For the Lunar New Year 2023 holiday period, Chinese tourists returned to travel in a big way after almost three years of zero-Covid restrictions were scrapped. It was mainly domestic travel, but intra-regional destinations also saw a surge in bookings. As this year shapes up to be a year of revenge travel and revenge shopping for Chinese tourists, are travel retail and luxury brands ready for a Q2/Q3 sales boost? And what are the post-Covid online sentiment trends to know?

Revenge travel is finally here

After nearly three years of isolation the Chinese can finally travel again. With both overseas and domestic trips now possible, further to the Chinese government’s decision in mid-December to dispense with its strict zero-Covid travel restrictions, more than 2 billion Chinese passengers were expected to travel over the 40-day chunyun Lunar New Year spring holiday period.

On 27 December 2022, Trip.com, recorded a 254% increase in mainland China’s outbound flight bookings compared to a day earlier. Flights bound for Singapore, South Korea, Hong Kong, Japan and Thailand led the surge, making them the top five tourist destinations following China’s decision to reopen borders. The outbound travel bookings continued to rise in the run up to the Lunar New Year spring holiday. Trip.com said between 26 December 2022 and 5 January 2023, search interest for outbound flights from mainland China increased by 83% compared to the previous two-week period, with outbound flight bookings increasing by 59% over the same period. Macau, Hong Kong, Taiwan, Thailand, Australia, Singapore, US, Malaysia, UK and Indonesia were the most popular forward bookings.

While nearby tourist hotspots Hong Kong, South Korea and Japan all play dominant roles in the roll out of revenge travel, the timing of when Chinese travellers will return to overseas travel is the big question for travel retail brands – especially as current flight itineraries are down by about 80-90% according to estimates.

On the eve of the Lunar New Year travel period, ForwardKeys reported: “forward bookings were 47% behind pre-pandemic levels but already 30% ahead of last year,” according to China Market Analyst Nan Dai.

