With the US now open for international travel, global tourism is back on track.

Thanksgiving travel: macroeconomic signals

Thanksgiving marked the beginning of what is shaping up as the busiest holiday season in two years, with consumer spending driving more buoyant economic markets. Rising Covid-19 vaccination rates have made people more confident about travel and coupled with the opening up of the US for tourists, there has been a surge in flight bookings.

Over the Thanksgiving long weekend (this year many Americans made it a week long vacation), travellers set a pandemic record with more than 2.3 million people in the air, according to the TSA – the number is 88% of the traffic on the equivalent Wednesday in 2019.

According to Reuters research, US consumers entered the holiday season flush with spending power, thanks to a ‘still-hefty pile’ of leftover savings from multiple rounds of government pandemic relief and now double-digit year-over-year wage increases, as businesses compete for scarce workers.

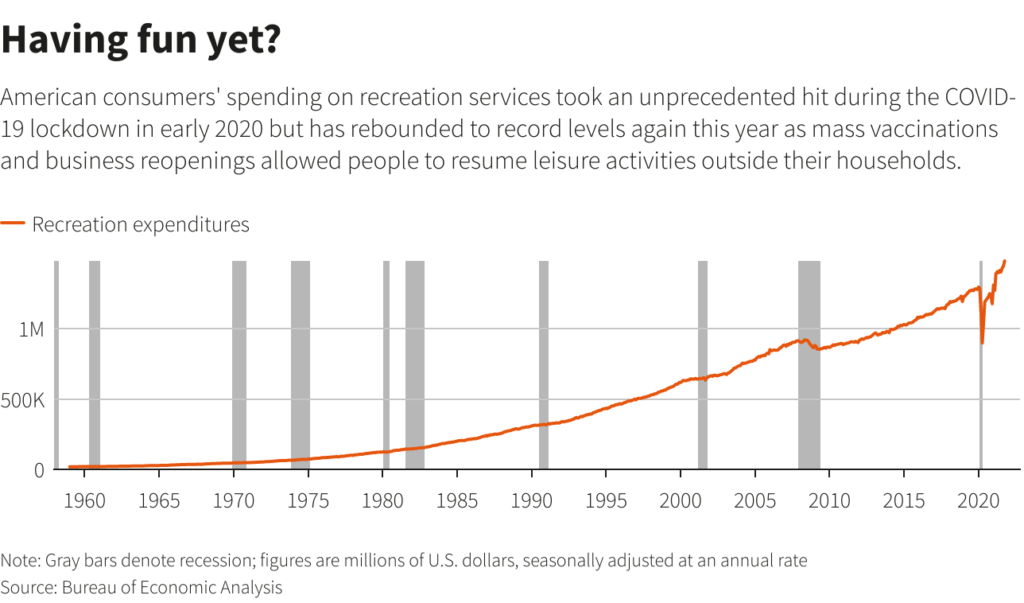

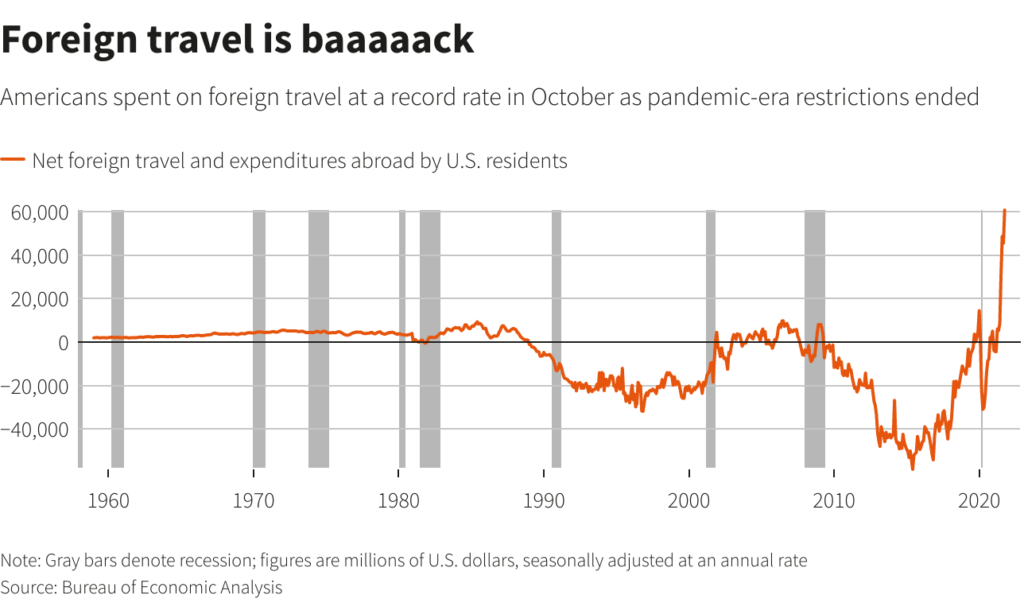

New economic data analysis reveals that consumer spending overall grew by a greater-than-expected 1.3% in October. Spending on big-ticket items like cars lifted the headline figure, but the data also showed broad-based increases in spending on services like travel and eating out that had been sharply curtailed during much of the pandemic.

But the biggest driver for spending on travel has been recreational freedom of movement; so leisure activities such as eating out, staying away from home and foreign travel over the last month have fuelled greater expectations for more of the same from laggard consumers.

Upsizing Thanksgiving accommodation

Hotels were recovering faster than air bookings in time for this year’s Thanksgiving according to Adara, the traveller insights agency that has noted higher booking values for trips booked 19 November to 5 December.

‘Leisure Non-Family’ is out-pacing ‘Family’, which reflects the ease of planning for fewer people amidst Covid concerns.

Hotel demand is at 94% of 2019 levels vs. 62% for air travel – divergence is likely due to multiple hotel stays for a single trip and drive destinations.

There is a bump in 1-2 day trips for both air and hotel bookings, likely correlated to more solos/couples traveling; Adara expects travellers’ length of stay to shift longer as more bookings increase for families.

A significantly higher percentage of shorter hotel stays points to multiple hotels for a single air trip and drive destinations.

