As luxury brands emerge from an extended period of reduced sales due to the Covid-19 pandemic, online has been a saviour. And travel retail is more important than ever, especially for younger Chinese consumers.

As per the latest Bain & Co x Altagamma Luxury Study, luxury brands are mitigating reduced global retail sales by ramping up their digital strategy. They are keen to focus on the new wave of younger online shoppers who are spending their way through and out of the pandemic.

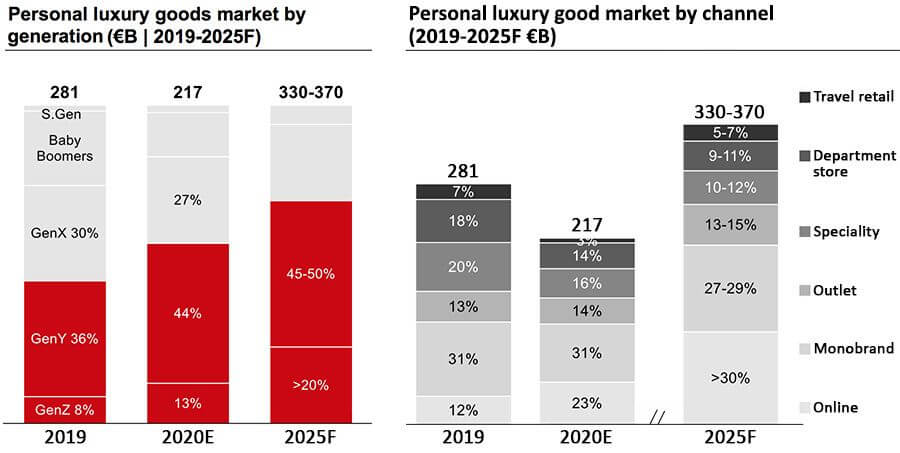

Phygital luxury retail is rising exponentially, especially in China according to the latest Bain & Co Luxury Study, that says online luxury shopping has soared due to the pandemic. Digital shopping is now double what it was last year, driven by younger cohorts from Gen Y and Gen Z according to the latest market report, published in association with Altagamma, the association of Italian luxury brands.

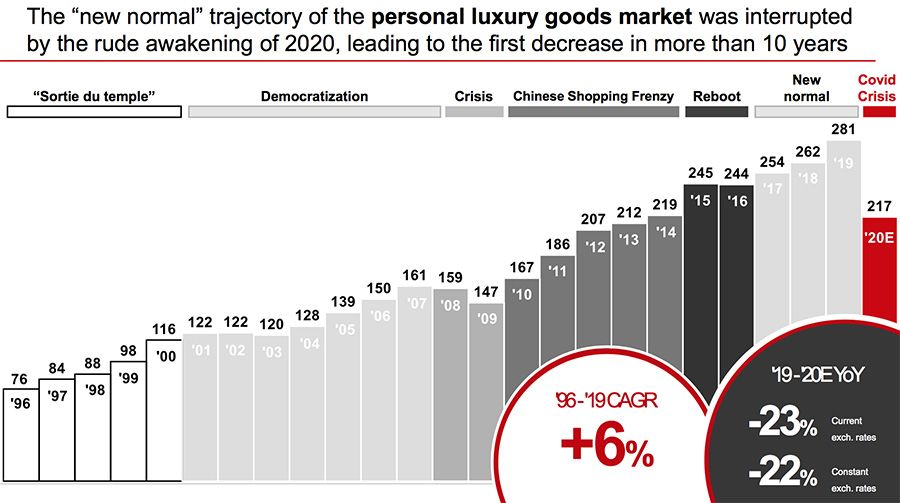

While the bad news is that sales of luxury goods are set for a record fall this year, the good news is that they are predicted to recover by 2022 aided by online shopping behaviour.

Bain said the share of luxury purchases made online nearly doubled from 12% in 2019 to 23% in 2020. Bain’s forecast for the personal luxury goods sector is that it will drop 23% this year to $258bn, which is slightly better than its previous estimate of a 35% dip, given in the spring.

