HNWIs are staying at home and spending big on luxury jewellery & watches (J&W) as pent-up demand fuels domestic surges in the UK, US and China.

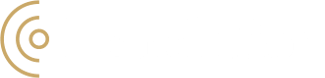

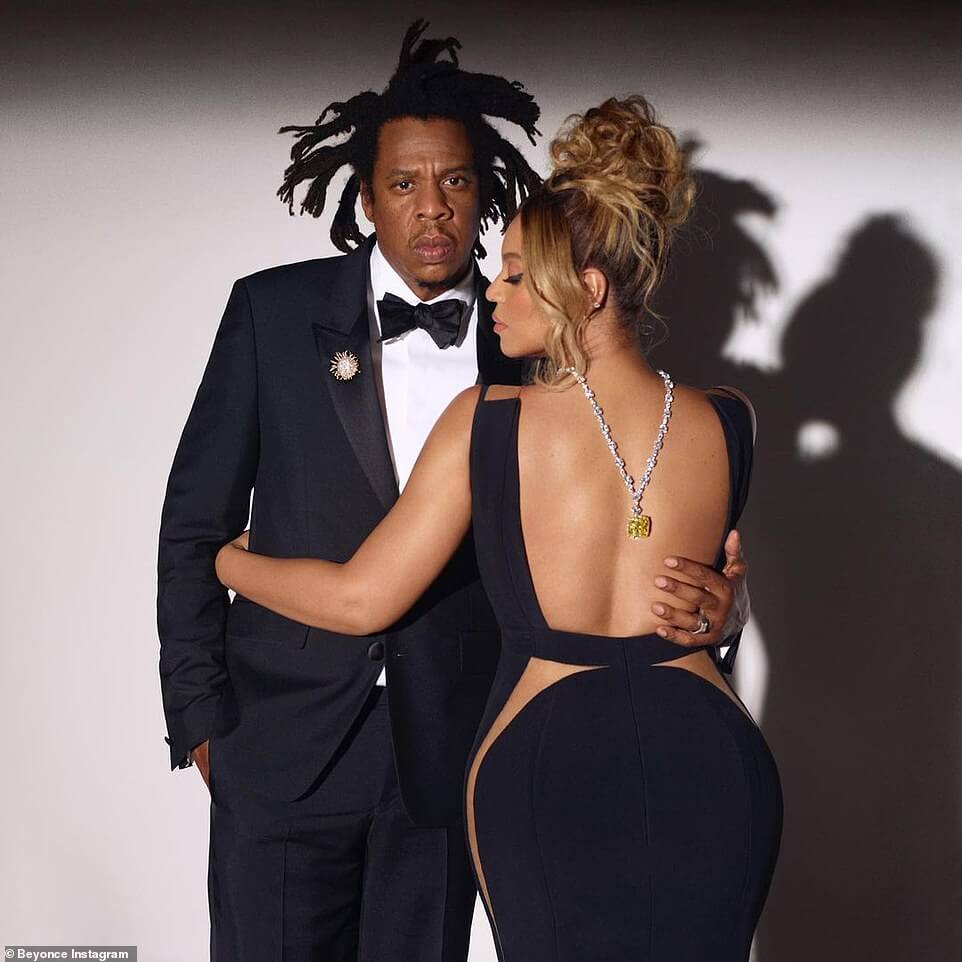

Beyoncé & Jay Z epitomise new domestic luxury spending habits for HNWIs in Tiffany & Co’s new advertising campaign that portrays them in black-tie evening attire, ready to entertain at home and in front of a never-seen-before Basquiat painting in Tiffany & Co’s signature turquoise blue. Luxury’s new normal spending cues are clearly comprised of relaxed elegance, exclusive art and understated glamour.

Domestic spending surge

From the US and UK to China and Hong Kong, luxury spending has seen surges in domestic demand – especially for the jewellery and watches category. While ecommerce sales have boomed around the world during the pandemic, physical retail’s recovery has remained muted, having previously been fuelled by overseas shoppers. However as lockdown restrictions have eased over the summer, spending is being driven by luxury shoppers with pandemic-related savings and pent-up demand for localised purchases that reflect celebration and self-gifting.

Luxury houses Kering and Richemont have recently reported stellar North American H1 2021 sales for brands including Gucci and Cartier respectively. And for Hermes, sales in the Americas, led by the US, quintupled and were the most buoyant, said the brand.

