European travellers are shifting to purposeful duty free shopping behaviours and prefer digital payments, according to market research from Pi Insight.

While they might be spending less time in-store, European duty-free shoppers have become more purposeful and promotion aware, since the beginning of the pandemic. Self-treating, gifting and promotional prices have all increased as key purchase drivers compared to before the Covid-19 pandemic, according to a recent research report from travel retail market specialist Pi Insight.

Pi Insight’s Recovery Series is a new regular shopping behaviour report that focuses on the in-store activity of recent European travellers, in a bid to better understand current airport shopping behaviours and how they have changed since the beginning of the pandemic.

The research, which includes reports for the top performing tax and duty-free categories Luxury, Beauty, Alcohol and Confectionery, consists of more than 7,000 quantitative interviews with consumers in the UK, France, German, Russia, Spain, Sweden and Turkey. The respondents are those who had travelled internationally between May and October 2021.

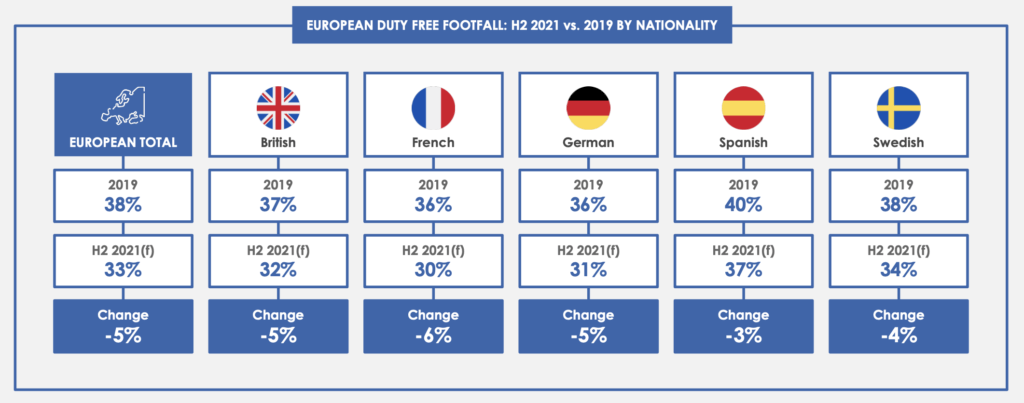

An elevated duty free footfall challenge is anticipated across each of the core European nationalities in the coming six months, with footfall reductions being anticipated across each market, reports Pi Insight.

Pi Insight says the findings highlight a mindset shift from travellers who were previously passive shoppers (in 2019), to ones who are now more direct and purposeful in their shopping mentality (in 2021).

There are a number of drivers that travellers listed as the key reason for visiting a duty free store:

- To treat myself: 44% vs. 30% in 2019 (+14%) (also now the #1 visiting driver overall)

- I was looking for a gift: 29% vs. 20% in 2019 (+9%)

- To take advantage of airport prices: 38% vs. 31% (+7%)

- To look for any promotions / good deals: 30% vs. 23% in 2019 (+7%)

- To look for a souvenir/regional/local product: 20% vs. 14% in 2019 (+6%)

- To look for new products: 24% vs. 18% in 2019 (+6%)

A more impulsive shopper

The report highlights a more impulsive mindset for duty free shoppers in 2021. Despite a more purposeful mentality, respondents said their purchase planning had decreased, with impulsive purchasing now accounting for 60% of duty free shopping items.

For those travellers that do plan ahead of their duty free shopping trip, (32% have an existing duty free purchase intention), planning to a brand level has also decreased to half of shoppers as opposed to 81% of planned buyers in 2019. Pi Insight says this illustrates an increased openness to influence in-store and a clear potential for brands to influence the purchase decision process when shoppers are deciding what to buy.

In-store behaviours: expected time in store

There is likely to be a fairly significant impact on the amount of time spent in store among European shoppers travelling within the next six months, with 2 in 5 expecting to spend less time in store vs pre-Covid. Frictionless purchases options and ease of shopping will therefore be key, says Pi Insight.

40% of European shoppers expect to spend less time in store than they did when travelling before the Covid-19 pandemic, vs 8% who expect to spend more time in store.

The majority (53%) of European shoppers over the coming six months will be open to staff interaction, although some caution does remain with 44% only being willing to interact if really necessary.