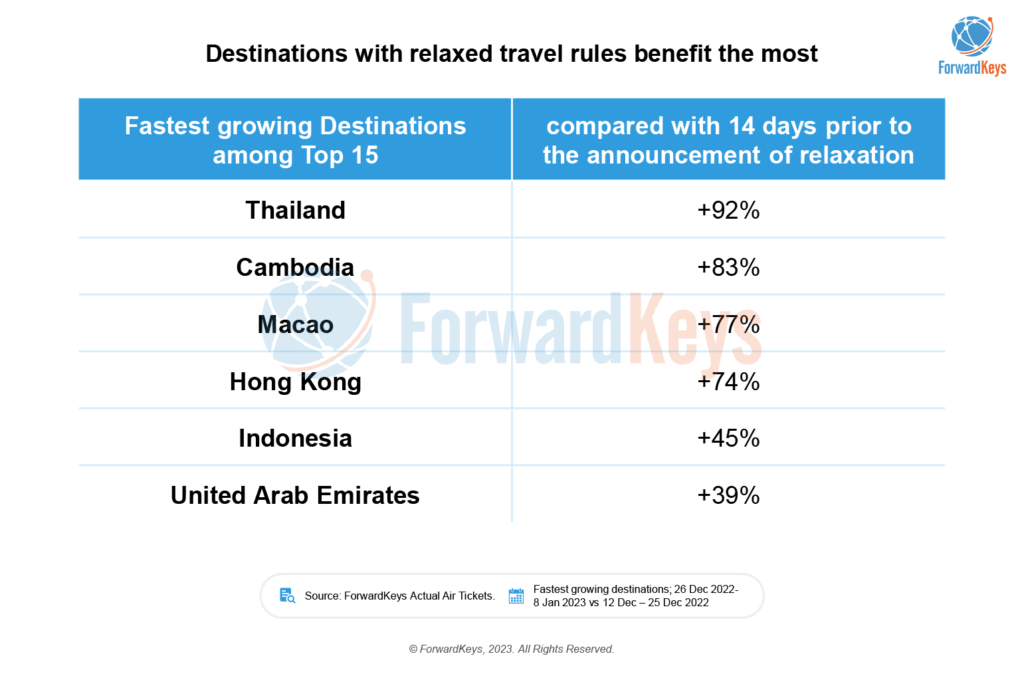

The pent-up demand remains high and in terms of outbound travel, Southeast Asian destinations are most likely to first benefit from the return of Chinese tourists. “All these destinations have relaxed rules for Chinese travellers. Arrivals from China will not be required to provide test results for COVID-19. Visa waiver to Indonesia, visa-on-arrival to Thailand, Cambodia, and UAE – all make it even easier to travel,” adds Dai.

However, the lack of flight capacity and high fares could be a bottleneck for China’s outbound travel recovery in Q1. “Current scheduled international flight capacity in Q1 is only at 21% of 2019’s level; it will be difficult for airlines to gear back up very quickly. We can expect more significant increases when airlines start to ramp up their schedules for the summer season starting from 26 March,” shares Dai.

“While recovery will start gradually in the first six months of 2023, it’s clear that outbound travel will really pick up in the second half of the year,” says Dragon Trail Market Research Analyst, Yelinuer Kadeerbieke. “42% of Chinese said they would travel outbound in July and August, with 32% planning an autumn Golden Week getaway outside mainland China.”

Revenge spending on the agenda for luxury brands

In the first six days of the Chinese New Year holiday, a total of 308 million tourism trips within China were made, data from the Ministry of Culture and Tourism showed. With revenge travel also came revenge spending; total revenue generated from domestic tourism during this year’s holiday stands at 375.8 billion yuan ($55.6 billion), a 30% year-on-year increase from 2022, and 73.1% higher than in 2019.

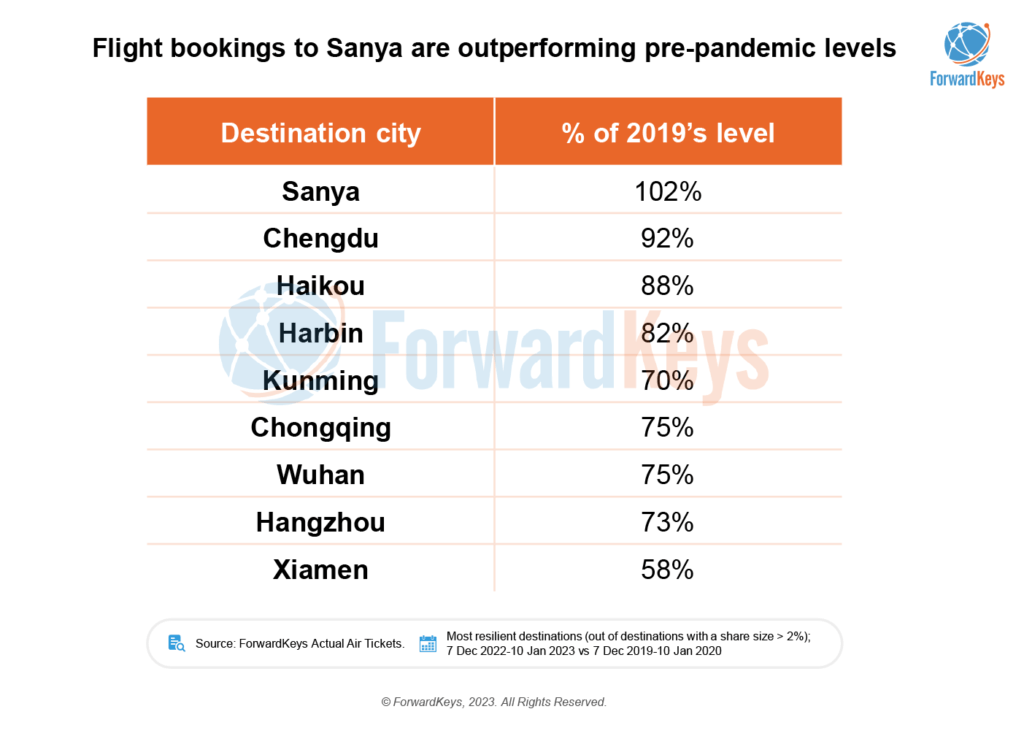

Mainland shoppers have flocked to local tourism hubs like Macau and Hainan over Chinese New Year and are expected to choose intra-regional destinations like Thailand and Singapore in Q1 and Q2 before returning in droves to European fashion capitals later this year – making Q3 and Q4 key marketing spend periods for luxury brands.