A drop in the proportion of 10+ day air trips indicate a return to more traditional holiday behaviour.

Travellers are booking more expensive rooms with nightly rates over $200 — up 9% compared to 2019 (18% vs 27%).

Compared to 2020 where rate deals offered travellers luxury for less are now paying more typical rates for higher tier hotels.

Splurging behavior has been a hallmark of 2021 and it looks as if travellers have gained an enduring appreciation for the upscale experience.

Transatlantic traffic boost

It was a momentous day for international travel, when on 8 November the much-awaited transatlantic route between the US and the UK/Europe opened for business and the US declared itself open for vaccinated visitors from 33 countries.

Airlines including Delta and British Airways reported surging bookings for US inbound travel. Delta said its international bookings jumped +450% in the six weeks prior to 8 November, while American Airlines reported demand on flights from the UK and Brazil was nearly 70% higher that week than the week prior.

As Virgin Atlantic and British Airways put aside their traditional transatlantic route rivalry and staged simultaneous Airbus A350 departures from London Heathrow at 08.30am on 8 November, using parallel runways to mark the occasion, it was a stark reminder that long-haul travel is the ‘golden goose’ for airlines’ profits, with the UK by far the busiest transatlantic market from the US.

However, despite the surge of additional seat capacity for airlines’ transatlantic routes, since 8 November, it’s corporate travel that drives revenues, and most experts believe the higher spending business class flyers will lag the recovery of leisure travellers.

US spending on corporate travel is expected to reach only 25%–35% of 2019 levels by the fourth quarter of 2021, and 65%–80% a year later, according to a Deloitte survey of 150 travel managers and Europe-based carriers tend to be more reliant on transatlantic revenues than their US competitors.

In the wake of the US reopening, British Airways owner, IAG predicted a narrower loss – €3bn this year, down from €4.3bn in 2020 – and a possible return to profit by Easter. While the re-opening of the transatlantic corridor brought some gold dust to the aviation industry and long-haul carriers looked to be resuming their competitive (yet pricier) route marketing, short-haul airlines were also turning more bullish; Jet2 and easyJet are among those preparing for a potential rush to destinations such as Greece for 2022 – a trend that saw early momentum as British holidaymakers rushed to book winter sun trips during the October half-term break.

