Will recent global travel restriction easing measures bring tourism recovery – and when?

The news of Singapore and Germany’s Vaccinated Travel Lane (VTL) agreement, launched 7 September, signals a new era for post-pandemic global travel. And combined with the newly announced easing of restrictions between the US and Europe, for early November bookings, there are strong indications that we will see recovery happening as early as Q4 2021 and into 2022.

Flights bookings expert and Echolution partner, ForwardKeys has revealed a set of encouraging travel data analytics that showcase strong pent-up demand for air travel in the Asia Pacific region.

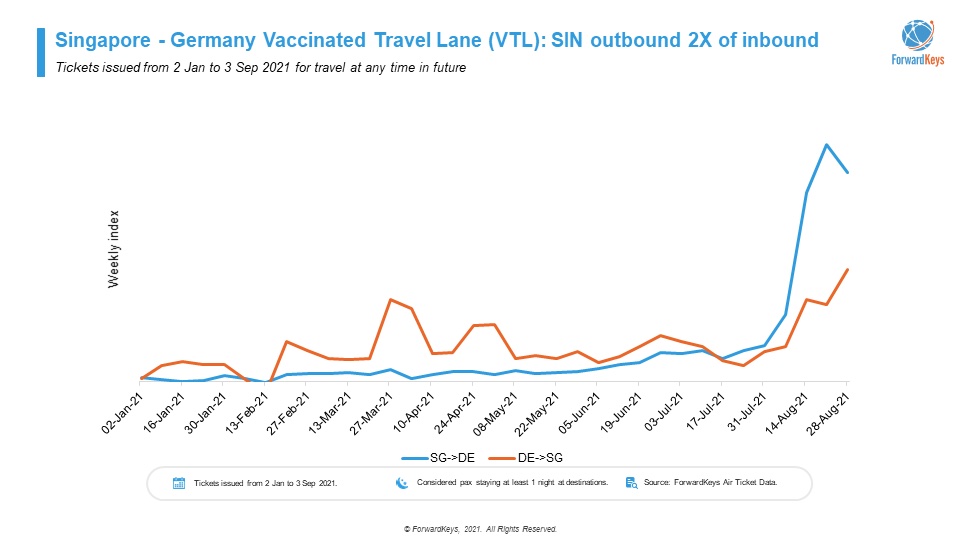

When examining the air tickets issued between the announcement day on 19 August and 3 September, demand for travel from Singapore to Germany was 135% higher than from Germany to Singapore.

Forward bookings from Germany to Singapore reached 18% of those issued in the same period in 2019, while in the other direction the data shows bookings are at 93% of 2019 levels.

“We had observed similar lopsided demand when the Australia-New Zealand ATB launched in April earlier this year, with almost three times as much travel going to New Zealand than the opposite direction,” said Jameson Wong, Vice President Strategic Clients & Partnerships APAC at ForwardKeys.

“However, while that initial rush was primarily due to returning New Zealanders residing in Australia, the Singapore to Germany air bookings reflect a considerable amount of pent-up demand from the leisure segment. For both directions, around 70% are return tickets, indicating a sizeable pie of short-term visitors,” added Wong.

According to some media, the new VTL is a blueprint for how international travel can resume safely.

Singapore outbound is 2X of inbound and leisure-charged

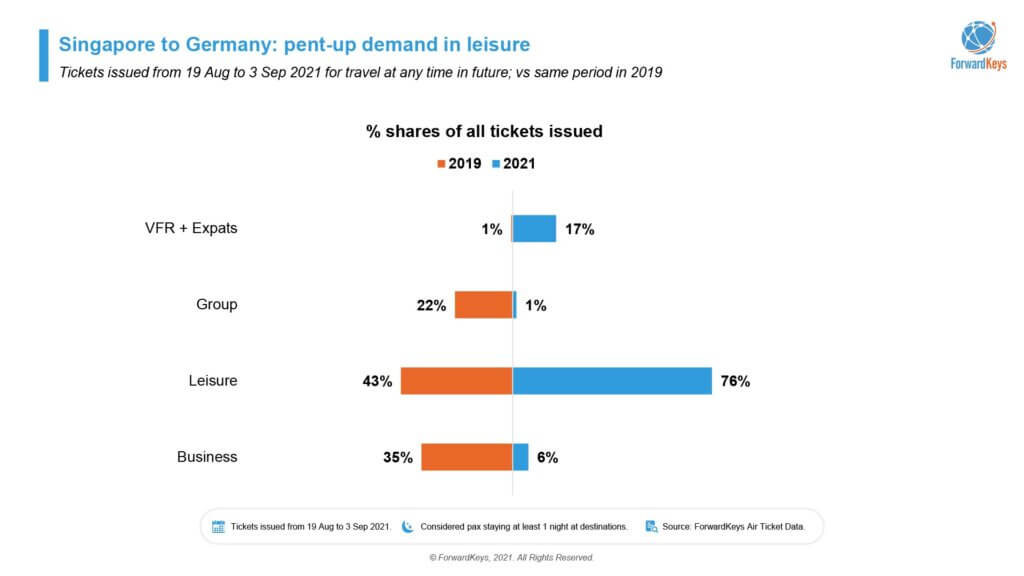

ForwardKeys reports that the biggest proportion of travellers making forward bookings from Singapore to Germany, are leisure travellers, accounting for 76% of all travellers – up from 43% in 2019.

“From quarantine-free fine prints, traveller confidence, timing, clarity of information, the attractiveness of the destination to the ease of making travel arrangements, the stars seem to be well aligned for the long-haul, outbound leisure travel to truly restart,” commented Wong.

