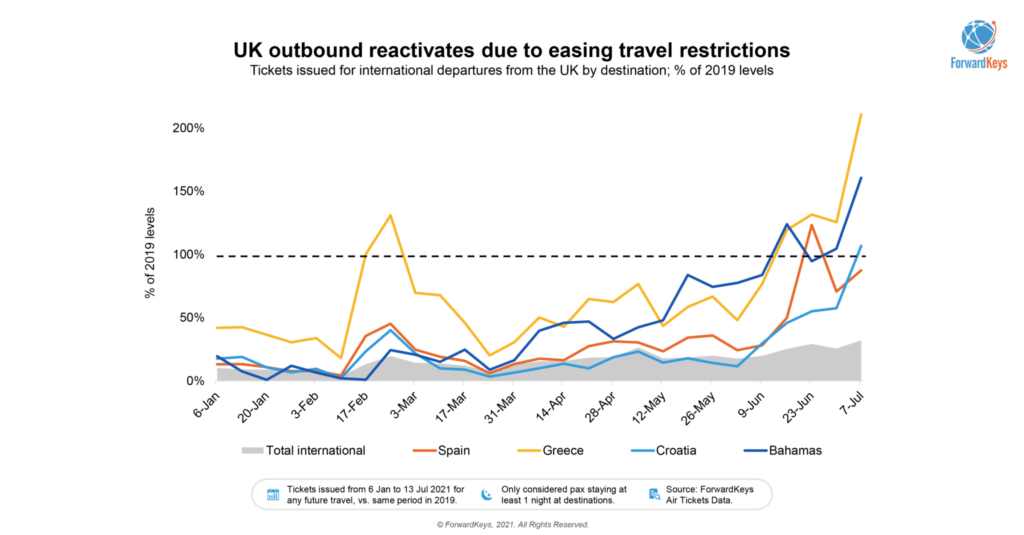

What is the impact of the UK government’s decision to lift quarantine requirements for travellers coming (back) from amber list countries? This question has been posed by flights booking data specialist, ForwardKeys, that tracks Europe’s key tourism destinations. It says there is a clear link between the ease of travel restrictions and the rise in bookings from the UK.

Weekly tickets for future travel from the UK to traditional destinations have exceeded pre-pandemic levels with Greece on top, at 211% of 2019 levels. Croatia has also reached pre-pandemic weekly ticketing levels in the last week (107%) while tickets for travel to Spain, at 88% of 2019 levels, are fast increasing.

ForwardKeys reports that the highest week-on-week increases for outbound UK international flights (in the week to 13 July), are for bookings to Germany (up 113%), Croatia (up 69%), Sweden (up 68%), Portugal (up 65%) and Albania (up 64%).

Does this come too late to save the summer season? Probably. This uptick in European destinations bookings is likely to be too late the save the summer leisure travel season, says Olivier Ponti, VP of insights for ForwardKeys. “Nevertheless, it is a positive development for many travel businesses, and as we haven’t shared many good pieces of news recently, let’s see the bottle half full rather than half empty.”

EasyJet chief executive Johan Lundgren told the Financial Times: “You can definitely see Europe is leading the way out of this, and the UK unfortunately is falling behind.”

Currently EasyJet’s UK bookings are lagging behind those in Europe. Usually, its business is split evenly between the UK and Europe – at present two-thirds of its bookings come from continental Europe. EU passengers are now able to use a digital Covid19 passport to cross borders, which is in contrast to UK regulations, that do not comply and involve a variable country traffic light system with associated (costly) testing requirements.

Lundgren questions the UK travel restrictions, which are based on a classification for countries by Covid-19 risk. “You have to suspect there is a different approach and different risk willingness when it comes to travel compared to reopening the domestic economy,” Lundgren tells the FT. “You can go into a nightclub with no restrictions whatsoever, but you can’t travel to a low-risk destination to go to the beach without having to take expensive testing, it just doesn’t make any sense.”

