Pent-up demand for leisure travel looks set to be a major catalyst for tourism’s post-pandemic recovery in 2022. Consumers are due to spend more on treating themselves to bigger and better holidays in 2022 and they’re looking for flexibility from booking platforms as expectations for trip planning have changed in today’s changeable market.

2021 saw a number of travel booking platforms invest in more sophisticated search and preference tools – to cater to new levels of interest and ever more diverse tourism trends. This means there are rich data available for traveller demographic profiling, while pre-trip search intent is more widely available for destination marketing organisations (DMOs) and brands looking to market to consumers earlier than ever before.

Greatest of All Trips (GOAT)

A GOAT mindset has emerged, according to Expedia’s latest consumer research, that finds travellers want their next vacation to be their Greatest of All Trips (GOAT), in pursuit of transformative and meaningful travel experiences.

Among the top GOAT characteristics uncovered by the 12-country report: respondents are planning to be more present and live in the moment (25%), immerse themselves in culture, splurge on experiences and seek out excitement, as they crave the feelings of contentment/ mental wellbeing (41%), gratification (35%) and excitement/ exhilaration (36%).

The pandemic made it difficult to travel or do anything on a whim, with 37% of US travellers admitting to being less spontaneous since the pandemic. While travel advisories and guidelines will persist for the foreseeable future, 26% of travellers are aiming to be more flexible and go-with-the-flow this time around.

After cancelled trips and postponed celebrations, travellers are ready to make up for lost time and go big to put themselves first. Over the next year, 40% of US travellers are more willing to treat themselves and spend money on their next trip. From indulging in luxurious experiences (15%), to upgrading on rooms or flights (16%) to visiting a bucket-list destination (32%), 2022 will be all about the splurge-cation.

The study also revealed that Gen Z and Millennial travellers (aged between 18 and 34) are the most likely to go big (80% compared to 56% of travellers over the age of 50), while Gen X travellers are the most likely to splurge on a high-end restaurant (18% compared to 16% overall).

Culture will play an important role in destination choices for travellers in 2022. Immersive discovery is on the agenda for American travellers, who are most prone to stepping outside their comfort zone (22%) and immersing themselves in a destination, culture, and experiences completely different to their own (19%).

From trying food they’ve never eaten before (40%) and experimenting with local delicacies (31%), to attending a local music event (14%) and seeking out off-the-beaten track experiences and destinations (23%), US travellers have a renewed curiosity to learn and experience the world.

In 2022, travellers aren’t just craving new tastes and places, they’re sensation seeking – they want to be excited and exhilarated once again (41%); with 11% willing to try daring or high adrenaline activities and experiences and 24% looking to have an unforgettable night out.

Additionally, when it comes to their next trip, one-fifth (21%) of travellers are most excited about doing things they would usually never do, including sleeping under the stars (19%), travelling alone (17%) skinny-dipping (11%) or having a vacation romance (10%). Travellers have been using Expedia’s “Adventure & Outdoor” filter to narrow down experiences that are focused on adrenaline-inducing experiences.

Unfiltered enjoyment is another key trend. A successful trip is no longer defined by likes on social media; rather devices are out, and traveller priorities are shifting to place a greater focus on staying present and mindful. More than a third (36%) of US travellers are searching for a sense of contentment and mental wellbeing on their next trip, and nearly a quarter (24%) plan to spend less time on their devices to be more present.

Value-economy

There is a new value-economy at play for travellers looking to renew their relationship with the experiences they receive from tourism. According to Expedia’s intent-themed report called Traveller Value Index: 2022 Outlook, after two years of enduring a global pandemic, people value travel and personal time more than ever.

Simultaneously, travellers have started to adapt to the realities of COVID-19, ranking flex travel at the top of their priorities and focusing intently on travelling for good, including taking steps such as choosing less crowded destinations to limit the effects of over-tourism. The report underscores the resilience of the industry and reveals how travel companies can adapt to achieve a competitive advantage in this rapidly evolving environment.

“Travel is about to experience a year unlike ever before as people plan purpose-driven trips, value vacation time more, and up their investment in unique experiences,” said Ariane Gorin, President, Expedia for Business. “Still, travellers are preparing themselves for possible trip changes as COVID-19 persists, and they want an array of options at their fingertips. Travel companies that prioritize safety and wellbeing, innovative solutions, and transparent communication will be the clear leaders as the entire industry shifts from survival mode into accelerated demand and growth.”

