Where are Chinese travellers shopping now? At home. Or in Hainan.

Hainan is shaping up to be a beacon for domestic travel retail recovery in China, as the sub-tropical island resort plays host to the country’s inaugural International Consumer Products Expo and tourists flock to the duty free shopping hotspot in time for the Labour Day week-long holiday.

The Chinese government’s strategy to make Hainan into a Free Trade Port and duty free shopping hotspot is a long term plan. Even in a post Covid-19 world, the structural repatriation of luxury sales growth to mainland China will prevail, writes analyst Erwan Rambourg for Jing Daily.

Hainan sweetens the deal, says Rambourg as consumers are able to get the benefits of duty free shopping while staying at home, which is supportive to luxury consumption in mainland China during major travel holiday periods such as Chinese New Year, Labour Day and Golden Week. However, “Hainan’s continued success could also put additional pressure on other markets that previously relied on mainland Chinese luxury consumption, notably Hong Kong, Macau and Europe.”

Major duty free retail operators, Lagardère Travel Retail, Dufry Group and DFS Group have moved fast on the Hainan expansion opportunity, with all three players opening destinations on the island between December 2020 and January 2021.

For example, LVMH’s DFS and partner Shenzhen Duty Free Group opened the first phase of their new downtown duty free retail complex in Haikou Mission Hills. The complex, located within one of Hainan’s largest and most popular leisure resorts, will be completed in phases over the next two years, eventually spanning over 30,000 sq m. The mall-style complex boasts the largest beauty hall in DFS’ global store network, according to DFNI.

Ralph Lauren and Coach are among the luxury brands that are doubling down on Hainan, with Ralph Lauren calling it a ‘strategic priority’ for growth, according to Business of Fashion.

While some luxury brands are wary of investing in their own retail spaces in Hainan, due to the state-owned wholesaling requirements, the domestic Chinese sales opportunity is looking good there for the next few years at least, according to a Financial Times report.

Beauty and cosmetics products account for almost half of all duty free sales in Hainan, according to Bernstein Research, while luxury goods make up about one-third of sales. But the latter are growing rapidly with the number of luxury brands on the island up 80% in the past six years. “We expect more are going to come,” Bernstein analysts report.