DMOs look to Big Data to flex traveller offers

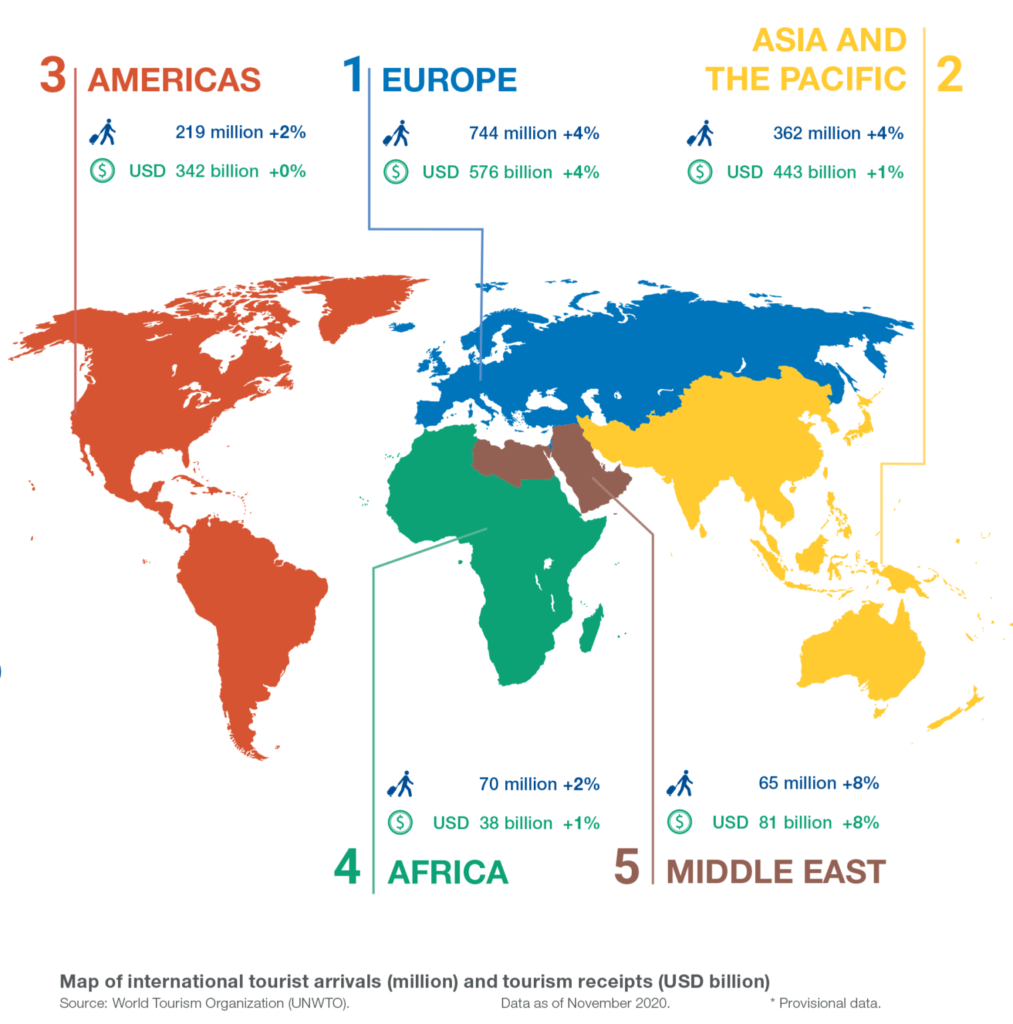

Travel data analytics is becoming increasingly critical for Destination Marketing Organisations (DMOs), who now need to target diverse and varied passenger demographics to understand where their customers are coming from.

With this in mind, DMOs in the tourism sector are looking to focus on more targeted source-market campaigns. These could include marketing campaigns offering packages sorted to visitor’s likely interests or passenger profiles, to focus on driving new visitors from different source markets, suggests ForwardKeys that has partnered with the UNWTO on a new initiative to showcase tourism recovery through data sharing.

