Driven by the pandemic, consumers now have higher expectations for retail brands to introduce digital shopping options, according to two new pieces of market research.

88% of US customers expect companies of all kinds to accelerate digital initiatives due to the pandemic, according to a study by Salesforce and 83% expect retailers to provide flexible shipping and fulfillment options such as buy-online-pick-up-in-store.

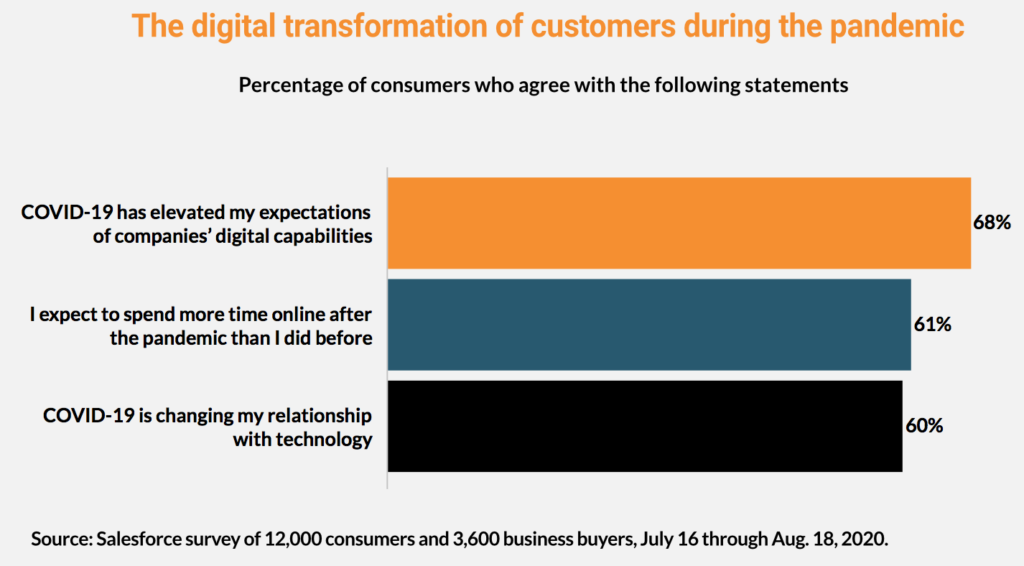

Meanwhile, 68% said Covid-19 has elevated their expectations of companies’ digital capabilities, 61% expect to spend more time online after the pandemic compared to previously and 60% said Covid-19 is changing their relationships with technology.

For the travel retail sector, how companies digitally interact with their customers – physically at the airport or online pre-travel – is a top priority among 1,500 consumers who had travelled internationally in the past 12 months, finds a new study by market research specialist m1nd-set.

Travel retail tech trends

Advancements in technology and how consumers are likely to benefit from them, were the top factors that will drive increased digitalised shopper behaviour, says m1nd-set. The key views on future trends include:

Click-and-collect has seen significant growth in recent months with over 25% of shoppers expressing the importance of this feature among delivery options.

Same-day and next-day delivery services have grown during the pandemic and will become more commonplace, forcing retailers to become more flexible around their supply chain logistics.

Greater personalisation, including AI and facial recognition technology, was cited as an influential new trend and will need to be more widely adopted in brands’ marketing and product offers.

Visual Search, cited for its ability to meet consumers’ instant satisfaction and product fulfilment, emerged as a key trend in the research.

Augmented Reality (AR) shopping applications were a popular choice with more than three-quarters of shoppers in some developed markets highlighting that they expect retailers to provide AR as part of the shopping experience.

Contactless solutions including payment, delivery and frictionless stores, where QR codes and robotics are used more frequently were named as key trends with shoppers expecting to see these options more often in the travel retail space as a result of the pandemic

Social shopping has become increasingly expected within travel retail as younger consumers – Millennials and Gen Z demographics – prefer to see their choice of brands available to purchase from shoppable Instagram or Pinterest posts as well as via video platform live-streams.

“The research underlines the growing importance the pandemic has had on technology in retail as well as the importance of unique in-store experiences,” Peter Mohn, CEO & Owner at m1nd-set commented.

“It’s estimated that the pandemic has accelerated the shift to digital by around five years. Even when analysing the findings about the importance of the retail experience, we see that shoppers are looking for a more integrated experience, which combines both physical and digital – they want to experience in-store and purchase online. The growing focus on digital has implications for the travel retail sector too of course.

“The ‘immediacy’ trend regarding delivery, with the growth of same-day delivery, click-and-collect options and the curb-side pick-up model we see in high-street retail, will need to be mirrored in travel retail with a greater emphasis in the future on out-of-store pick-up locations between security and the gate or even seat-delivery on board the aircraft,” Mohn continued.

Re-emerging inflight offers

The m1nd-set study also looked at the re-emerging relevance of a digital inflight offer for airlines that are adapting their data-mining capabilities and updating their online catalogues along with home delivery.

“The greater emphasis on digital is even likely to put the ‘inflight’ retail offer on a more level playing ground with airport retailers,” said Mohn, “especially given that airlines benefit from having direct access to the passenger data including highly valuable information such as travel class, frequency and whether a passenger is travelling with their family.

Airlines with a more data-centric mindset could be a game-changer for the industry, said Mohn. “This contextual and circumstantial data, when properly ‘mined’ and managed, will be the new gold. All stakeholders are being forced to rethink their business models and revenue strategies. If airlines start to capitalise on their unique asset and invest more in the data management for ancillary revenue purposes, this could be a game-changer for the industry.”

Echolution takeaway: Research shows digital interaction with consumers will drive purchasing behaviour based on brand engagement and convenience. Giving travellers clear call to action messaging will be key to drive footfall back into duty free stores.