“It is clear that this year will be the biggest drop ever for the industry, and some trends such as online commerce and reducing the reliance on tourists are fast forwarding versus what would have happened without the crisis,” lead author Claudia D’Arpizio explained. “A full recovery will happen between mid-2022 and 2023 depending on wider macroeconomic factors.”

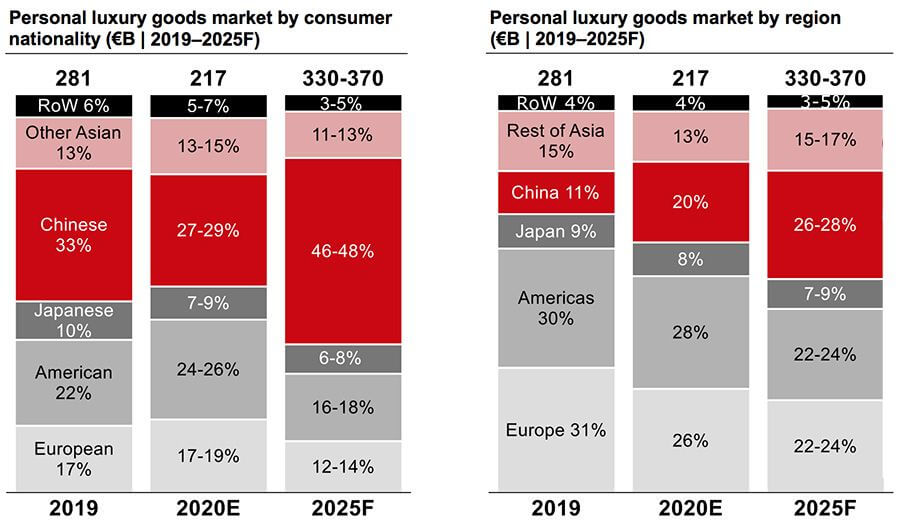

“Chinese consumption has been roaring across channels, categories and price points, driven largely by young people,” said D’Arpizio. “They will drive the recovery next year mostly in China but also abroad if the vaccines help open up travel.”

By 2025, Millennial and younger consumers will be the most important spending demographic, with an estimated 65-70% share of the luxury market. With a marked shift in generational change seen in 2020, Bain predicts these younger cohorts are expected to contribute to 180% of the luxury market’s growth in the next five years. The market share of Gen Z consumers will grow from 8% in 2019 to 20% in 2025; that of Gen Y consumers, will rise from 36% to 45-50% in the same period.

“The under-25 consumer segment is the most important, they are consumers who are truly significant for the luxury industry,” said Federica Levato, one of the study’s authors.

“They are the consumers who most indulged themselves with gratifying luxury purchases during and after lockdown. They are the most active consumers on the web and have been helping their grandparents to buy online. They have also been the first to go out shopping in stores after the end of lockdown,” said Levato.

Bain suggests price tiers are a key driver for diverse regional shopping behaviour. New age digital luxurians shop cross-category, favour affordable and entry-level designer products in Europe and the US; while in China their purchases are more diverse, driven by price and exclusivity ranging from entry-level to top-tier products.

Digital luxe

The notion of VIP shopping for the likes of Burberry, Louis Vuitton and Cartier is not new. In today’s digital-first omnichannel global marketplace, talking to HNWIs is simply a matter of having a data-centric view to targeted marketing.

This is why luxury houses such as LVMH, Richemont and Burberry have been investing heavily in digital infrastructure, for over a decade now. Lost among all the election news earlier this month was the move by Alibaba to partner with Farfetch – a direct line to China’s digital natives who consider online-to-offline (O2O) shopping via platforms such as WeChat or Alibaba’s TMall in the same vein as breathing fresh air.

The $1.1 billion Richemont and Alibaba joint venture with Farfetch announced in early November is a sign of the huge potential luxury brands see in the Chinese online market.

The investment deal with Farfetch is being described by the companies as “a global strategic partnership to provide luxury brands with enhanced access to the China market,” as well as a big step towards “accelerat[ing] the digitization of the global luxury industry,” as business fashion blog, The Fashion Law reports it.