“They (DMOs) can identify their potential customers while increasing the efficiency and the quality of services given at every stage in the planning process and customer journey. Big Data can also be used as a predictive tool to forecast which new products, hotels, and tours might work well in their destination,” says Emilio Iñes Villar, VP of Destinations at ForwardKeys.

Innovation and adoption of technology have made it feasible to give real-time insights into what travel brands and tourism organisations need, the overall growth of the business, and competitive performance in the market.

“What we can expect from the future is that smart cities and key tourism players will increasingly use Big Data to their advantage. This will truly revolutionise what cities and destinations offer to their international traveller arrivals and local residents alike. With initiatives around the globe, intelligent travel is the way of the future for tourism,” concludes Villar.

Translating pent-up demand into actionable insights

Navigating different region’s challenging travel restrictions and anticipating consumer pent-up demand for tourism will be critical for travel retail brands to plan ahead for recovery. For marketeers, knowing where and when travel is likely to resume allows for cautious campaign planning.

According to Adara, a travel intent data specialist, in Asia travel consumers have high levels of pent-up demand. The firm cites a global survey by Collinson Group that indicates 77% of travellers in Asia are ready to fly in the next 12 months and, despite Asia’s lower vaccination rates compared to the US and Europe, nearly 80% of these travellers have growing confidence in the safety of air travel as vaccination programmes in countries such as Singapore and South Korea ramp up.

Adara has seen an increase in travel booking searches to Asia countries with little to no shift in booking numbers. For example, international routes bound for Bali are showing signs of growing demand, as evidenced by a strong increase in search volume between 24 May to 22 June, especially from flight routes originating from destinations like British Columbia, Canada and San Diego in the US.

Canadian-based travellers in particular have shown a strong increase in interest with the market share of international travel to Indonesia up by 178%. Meanwhile, domestic travel in Indonesia saw an 18.8% growth in volume of searches between 24 May to 22 June, and bookings are up by 27.4% compared to the previous 30 days. This all suggests strong travel intent and growing signs of pent-up demand amongst consumers.

“Consumer behaviour and preferences will change depending on which phase of travel recovery their respective country is at. These new, disparate demands will require different strategies to market to target audiences,” says Carolyn Corda, CMO and CCO of Adara.

US on a roll

The upward trajectory of the US travel market was continuing as summer vacation season kicked off, according to Skift. Research from the travel insights firm shows the number of Americans who travelled jumped to 42.3% in May, 2 percentage points higher than February 2020, before the pandemic hit. The organisation finds domestic travel is the leading driver for tourism in 2021 and against a backdrop of volatile international travel restrictions (the US has just extended its travel ban for Canadian and Mexican land borders until 21 August), Skift suggests the US is on track to have one of the strongest summer travel seasons on record.

One pocket of international growth in the Americas has been Latinos travelling into the US to get vaccinated – especially from Mexico.

Numbers of travellers started to increase in March and April, when flight prices from Mexico to the US rose an average of 30%-40%, according to Reuters that reported there were ‘thousands’ of Mexicans and Latin American nationals who hold US visas who have travelled to the US for vaccinations. They made a trip of it and stayed for a week or more. Top destinations have been Houston, Dallas, Miami and Las Vegas. Also New York, further to the city’s strapline: “Welcome to New York, your vaccine is waiting for you! We’ll administer the Johnson & Johnson vaccine at iconic sites across our city,” as per the government’s Twitter announcement in early May.

Echolution takeout:

While industry projections on the recovery rate of international travel are varied over the next two to three years, according to a Collinson and Capa survey, the issue of pent-up demand remains a key driver for the sector.

Echolution has a strategy of continuing to innovate around data partnerships to fuel a better viewpoint of the travel industry’s recovery. With the support of new partners across flight bookings, NDC collaborations as well as payment providers and media consumption habits, we are able to have a continuously updated view of traveller behaviours.