Surge in travel for personal wellness

The pandemic caused people to reflect on the importance of spending time with family and preserving their wellbeing. Most people (81%) plan to take at least one vacation with family and friends in the next six months, and the majority are seeking quick doses of adventure, with more than three quarters (78%) expressing an interest in frequent short trips.

Similarly, nearly half of all UK travellers (42%) are searching for a relaxing holiday to help their mental wellbeing following a stark rise in mental health issues over the pandemic.

New world of work will alter traveller priorities

As companies prepare to return to the office and evolve remote work policies, employees are looking to make greater use of their vacation time, and in some cases, combine work and play. More than half (56%) of those who often work remotely will take a “bleisure” style trip — extending a work trip for leisure, or vice versa.

Investment in travel to boom compared to pre-pandemic

More than half (54%) of respondents say they plan to spend more on trips than they did before the pandemic. Meanwhile, 40% plan to use loyalty points for at least part of a trip in 2022, with Gen Z in the lead.

People will travel more responsibly, with increased focus on sustainability

Over half of people (59%) are willing to pay more fees to make a trip sustainable, and 49% would choose a less crowded destination to reduce the effects of over-tourism.

Travellers will be on hunt for great deals and flexibility

The new value-economy comes to the fore in traveller communications. Value is emerging is an absolute must in the eyes of travellers. A large majority (84%) of respondents agree that a discounted fee is influential when booking a flight online. A nearly identical percentage (83%) say flexible fare options makes a world of difference.

Leisure travel intent

Leisure travel is back on the agenda for a majority of consumers across five major countries, according to Tripadvisor’s latest trends report, Travel in 2022 – A Look Ahead. It reveals that planned travel for the year ahead surpasses actual travel in 2019.

In the UK, 78% of respondents said that they are likely to travel for leisure in 2022, compared to 72% of those who said that they travelled for leisure in 2019. In the US, 2022 leisure travel intent is up 8% compared to 2019, with 71% saying they are likely to travel for leisure in 2022.

Singapore leads the way in travel optimism, with 82% reporting they are likely to vacation in 2022, up 2% compared to 2019. Australia (72%) and Japan (51%) are trending similarly, with those who are planning a leisure trip in 2022 up 7% and 5% from those who reported traveling in 2019, respectively.

Levelling up spend

Average spend per trip for 2022 is beyond that of 2019, as travellers look to level up their travel experience. According to the Tripadvisor report data, American travellers are expected to spend 29% more on their average trip in 2022 than they did in 2019. In Australia, average booking rates are expected to be up by 16% in 2022 against 2019. Singaporean travellers booking values are also expected to increase by an average of 7%.

Shifting from behaviour to sentiment, over a quarter of travellers in each of the five markets surveyed said it is more important now than before the pandemic to splurge on a big trip. In the US, roughly 3 in 10 Americans (29%) who travelled for leisure in 2019 said it’s more important now to splurge on a big trip. 28% of Singaporean and Australian travellers, 27% of Japanese travellers and 25% of UK travellers said the same.

People not places

According to a Google thinktank piece, search data trends revealed that tourism in 2021 focused on travelling for people rather than places (visiting friends & family became a primary motivator for travelling). This is echoed by tourism academic Fabio Carbone, who highlights that consumers are looking to travel more to visit loved ones than destinations.

Another of the Think Google travel motivators was ‘getting away’. After a dry period of travel, people are looking to disconnect from day-to-day life. With continuously changing restrictions, and ongoing hesitancy over long-distance trips, travel brands should be looking for opportunities to show how they can help people press the reset button and enjoy life’s simple pleasures via the trend for Slow Living.

With keeping up with global travel restrictions a continuous challenge, many travellers were looking for getaway destinations closer to home. Intent to travel domestically was a key driver, especially in Germany, Italy, Poland, Spain, Turkey, and the U.K.

Sustainable travel was already cited as a trend back in 2019. While 2020 saw far less travel than anyone could have anticipated, the green trend continues to grow. Google research shows that environmental responsibility may become a bigger focus for future travellers, as 42% of travel brands expect this to be an increasing need in their marketing.

Destination trends & traveller intent enrich marketing decisions

While the pandemic has fuelled a surge in e-commerce shopping habits, consumers have become more digitally-savvy and with it, their search habits have revealed new layers of travel intent – from spending thresholds to destination research and wellness drivers.