Increased digital in-store habits

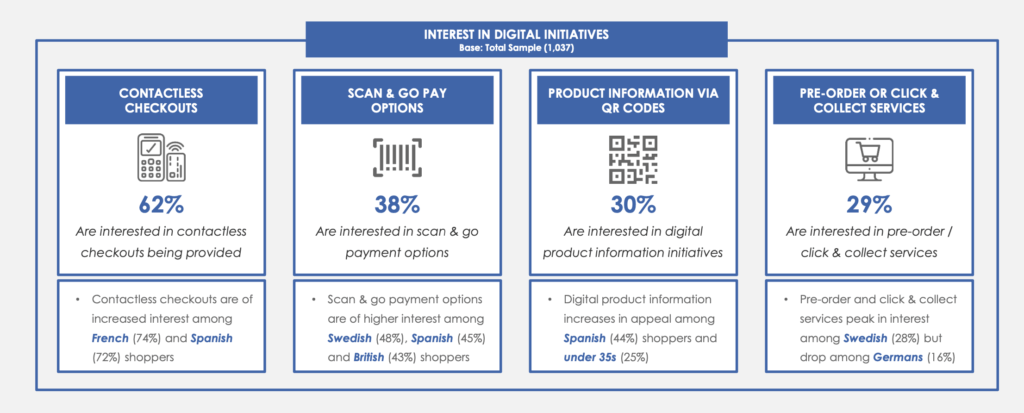

Digital in-store initiatives have the potential to drive reassurance and appeal among upcoming European shoppers with those focused around payment options driving the highest rates of interest.

Digital in-store initiatives drive high appeal among upcoming European shoppers, with digitalized and contactless payment options driving the highest rates of interest.

- 62% are interested in contactless checkouts being provided; of these, the highest appeal was among French (74%) and Spanish (72%) shoppers.

- 38% are interested in scan & go payment options; of these, the highest appeal was among Swedish(48%), Spanish (45%) and British (43%) shoppers.

- 30% are interested in digital product information initiatives; of these, the highest appeal was among Spanish (44%) shoppers and under 35s (25%).

- 29% are interested in pre-order / click & collect services; of these, the highest appeal was among Swedish(28%) but dropped among Germans (16%).

European traveller data update

It its latest intra-European traveller insights report for November, ForwardKeys has reported increasing levels of tourism recovery. However, this month, as the UK’s spike in Omicron variant cases causes fresh concern over travel restrictions across the Continent and beyond, the travel industry will be closely monitoring the data.