Rocketing sales

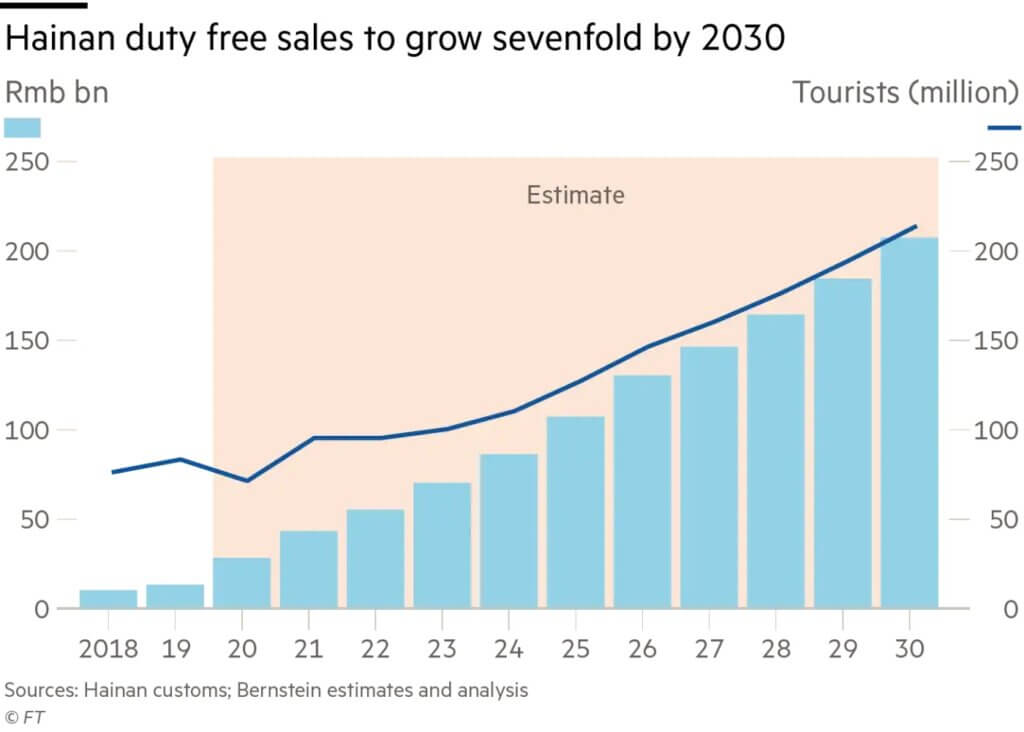

According to China retail market analysts at UBS, Hainan’s duty free sales more than doubled in 2020 from the previous year to $4.6bn and the firm forecasts a compound annual growth rate of 40% from 2019-25.

As an island resort, Hainan reports its own retail sales, which ‘rocketed’ to $736m in February, up from $568.5m in January, according to The Moodie Davitt Report, representing a record month.

Business was boosted sharply by the Chinese New Year celebrations, which saw duty free sales reach $216.5m in the peak period 11-17 February. Total sales, including duty paid items, reached $231.9m during the seven-day holiday, according to Hainan Customs.

828,000 shoppers visited the island’s duty free stores in the month, a quarter of them during the 11-17 February holiday period. Furthermore, average spend per shopper increased by 59% year-on-year to $889 in February, rising to $1075 for 11-17 February.

Domestic travel boom ahead of Labour Day holiday

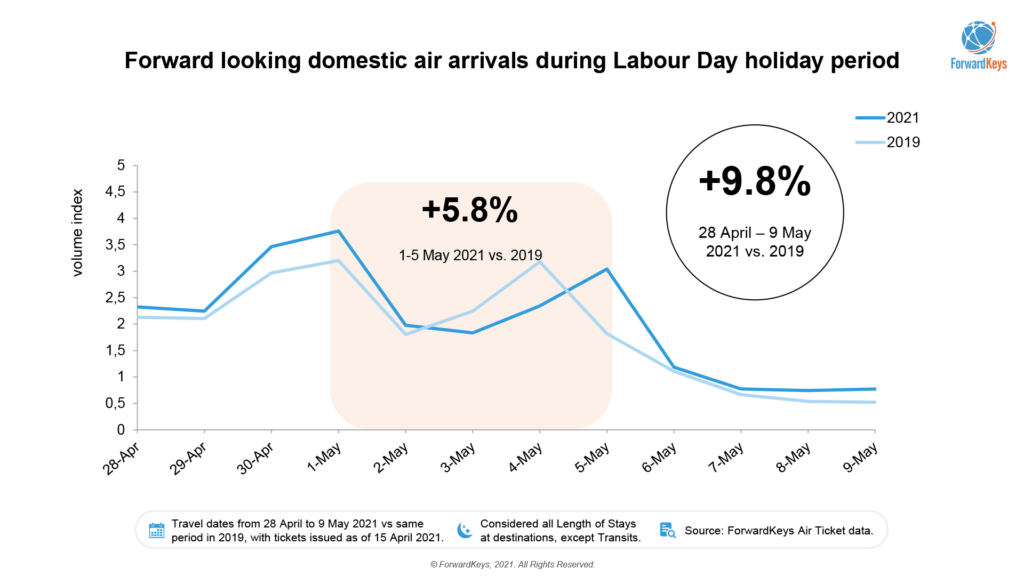

Chinese domestic travel during the forthcoming Labour Day holiday (1-5 May) is set to exceed pre-pandemic levels substantially, according to new research from travel data specialist, ForwardKeys.

Looking at flight bookings from mid-April, total tickets issued for the peak spring holiday period were 5.8% ahead of where they were at the equivalent moment in 2019. Bookings for the extended holiday period, 28 April – 9 May, were 9.8% ahead.