A number of travel technology firms have formed alliances, with their partnerships spanning data analytics opportunities to help destination marketing organisations (DMOs) and other tourism service providers predict traveller trends in advance.

Tech investments

Chinese online giant, Trip.com. has bolstered its flight search engine capabilities to boost its European bookings appeal and according to Skift, it’s a move that further highlights the powerhouse platform’s investment in back-end technologies.

“Western companies such as Hopper and Amadeus are lining up to sell enterprise tech solutions to Trip.com Group. That’s because the Chinese travel powerhouse is in a shopping mood. It sees back-end technology as critical for making further market share gains in Europe,” says the travel website.

Flexi-travel

Zeta Global, a cloud-based marketing technology firm has partnered with Adara, the travel insights specialist to create the Traveller Data Cloud. The new traveller intent insights platform combines Zeta’s profiling capabilities for more than 225 million American consumers with Adara’s first-party travel signals from over 300 global brands.

For example, according to Adara data, last minute hotel bookings made less than 15 days in advance for business travel have almost doubled since the beginning of 2021, and leisure travel for families continues to grow. The trend is expected to grow steadily in 2022, which is also supported by the International Air Transport Association’s July 2021 report, which revealed 57% of people expect to travel within two months of the pandemic’s containment.

“One pandemic side-effect was consumers’ speedy adoption of digital technologies which at the same time raised their expectations for personalized treatment,” comments Zeta. “People are longing to travel once again – and while some have already started after receiving vaccines, we predict consumer interest will soar to new heights in 2022,” says Eric Bamberger, SVP Travel and Hospitality at Zeta. “However, consumers will be pursuing flexible, often changing plans that require travel and hospitality brands to have a deeper understanding of each individual traveller’s unique needs.”

Global travel marketplace Skyscanner has launched a Travel Insight Vision business intelligence tool aimed at helping destination marketing organisations (DMOs) better understand the latest international travel trends.

The Destination Trends module offers a mix of historical data and forward-looking information about inbound travel trends. More than ever, DMOs need to be informed in real-time as travellers react to changes in restrictions and border policies, says Skyscanner.

The platform offers tools to predict inbound demand, evaluate changes to the inbound market mix at a country or city level, including differences in the most popular inbound routes and how these change over time.

For example, following the news that the US was re-opening its borders to travellers in November, the platform found that UK travellers made up 21.4% of inbound travel interest, Spanish travellers 6.2%, Italian travellers 5.5% and German travellers 4.3%.

Michael Docherty, Lead for Data Products at Skyscanner comments: “As the world begins to re-open and international travel is once again possible, it has never been more important for travel businesses – especially DMOs – to have access to reliable, trusted data to plan their recovery strategies and capture new or changing inbound demand. Traveller behaviour is not going to be the same as it was pre-pandemic, airlines are announcing new routes, travellers are increasingly interested in second cities and this behaviour will continue to evolve as we look ahead to 2022.”

ForwardKeys and flights search platform Kiwi.com have formed a data sharing partnership, to allow DMOs to tap into both parties’ airline booking trends insights.

“Our flight search data represents a daily refresh of a majority of search volumes made globally. What this means for DMOs is an eagle view of the current travel intent by region or country to their destination,” says Wouter Veenstra, of Kiwi.com.

“Kiwi’s global search dataset will fuel our new Destination Gateway product into a new dimension, allowing tourism organisations to finally quantify demand and intent,” says Laurens Van Den Oever, Chief Commercial Officer at ForwardKeys.

“They can now measure their performance, flight connectivity, plan their marketing campaigns based on travel preferences and intent of different source markets, and understand the travel recovery to their destination,” adds Van Den Oever.