LVMH said its sales trends improved significantly in Q3 2020, driven by its key fashion and leather goods division, amid signs of a global upturn in activity, particularly in the US and Asia.

Although LVMH did not disclose the increase in online sales, the company said e-commerce had compensated for prolonged store closures through spring and summer.

“We’ve seen a big surge in the share of the business we do with online, I would say across the board,” chief financial officer Jean-Jacques Guiony told analysts.

“What this complicated period has shown us is that there is a validity in the vertical e-commerce system for all the brands,” he added. “Online will continue to develop, [but] certainly not at the speed we’ve seen this year, which was definitely a function of stores being closed.”

“Though the momentum we had built was disrupted by COVID-19 at the start of the year, we were quick to adapt, while making further progress against our strategy,” Burberry CEO Marco Gobbetti said in November when the British luxury brand posted double-digit sales growth in China for Q3 2020, which has helped to put it back on track to return to company-wide growth.

“While the virus continues to impact sales in EMEIA, Japan and South Asia Pacific, we are encouraged by our overall recovery and the strong response to our brand and product, particularly among new and younger customers. In an environment which remains uncertain, we will continue to deliver exceptional product, localize plans and shift resources, while leveraging the strength of our digital platform to inspire customers.”

Richemont reported its sales for the first half of the year decreased by 26% year-on-year. But this was countered by its Q2 sales that were down only 6% following a 47% decline in Q1. Sales in China were up by 78%, which mitigated declines in Europe and the US. Online retail channel sales were down only by 4% for the first half of the year compared to 2019.

“A strong presence in China and an acceleration in digital initiatives have partially mitigated the consequences of temporary store closures and a halt in tourism worldwide,” said Richemont chairman Johann Rupert. “Our Maisons were swift to build on past investments in digital infrastructure and maintain direct engagement with clients, contributing to our Maisons’ resilience, with online sales growing at a triple digit rate,” he added.

Targeting digital natives in travel retail

Meanwhile in anticipation of global travel returning to pre-Covid levels once there is a mass roll out of multiple vaccines around the world, luxury fashion brands will need to act now in order to leverage new digital shopping behaviours. This will help drive traffic to their retail showcases at major airport destinations, to cope with pent up traveller demand.

Building on their increasingly Asia-centric digital strategies, luxury fashion brands that are looking to reinvigorate their global travel retail presence should be taking lessons from major airport locations such as Istanbul, Paris Charles de Gaulle and Beijing Daxing or Hainan in China. Paying particular attention to how they are investing in their luxury retail offers that target travellers.

Physical airport retail innovation

Major airport retail operators such as Lagardère Travel Retail and Gebr. Heinemann are investing in luxury airport retail spaces, despite reduced global travel, ahead of a recovery.

Lagardère Travel Retail has recently opened a number of luxury partnership stores at Shanghai Hongqiao and Shenzhen airports. The French duty-free operator says the new stores are strategically located to support the growth of travelling middle-class consumers in the region.

In some cases, the standalone stores represent the brands’ first entry into the Chinese travel retail sector. These include an 80 sqm Chanel beauty & accessories standalone store, a 58 sqm Gucci watches & jewellery store and a 93 sqm Sandro store at Shanghai Hongqiao Airport in addition toa 150sqm Cartier store, specialising in high jewellery, watches and accessories and a 134 sqm Burberry concept fashion store at Shenzhen Airport.

In some cases, the standalone stores represent the brands’ first entry into the Chinese travel retail sector. These include an 80 sqm Chanel beauty & accessories standalone store, a 58 sqm Gucci watches & jewellery store and a 93 sqm Sandro store at Shanghai Hongqiao Airport in addition toa 150sqm Cartier store, specialising in high jewellery, watches and accessories and a 134 sqm Burberry concept fashion store at Shenzhen Airport.

