The Dubai Expo is putting travel to the Middle East under the spotlight for the next six months. And with the Expo’s focus on culture, comes commerce – as luxury brands celebrate the return of the Middle East shopper both at home and overseas.

As the commercial capital of both the UAE and the wider Gulf region, Dubai is more than just the host of the first world Expo to take place in the Middle East, it’s an epicentre for the region’s mix of culture and innovation. While the location naturally celebrates Dubai’s global air-hub status for retail tourism, the Expo 2020 event will showcase 192 country pavilions, serving to remind the world that Dubai is a global city.

Running from 1 October, 2021 through end of March 2022, the Expo 2020 will see global luxury brands capitalise on a gradually recovering tourism industry with localised brand activity from the likes of Chanel and Giorgio Armani, which are both hosting fashion shows in Dubai over the next few months, reports the Business of Fashion (BoF).

“I saw what the expo did to Milano, in terms of energy, and I am sure it will be the same for Dubai. The market is extremely important for us, vital I’d say, and I am holding this special event as a sign of hope and restart,” says Giorgio Armani. He adds that the Expo 2020 will act as the cradle of a new concept of luxury….and the dynamism of local life, culture, invention.

Luxury groups such as Chalhaub and Al Tayer are optimistic for the Expo effect to rub off onto their global retail audiences.

The BoF report also cites Patrick Chalhoub, CEO of the Chalhoub Group, which operates joint ventures with brands including Louis Vuitton and Dior, who comments: “Hopefully we’ll get 10 million [visitors], not 25 million, and hopefully five million of those are from overseas, instead of the 15 million [we were expecting]. So, we could cry, or, we could say, ‘Fantastic, we are getting five million people who are thirsty to travel.’

For Khalid Al Tayer, managing director of Al Tayer Insignia, a regional JV operator for brands including Gucci and Saint Laurent, the Expo offers an opportunity to be optimistic. “Following the [Tokyo] Olympics, this is one of the largest events in the world [and]… the expo narrative of sustainability and unity is more relevant today than ever as a message.”

But repatriation of global luxury spending into the domestic market in Dubai, is a key component of the Expo. As BoF reports, with 60% of pre-pandemic spend in the UAE connected to luxury retail (according Bain & Co), and a 17% drop in the luxury goods market of the wider GCC region (Gulf Cooperation Council countries comprising Saudi Arabia, Kuwait, Qatar, Oman, Bahrain and the UAE) in 2020 to $7.4bn, the luxury goods brands operating in the GCC are keen to reverse the regionalised downward spending trend. We can expect more localised luxury marketing activity such as Net-a-Porter’s newly launched Gulf-centric digital platform.