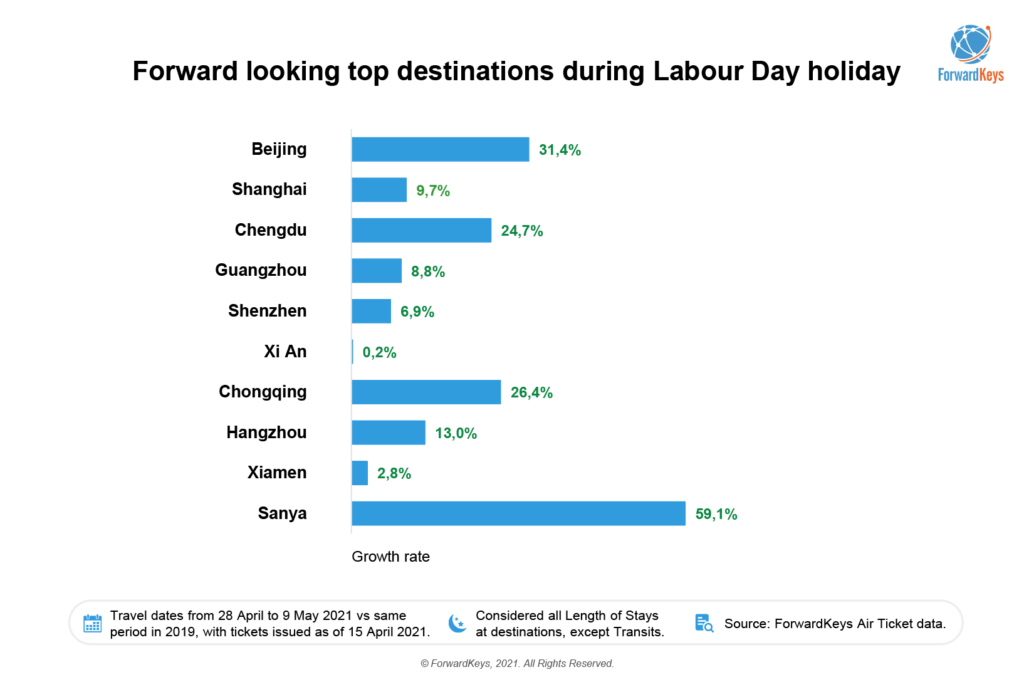

In particular, travel to Sanya, the key island resort destination, is proving exceptionally popular, with bookings currently 59.1% ahead of 2019 levels. Similarly, bookings to Haikou, the Hainan province capital, are 50.2% ahead of pre-pandemic levels for the same extended holiday dates, which have been five days for the past two years.

China’s capital, Beijing, and Shanghai, where Disney Resort is celebrating its fifth birthday with a ‘Year of Magical Surprises’, are also popular destinations for holiday travel this spring, with bookings 31.4% and 9.7% ahead respectively.