Lagardère Travel Retail CEO of North Asia Eudes Fabre said: “China is an incredibly resilient market, it has been breath-taking to observe how fast domestic traffic has returned to pre-crisis levels, and how eager Chinese shoppers have been to come back to our stores. The growth of the country’s middle class and its appetite for luxury brands has supported a sharp rebound in our business here.”

Luxury Square in Istanbul was opened at the end of 2019 and is a new multi-brand retail concept set over 1km of prime airside retail space, run jointly between duty-free operators ATÜ Duty Free and Gebr. Heinemann.

ATÜ’s strategy for the Luxury Square concept space is one of growing a luxury portfolio, according to CEO Ersan Arcan, who told DFNI in April: “The brand mix depends on the performance over coming months. We project an 18- to 20-month recovery period in order to reach 2019 figures. Yes, we want to welcome more brands to join the likes of Burberry, Givenchy and Chloe, (in February there was a waiting list of 27 new subcontractors wanting to get into vacant space) but it’s too early to make those decisions. If there is a chance to move brands around, we will. That mix is our choice – the focus is on maximizing the Luxury Square potential. We want as many brands as possible to try out our new multi-brand concept.”

Heinemann’s Director Purchasing, Fashion & Accessories, Jan Richter said the area was inspired by luxury department stores in the domestic market of major global cities. “The luxury dynamic speaks for itself,” he explained. “We aimed to convince and execute a new perspective on luxury merchandising.”

Heinemann has increased its focus on the sunglasses category, which is an important pillar for expansion and has showed double digit growth in 2018, reported DFNI. “The newest concept takes an ‘all under one roof’ strategy– sunglasses is next to leather goods and fashion categories. Now part of the strategy is to extend the sunglasses business with a roll out of stand-alone multi-brand stores,” says Richter.

Richter says the company is planning to approach its luxury retail offer at Moscow Sheremetyevo Airport in a similar fashion, replicating the Istanbul multi-brand experience but on a smaller scale.

Downtown destinations

Richemont-owned Cartier has had a laser focus on upsizing its travel retail portfolio in recent months. In September the luxury jewellery brand launched its most progressive new look travel retail destination to date in collaboration with China Duty Free Group, at the retailer’s Sanya International Duty Free Shopping Complex, in Hainan.

The brand said, “by placing the shopper experience at the heart of its travel retail concept, Cartier has truly established its Sanya boutique as a ‘must-visit’ downtown shopping destination in one of travel retail’s most innovative and rapidly growing global locations.”

Over the past 12 months, Cartier has increased its travel presence with a Cartier de Panthere ‘Into the Wild’ retail exhibition in collaboration with DFS in Macau and more recently with Harrods in London. The new look travel retail boutique concept was launched in Hong Kong International Airport in November 2019, ahead of Sanya.

In July, Burberry launched a social retail store in Shenzhen, China that is designed to harness the power of social media interactions. The concept works within the parameters of social media to enable customer interaction with Burberry products and the brand both digitally and in person. This cross-fertilisation of brand exposure points to a game-changing way forward for in-store experiences in the future. Marco Gobbetti, CEO at Burberry said: “When it came to innovating around social and retail, China was the obvious place to go as home to some of the most digitally savvy luxury customers.

“Together with Tencent, we have pioneered a new concept that will redefine expectations of luxury retail. The first step in an exclusive partnership between our companies, Burberry’s social retail store in Shenzhen is a place of discovery that connects and rewards customers as they explore online and in store. It marks a shift in how we engage with our customers.”

Echolution takeaways: For luxury fashion brands operating in travel retail, there is a marked shift from physical retail spaces to omnichannel and digital activity, thanks to pandemic-induced online shopping. The leathergoods and eyewear categories in particular will need to amp up digital retail strategy to encompass an online-to-offline journey and target younger Chinese consumers who are active in shopping the travel retail channel.

In order to do this effectively, brands need to invest in data partnerships that will bear fruit for new levels of consumer engagement with key demographics in mind. And in anticipation of travel retail’s recovery there will be renewed focus on overhauling luxury retail spaces in airport locations – travel retail’s recovery is coming and it’s being led by digitally savvy Chinese.