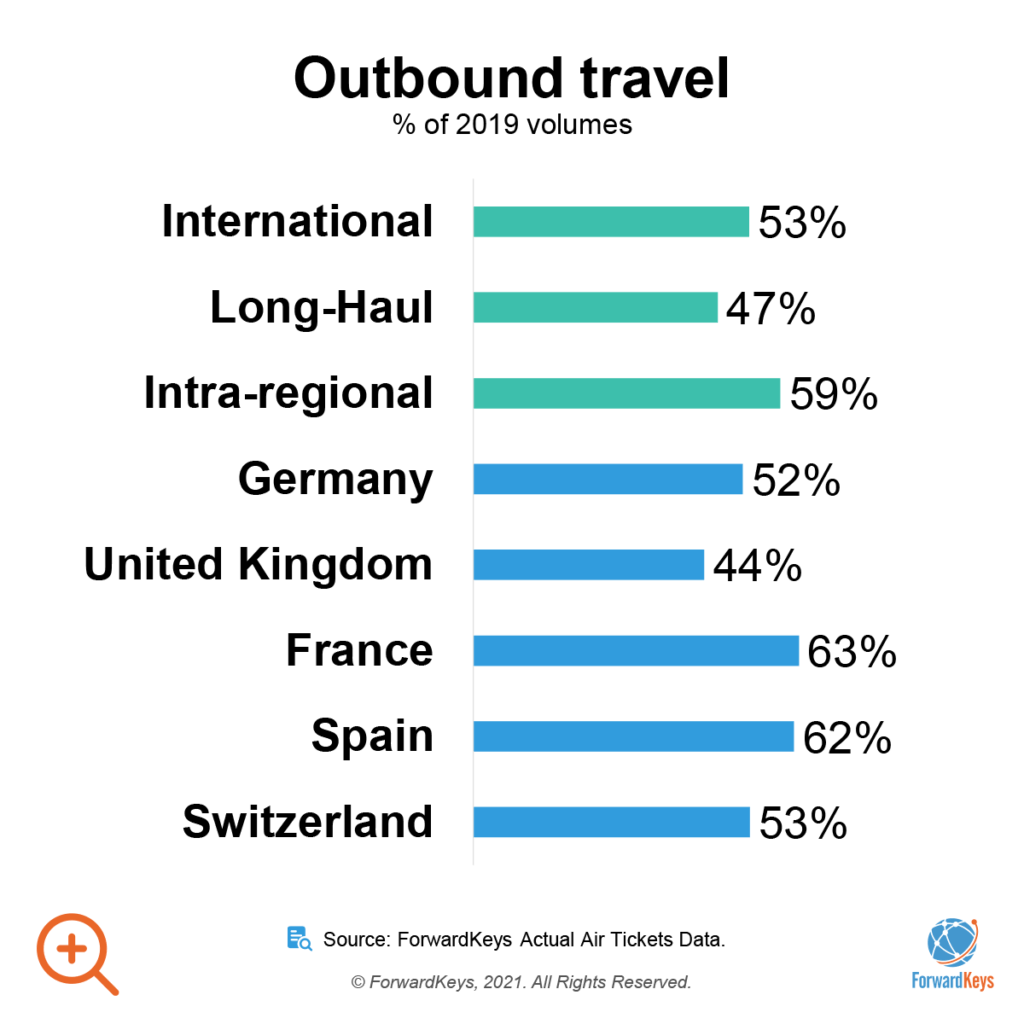

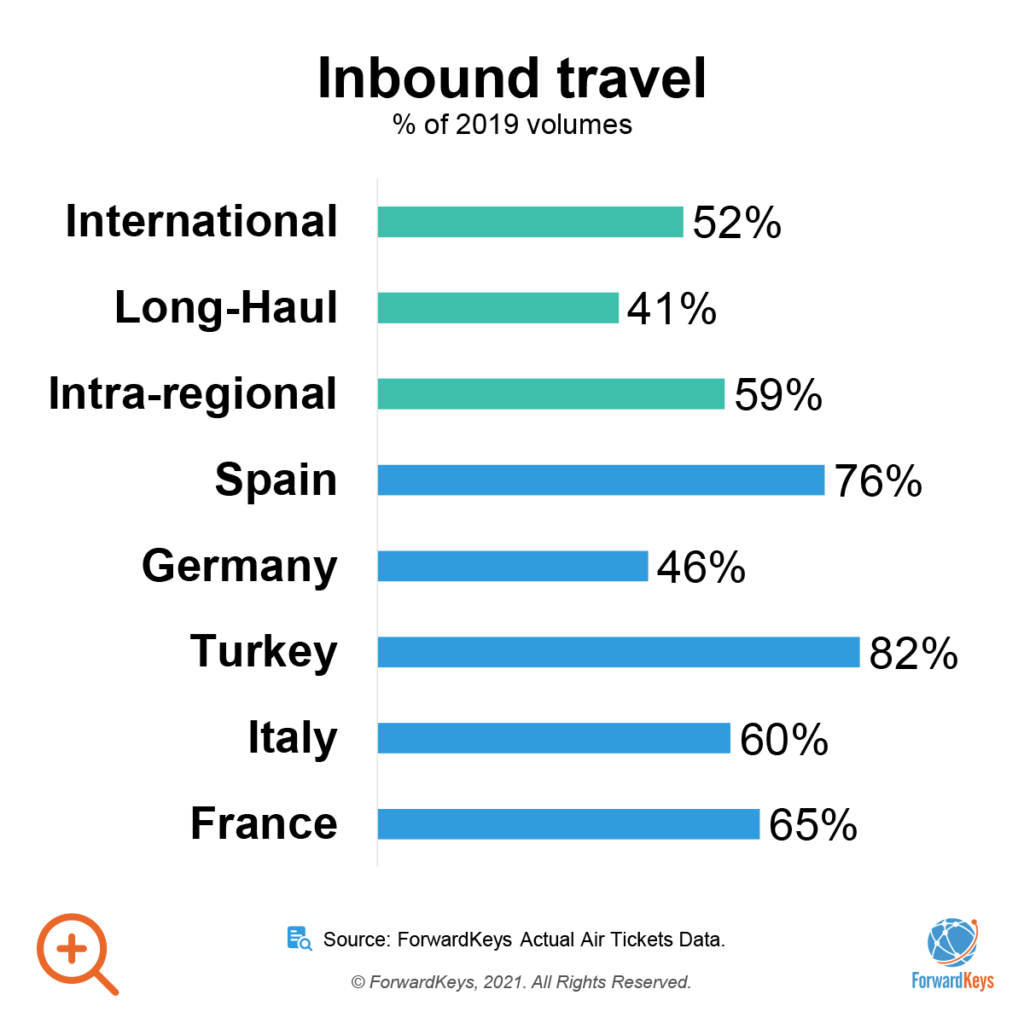

- Over 50% of inbound and outbound travel in Europe have recovered, although the question is if governments will introduce new travel restrictions as a reaction to the new Omicrom variant.

- Outbound activity from top markets showing lower recovery levels than inbound activity for top destinations.

- Intra-regional business travel has returned earlier than expected, already being back at 55% of 2019 levels.

Echolution takeouts:

European travellers indicate their duty free shopping habits are becoming more targeted and they are more open to digital payment options, paving the way for brands and retailers to provide more digital interaction in-store.

Digital marketing can help drive frictionless shopping behaviour and as more brands turn to omnichannel solutions, targeting travellers pre-trip and in market is an increasingly effective way to drive conversion in-store.