Luxury spending by overseas tourists is back on the agenda for LVMH. It posted record sales for 2022 in a market that is only just waking up to the prospect of Chinese travellers returning to international travel.

“There are green shoots in China,” LVMH CEO Bernard Arnault told analysts according to CNN. “In Macao, where Chinese can now travel to, the change is quite spectacular. Stores are full. It’s really come back [at a] very strong pace.”

Key malls like Shanghai’s Plaza 66 saw long queues form outside Chanel, Louis Vuitton and Hermès, as visitors made the most of the holiday with shopping sprees. At Plaza 66, the Louis Vuitton store’s total revenue reportedly reached 10 million RMB ($1.48 million) a day during the Lunar New Year holiday period according to Jing Daily.

Duty free sales across Hainan Island reached a total of RMB1.56bn (US$230.98m) over the seven-day Spring Festival (21-27 January), the latest data from Haikou Customs reveals. Tourism to Hainan has picked up and the island’s duty-free market is thriving, with overall sales increasing by 5.88% over the same period in 2022, the province’s customs department said.

Chinese: changing traveller tastes

Meanwhile, as Chinese return to overseas travel in 2023, their tastes and expectations have changed during the pandemic. This year, trends to watch include the desire for new experiences, new countries and new environments, but Chinese travellers have also emerged out of the last three years with a newfound consciousness for sustainable travel, health and safety, as well as more meaningful consumption.

Echolution takeouts:

Seasonal promotions give brands agency for Chinese travellers. As they start travelling again, they are looking for exclusives or limited edition products that they can research in advance and plan their trips to include shopping opportunities. These sought-after premium products – and associated promotions – provide an opportunity for brands to converse with discerning duty-free shoppers, such as Gen Z consumers like Xinyao Qiu.

While promotional shopping is a key component of the culture of Chinese travel, providing a discount or premium gift is one of the best ways to attract consumers, especially when the promotion is tied to a brand’s social media content. Brands can leverage their targeting power by flagging their latest campaigs on social media so that when travellers plan their shopping itineraries, which most do well in advance of departure, they are able to find the best propositions by location.

Skincare, cosmetics, fragrances, accessories and jewellery, luxury brands are all considered as must-have buys by frequent duty free shoppers, who are more likely to trade up to high-ticket purchases with promotional activity.

Rather than impulsive, 90% Gen Z Chinese consumers actually make considered purchasing decisions, according to research. They also value quality over quantity and would rather spend more on a particular item. That makes them just as price-sensitive as previous generations.

Qiu’s pro-promotions attitude represents nearly all Chinese tourists, in that she seeks exclusive products, good stock availability and the ability to research and make purchases in advance of departure. Brands that deliver on these consumer needs will be able to leverage and harness the upcoming revenge shopping trend from Chinese travellers in the coming months.

Luxury brands are increasingly looking to culturally relevant design partnerships that offer exclusive, more localised products and tap into the Guochao, or nationalistic-inspired trend.

“Brands should focus on how to engage with modern Chinese consumers in a meaningful and authentic way,” says luxury branding agency Hot Pot China. Deep insight and listening to local teams on the ground can bring exciting new angles to established brands, as well as cutting through the marketing noise that others have to wade through. Back in February 2022, luxury brand Moncler showed it knew how to do this through a design collaboration with Dingyun Zhang. Moncler entrusted a capsule collection to a rising Chinese designer, generating meaningful localisation in a way that resonated with its target audience. To do this takes great listening skills, cultural empathy and bold creative vision.”