HNWIs boost premium flight bookings to Dubai

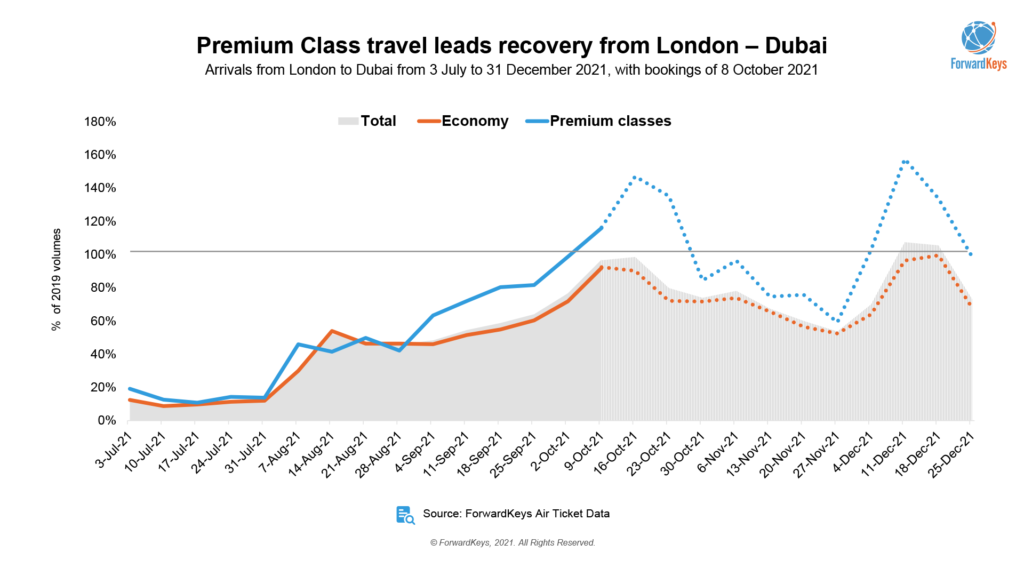

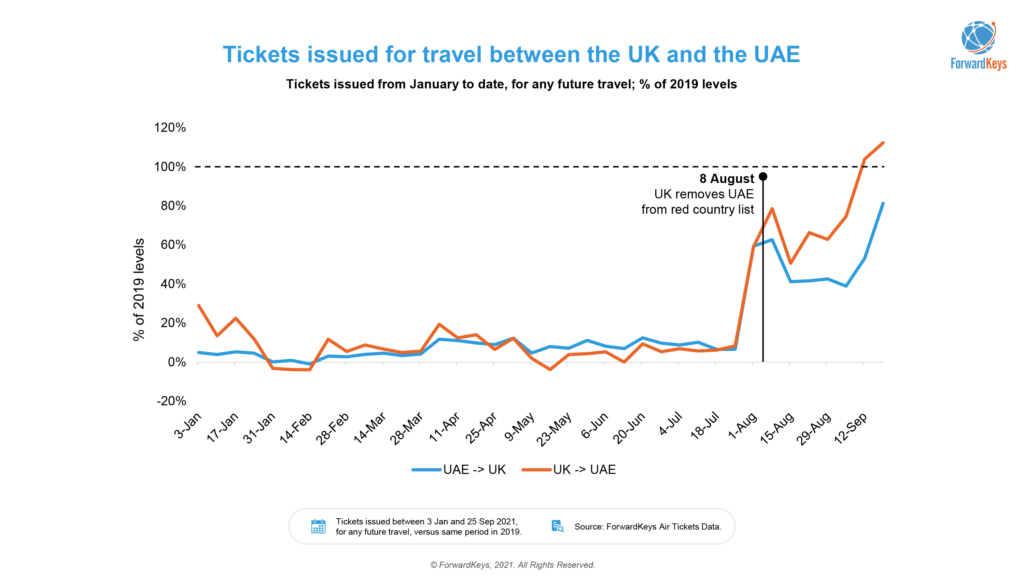

Meanwhile high vaccination rates and pent-up demand for travel are fuelling a HNW Middlel East travel surge. Olivier Ponti, VP Insights for flights data specialist ForwardKeys thinks changes to the red list travel restrictions (in the UK) have had a dramatic impact on bookings to the UAE.

“Red list removal, which means that travellers to the UK no longer need to book 11 nights in a quarantine hotel, has caused flight bookings to rocket,” says Ponti. “In the eight weeks since the announcement on 4 August, flight tickets issued from the UAE to the UK have climbed from 6% of pre-pandemic levels to 58%; and flight tickets issued from the UK to the UAE have climbed from 9% to 85%.

“In the first two weeks of October, tickets issued from the UK to the UAE surpassed 2019 levels; and I am cautiously optimistic that if there are no further waves of COVID-19, we will see a combination of pent up demand and the Dubai Expo driving travel from the UK to the UAE to record levels in Q4.”

Global investment in the Middle East region is reaching highs unseen since before the pandemic, according to Bloomberg that reports companies from the Middle East and North Africa look poised to raise record sums from loans as progress with vaccination and partial reopening of tourism spurs economic buoyancy. It highlights how Saudi Arabia has been rising in Bloomberg’s latest Covid resilience rankings.

Echolution takeout:

With news from Value Retail that its Gulf region customers are ‘trickling’ back to Europe again – eager to visit the luxury retail group’s newly renovated hotel-standard, VIP shopping suites in the UK, Italy and Germany – luxury marketing to Middle East travellers who are thinking of visiting Europe will need to be more tailored and channel targeted.

“We’ve come out of this stronger and the numbers speak for themselves,” Desiree Bollier, chairwoman of Value Retail Management and chief merchant of Value Retail tells The National.

“We’re almost back at 2019 levels. Since the borders reopened, we’re starting to see staggering numbers. I think we’re going to have one of our strongest fourth quarters in the history of the company.”

As Harrods-owner Qatar Investment Authority takes a closer look at purchasing Selfridges, with its HNW global Middle Eastern shopper in mind, there seems to be a new energy to this highly regarded, discerning luxury demographic who are vaccinated and ready to shop in their favourite retail destinations.