Pre-Thanksgiving flight booking trends

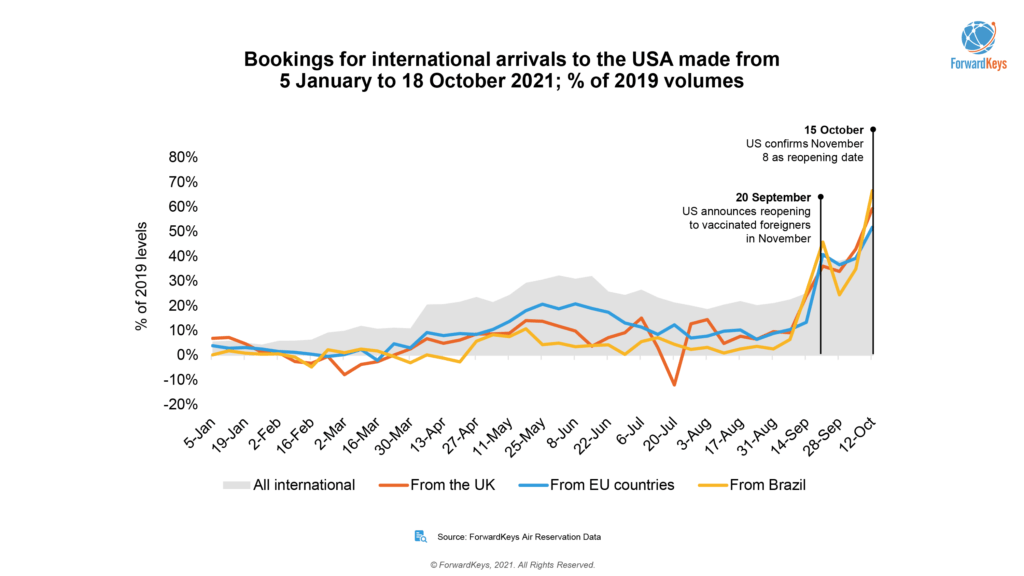

As soon as the US announced it would be open to vaccinated travellers from eligible countries in November, flight bookings rose sharply, according to travel analysts.

In the 24 hours that followed the 20 September announcement, flights from London to New York City were searched 1.4 million times, according to the global travel technology company Travelport, making it the most popular US-bound flight search of the day (according to their data).

But Europeans booked the most seats on another popular leisure route — London to Orlando — according to Travelport, which analyzes bookings made through travel agents and websites such as Booking.com.

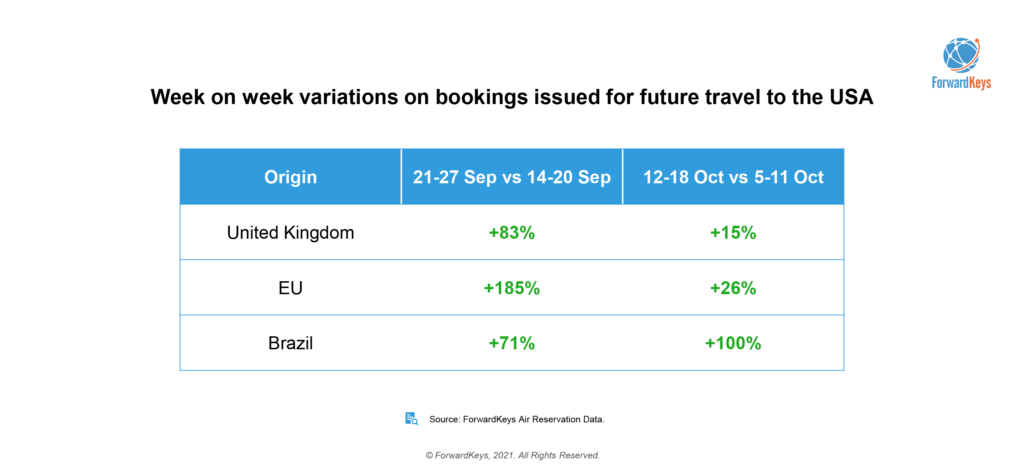

Following the 20 September travel easing announcement, ForwardKeys reports week-on-week bookings started climbing in mid-October, jumping 15% from the UK, 26% from the EU and 100% from Brazil compared to the week prior.