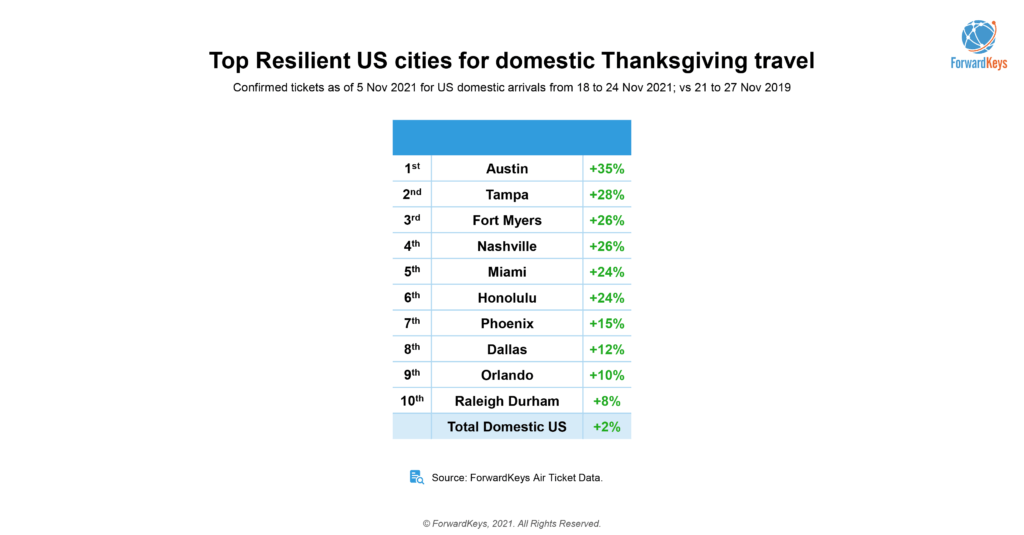

In November, domestic Thanksgiving travel was up by 2% on pre-pandemic levels, according to ForwardKeys data analysis that highlighted how three of the top five most resilient US domestic tourist hotspots – Tampa, Fort Myers and Miami – showed traveller demand for sun, sea and adventure locations. Austin, Texas was another Thanksgiving destination highlight, (up 35% on 2019 travel), which along with Miami as a popular destination, is in growing demand for winter sun staycations and/or relocation destinations among wealthy tech entrepreneurs who are working remotely.

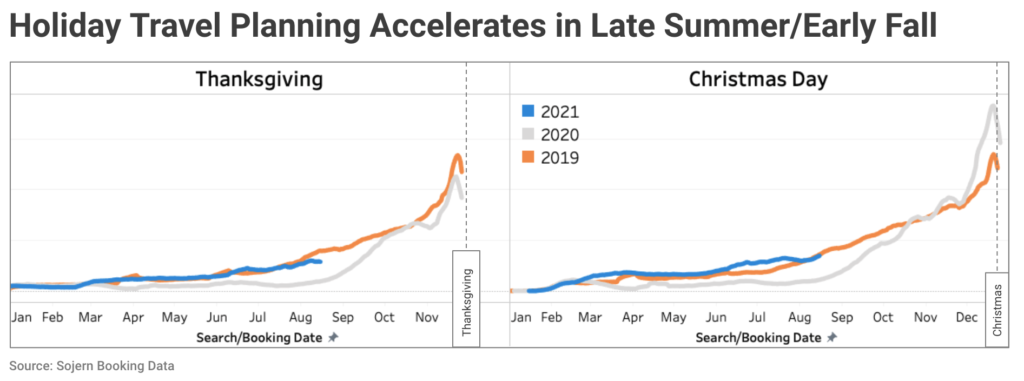

In September 2021, US travel insights specialist, Sojern reported that immediately following the Biden administration’s announcement to open the US for international travel in early November, airline booking searches for the Thanksgiving Holiday spiked. And this added a significant tailwind for traveller sentiment to search out travel plans (after an 18-month hiatus) from late summer and into the remainder of the year – Sojorn comments this was when the US tourism recovery gathered momentum.

“People really want to get out there, they are searching and booking. Their booking rates are similar to 2019, but their searches are far higher than 2019,” says Amber Kuo, director of travel insights at Sojern. “The travel demand is there.”

Echolution takeouts

Travel retail brands are looking for ever more sophisticated and personalised traveller profiling tools.

Echolution is equipped with a variety of technology options to support clients in unlocking the value of shopper or traveller data. By working with partners such as ForwardKeys, Amadeus, Sojern, Adara, Travelport and traveller booking platforms such as Tripadvisor or Trip.com, there are a range of consumer profiling tools available to marketeers.

Echolution’s tiered datastack approach transforms a number of these data sources into actionable targeting audiences – utilising brands’ own web and CRM data, alongside location data providers to provide niche and highly personalised media campaigns.

Through its exclusive partnership agreement with ForwardKeys, Echolution is able to combine targeted demographic profiling with traveller bookings data.

“ForwardKeys’ passenger traffic and flight bookings data enhances our view of the travel industry’s route to recovery and helps our clients plan ahead with a range of demographic insights at their fingertips. With the support of new partners such as ForwardKeys, we are able to have a continuously updated view of traveller behaviours,” says Echolution Partner, Eamonn Leacy.