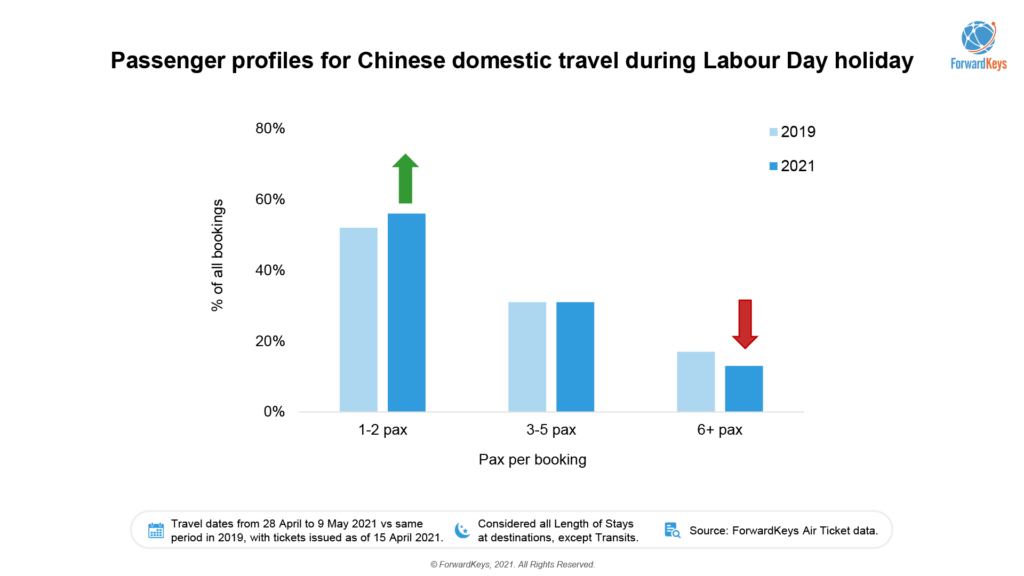

Another key insight from ForwardKeys is that fewer Chinese people will be travelling as part of a group this spring. An analysis of passenger profiles shows that the share of group bookings is down from 17% in 2019 to 13% in 2021. By comparison, the proportion of people travelling solo or in pairs is up to 56%, compared to 52% in 2019

In January, a resurgence of Covid-19 caused a substantial set back in domestic travel, with arrivals diving 69% compared to 2019, notes ForwardKeys.

However, containment of the disease and innovative travel promotions have stimulated a spirited revival. Surprise destination promotions, known locally as ‘blind boxes’, in which the traveller purchases a flight ticket to an unknown or surprise destination for a very cheap price ($10-15), have been a big hit.

Following the launch of plane ticket blind boxes by LY.com in March, more than 10 million people took up the offer in a sale coinciding with the Qingming Festival in early April, although not all purchases converted into flight tickets.

Other leading online travel agents, such as Ctrip, Fliggy and Qunar, followed suit in the third week of April and LY.com has recently completed a further round of blind box offers. The promotions have created considerable popular interest among young audiences on social media platforms, says ForwardKeys.

The firm also notes that while outbound travel is almost impossible for the Chinese, Macau has been an exception due to its bilateral agreement with mainland China for quarantine free travel. Currently, Labour Day holiday demand for the destination stands at 75% of pre-pandemic levels.

Olivier Ponti, VP Insights, ForwardKeys, says: “This year’s record-breaking Labour Day domestic travel is down to three factors: the release of pent-up demand, control of COVID-19 and imaginative marketing.”

Expo expectations

Expanding domestic consumption is a priority in China’s “dual circulation” economic strategy first highlighted by President Xi Jinping last May, which also called for a reduced dependence on foreign markets. As part of this localised consumption drive, Hainan’s Haikou city will host the first China International Consumer Products Expo from 7-10 May, organised by the Ministry of Commerce and Hainan’s provincial government.

Hainan has quickly developed into a domestic consumption and tourism hub and a beacon for international duty free development. A number of international luxury, fashion and beauty players including Tapestry Inc. (owner of Coach and Kate Spade), Swatch Group, L’Oréal Group and Shiseido have confirmed their participation in the inaugural China expo, alongside retailers Galeries Lafayette and LVMH-owned DFS Group, according to Business of Fashion. Besides domestic products, the expo will showcase consumer brands from 69 countries and regions including Japan, Britain and the US, with more than 200,000 visitors anticipated.

Echolution takeout:

While Chinese luxury shoppers remain firmly focused on domestic travel due to overseas travel restrictions, Hainan is a bright spot and brands present in its travel retail ecosystem look set to benefit from the sharp uptick in visitor numbers.

Reaching luxury shoppers in market will be crucial for brands to maximise travel shopping opportunities, especially for Chinese digital natives who plan their purchases and trip details via the likes of WeChat or Douyin in advance of travel.

Reaching the right demographic via the right social commerce channels with targeted geolocation activation tools will become increasingly important for brands that want to cut through the Hainan noise and provide convenient and engaging retail promotions.