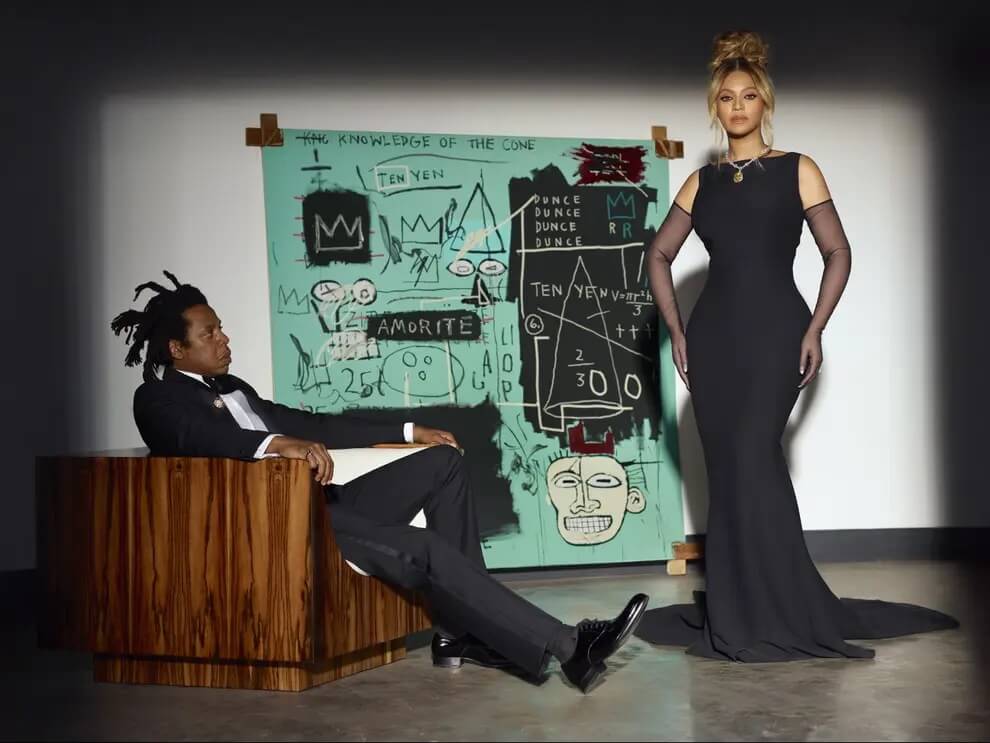

Gucci is ramping up its focus on high-end watches. To mark the Italian house’s 100th anniversary, Gucci has unveiled four new timepiece lines: Gucci 25H, G-Timeless, Grip and high jewellery watches.

Meanwhile, LVMH’s Watches & Jewellery business group recorded organic revenue growth of 71% in the first half of 2021 compared to the same period in 2020. Overall, the LVMH group reported revenue in Q2 2021 at €14.7bn, a 14% rise compared to the same period in 2019. It cited stellar demand for luxury goods – both online and offline – in China and US domestic markets.

Streetwear’s graphic luxe

Fuelling watch sales growth in the US market have been esoteric pieces that tap into luxury’s streetwear trend. Collaborations such as Shepard Fairey for Hublot or Ulysse Nardin’s Freak X Razzle Dazzle lend an artistic collectible appeal for these dense dark, geometric and monochromatic designs.

British consumers take to self-gifting

In the UK, Watches of Switzerland said it is getting more than its fair share of consumers’ disposable incomes and sales have surged in the first half of the year as Britons splashed lockdown savings on luxury watches and jewellery including wedding and engagement rings.

The UK’s biggest seller of Rolex and Omega watches said sales rose 43% compared with the pre-pandemic levels in the 13 weeks to 1 August, as the company bounced back from lost sales during pandemic lockdowns.

A strong UK performance helped the retail group more than double year-on-year sales to £297.5m in the quarter as trading in the US also took off.

Brian Duffy, CEO said sales had risen despite the loss of tourist traffic in the UK and fewer customers visiting stores. Only 7% of UK sales came from overseas visitors compared with about 30% in 2019.

He said: “People have accumulated disposable income as they have had fewer places to spend and enjoy it because of not travelling or socialising. We anticipated a strong period and so we have invested in marketing, training [for staff] and stock.”

He said sales of Cartier and Rolex watches had been strong, as had sales of Omega, which had benefited from its sponsorship of the Olympics.

Sales had partly been bolstered by a revival of weddings and engagements as restrictions on social occasions eased, he said. Wedding ring sales almost tripled and engagement rings doubled year on year, in line with an overall rise in jewellery sales.

Duffy said store staff believed customers, particularly women, were buying more gifts and jewellery for themselves, rather than for other people, as treats after a hard year, according to The Guardian report.

China: number one Swiss watch market

Meanwhile in China, as international travel continues to be banned and HNW luxury shoppers are forced to stay at home, the Swiss watch market has been booming. In fact, China has now become the world’s largest market for Swiss-made luxury watches, displacing Hong Kong’s decade-long run as the premier. Luxury brands such as LVMH’s Tag Heuer are investing big in China’s booming watch market as the country’s younger and more affluent consumers respond to localised campaigns.

China’s almost 1.4 billion residents have been the biggest buyers of luxury watches for several years. But most of their purchases had been outside the country, to take advantage of lower sales taxes in destinations like London, Dubai and Hong Kong.

Then came the pandemic, the suspension of international travel and a resulting surge in Chinese luxury consumers’ shopping domestically.

“We calculate that around 70% of Chinese luxury spend used to happen in the overseas market,” Véronique Yang, a managing director and partner at Boston Consulting Group in Shanghai told the New York Times in January 2021. “In 2020, that figure fell to around 30%. Chinese people have started to purchase within the domestic market.”

Echolution take-out

As retail tourism shifts its focus to luxury customers who are spending in their domestic markets, brands are rethinking how they talk to and market to their top customer groups.

Demographic profiling by brand propensity and shopping habits are key for campaign planning – especially as key holidays or festivals in different regions carry cultural nuances across age and wealth profiles.

Meanwhile in the UK, there are new laws for claiming back tax free savings from shopping sprees in Europe, due to Brexit. As government restrictions on international travel loosen for fully vaccinated passengers returning from European green or amber list countries, luxury brands are once again able to ramp up their tax free shopping messages to UK shoppers.