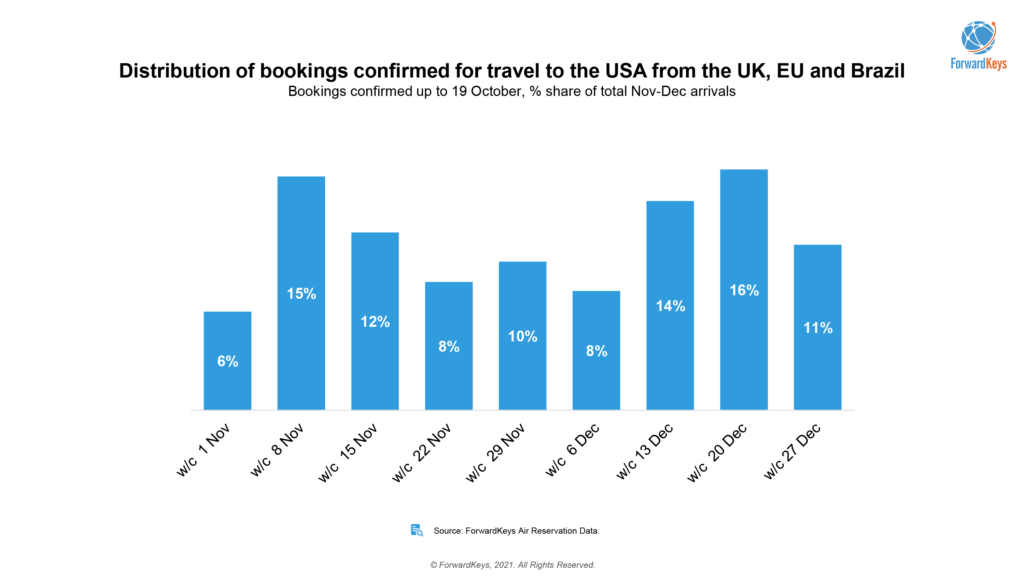

Looking at the distribution of confirmed bookings, for arrival in November and December, from those three source markets (Brazil, EU and UK), there were two clear peaks.

The first peak was for travel immediately after the relaxation of restrictions during the week commencing 8 November, achieving 15% of bookings.

The second peak was over Christmas, achieving 16% of bookings during Christmas week and 14% the week before.

Domestic Thanksgiving flight bookings

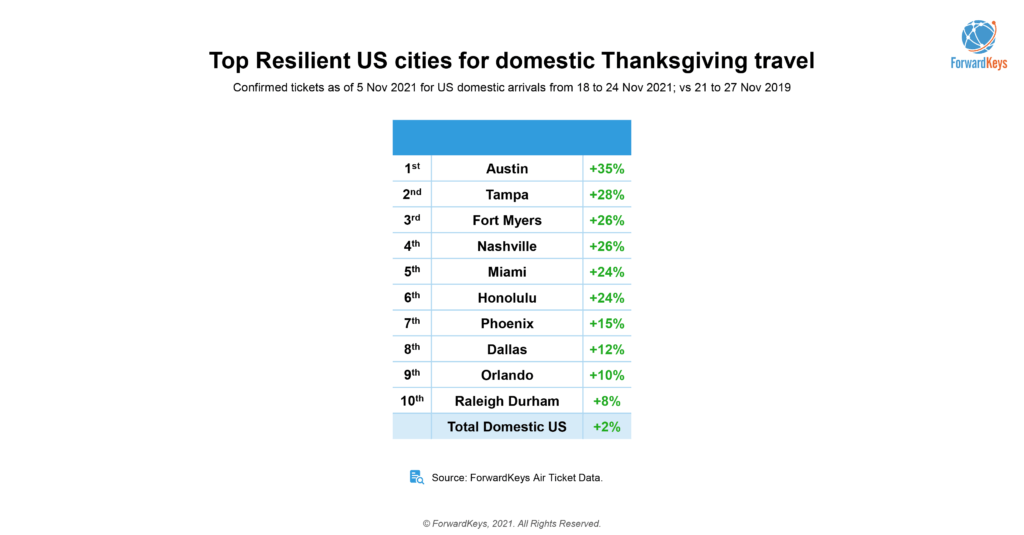

This Thanksgiving, total domestic air travel in the US was set to increase on 2019 levels, with flight tickets booked up to 9 November, at 2% above the same period two years ago. This increase demonstrates the strength of the domestic tourism market, especially for travellers’ choosing last-minute bookings that continues as a worldwide trend, but particularly in the US.