The share of tickets issued directly with airlines has grown four-fold, 88% now versus 22% in 2019, revealing the control and assurance that travellers need, as they re-embrace travel and juggle the ongoing, moving pieces.

Ema Mandal, ForwardKeys Insights Specialist, commented that interestingly, the average length of stay for leisure travellers has grown by 2 days from 13 days in 2019 to 15 days.

“We thought the metric would have lengthened significantly given the prolonged halt on long-haul. But it seems the travellers from Singapore to Germany are ‘warming up’, playing it safe and have not yet started to take advantage of the fact that one can take domestic flights within Germany without affecting the return VTL eligibility, which could have driven up the length of stay,” Mandal said.

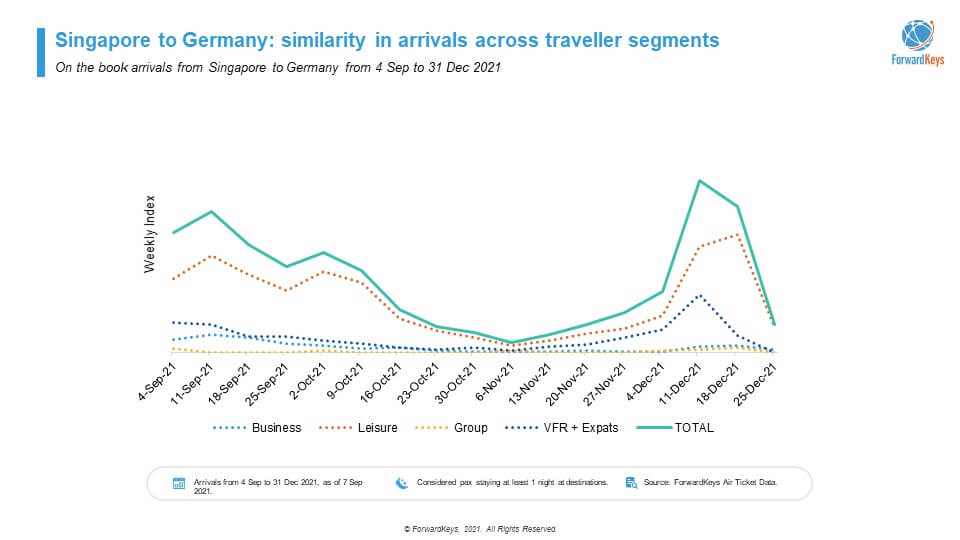

A closer look at seasonality reveals some similarities in travel patterns across the main traveller segments. Arrivals started to increase from 8 September when the VTL agreement started, but taper off in early November and subsequently pick up again when the school holidays commence from 20 November, peaking into December, just in time for the Weihnachtsmärkte in Deutschland, or Christmas Markets in Germany.

New interest in the Singapore-Germany VTL route was also confirmed by Expedia, that said searches for travel from Singapore to destinations in Germany spiked nearly 10 times in the first week, compared to the monthly average, according to reports.

Interest was also high for travel from Germany to Singapore, the site said. “While Singapore was never a top 10 leisure destination for German travellers, it was interesting to see interest for travel to Singapore from Frankfurt and Munich jump by 70% in the last 24 hours,” said Lavinia Rajaram, APAC head of communications at Expedia.

Meanwhile Singapore’s status as a global travel hub has been strengthened due the VTL agreement, likely at the detriment of Hong Kong, where ex-pats and international businesses alike are rethinking their location strategy. According to this CNN report, some companies have been weighing the merits of Singapore over Hong Kong as a centralised Asian business hub, especially as Beijing has tightened its grip over Hong Kong and the Chinese city’s international borders remain virtually closed.

US transatlantic corridor set to open early November

With the news that the USA is to finally reopen its borders in early November to vaccinated international travellers from a host of countries, the crucial transatlantic market can fuel the beginning of a meaningful global travel recovery.

Fully vaccinated air travellers from 33 countries including China, India, Brazil and most of Europe will be able to book travel for arrival in the US from early November, according to the latest UK-US Covid Taskforce announcement.

This is the news that travel, tourism and aviation industries have been waiting for and they are delighted.

Lufthansa Group chief executive Carsten Spohr described the development as “a major step out of the crisis”, while IATA director general Willie Walsh called it “a major step forward”.

Market analysts at Bernstein describe the news as “a significant boost to sentiment” at Europe’s network carriers. “During 2019, 26% of IAG’s ASKs [available seat kilometers] were either to or from the USA, with 24% of Lufthansa’s and 16% of Air France-KLM’s capacity,” Bernstein says, highlighting the importance of the transatlantic market to those airline groups.

Back in mid-August, there were early signs that US-UK travel was starting to resume, according to the Times when American-based low-cost airline JetBlue gave the transatlantic route a small vote of confidence by restarting its London Heathrow-New York JFK flights; while around the same time, Virgin Atlantic noted there was pent-up demand just from the US side, with bookings from JFK increasing 250% week-on-week after the 2 August easing of restrictions into the UK.

According to seat capacity analytics firm, OAG, a $1.5bn annual revenue opportunity has just come back on tap, starting with the profitable Holiday period in Q4 2021.

Echolution takeout:

These two major travel restriction breakthroughs are the catalyst that travellers and the tourism industry have been waiting for. They indicate a slow and steady return to pre-Covid travel booking levels and provide a blueprint for how other countries can open up travel to international visitors.

In order for travel retail brands to effectively target global travellers as they return to the skies, and to capitalise on their pent-up demand for retail tourism, Echolution has a suite of programmatic media solutions that can help brands communicate their current marketing messages to the right demographics. The most effective campaigns start talking to passengers pre-trip – where are your customers travelling to and from?