Three of the top five most resilient US cities show demand for sun, sea and adventure in Tampa, Fort Myers, and Miami. However, Austin topped the charts this Thanksgiving with a 35% increase compared to the same time in 2019.

International Thanksgiving flight bookings

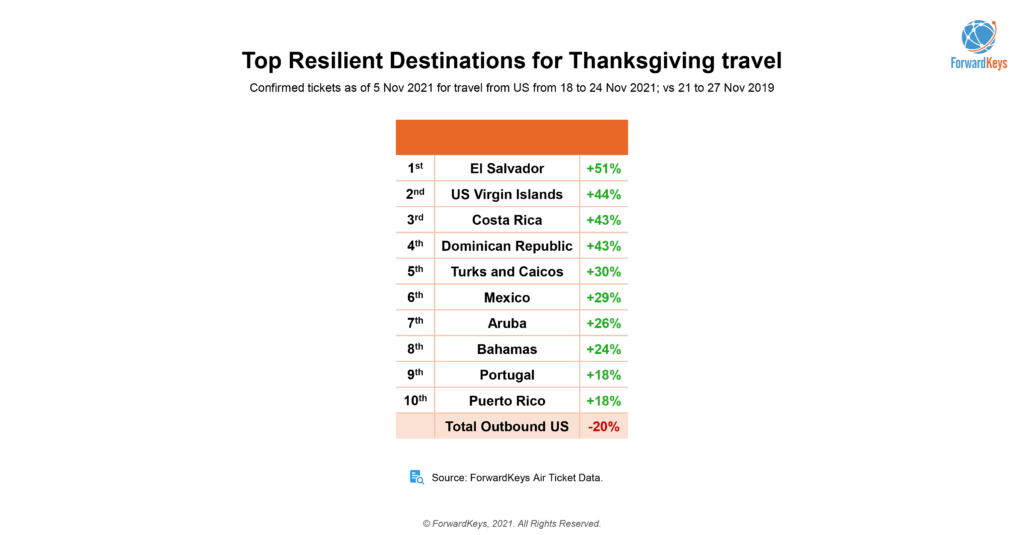

El Salvador emerged as the best performing global destination for US arrivals during Thanksgiving – with 51% more US travellers booking trips to El Salvador for the holiday, vs 2019. The popular Central America destination was followed by the US Virgin Islands, Costa Rica and the Dominican Republic in ForwardKey’s rankings for inbound Americas global travel.

International travel out of the US was down by just 20% this Thanksgiving. The fact that Portugal made the top 10 most resilient list demonstrates that US travellers are starting to feel more confident about long-haul travel again.

Ecuador was another destination rising in popularity, up by 38%. Top US destinations with arrivals from Ecuador were Miami (35%; +65% vs 2019), New York (29%; +71%), and Fort Lauderdale (10%). 97% of the issued tickets were in economy cabins and mainly for leisure travel (85%) for 13 days on average.

Total inbound US travel was down by just 37% for Thanksgiving (vs 2019), which bodes well for the remainder of the year, with more bookings from across the Atlantic and Australia on the book.

Echolution takeout

International travel is well and truly back! The US is driving a global resurgence in consumers booking travel. With the more profitable transatlantic routes back up and running, increased seat capacity and more European destinations being added weekly, airlines are playing catch up to meet pent-up demand from vaccinated travellers.

Travel retail brands can once again target travellers pre-trip, in transit and in market via programmatic marketing campaigns. As the US market becomes a benchmark for global tourism recovery, marketing to travellers who are in a ‘splurging’ frame of mind and with high-demand for winter sun after a two-year hiatus, the upcoming holidays season is shaping up to recovery quickly to pre-pandemic levels.