With Brexit under our belts in the UK, there is fresh intent to make EU duty free arrivals in airports a commercial opportunity for the travel retail industry. But where and when? And can this be a digital-first opportunity for travel retail stakeholders?

“With 27 countries for British tourists to visit and shop under new laws, the prospect of EU duty free arrivals represents a significant opportunity for travel retailers to offer geolocation promotions”, says Eamonn Leacy founder of Echolution.

“And now it’s more digital and more dynamic, than pre-pandemic due to the changing shopping behaviours of travellers.”

A new lobbying focus on duty-free arrivals sales at EU airports gives hope for the region’s beleaguered travel retail industry, according to a report by the European Travel Retail Confederation (ETRC) in partnership with ACI Europe and research firm, York Aviation.

The report provides evidence of the potential economic benefit that is achievable if the EU reviewed current legislation to allow passengers travelling from third countries to buy duty and tax free shopping on arrival at its member states’ airports.

Based on 2019 traffic figures, the research found that duty and tax free arrival shops would have generated around €4.3 billion in Gross Value Added (GVA), and generated €1.6 billion in tax revenues. These benefits (to struggling airports) are achievable by realising a commercial opportunity that remains entirely untapped, says the report. It estimates that arrivals duty and tax free sales could make up 20-30% of total travel retail sales at EU airports.

Furthermore, as the UK is no longer part of the EU, the numbers of non-EU passengers will increase substantially, and many smaller airports would greatly benefit from duty and tax free arrivals sales.

While arrivals duty and tax free shopping is common in many airports around the world, including EEA countries such as Norway and Switzerland, it is not currently allowed in the EU, which only permits duty and tax free sales for passengers leaving the EU bloc.

As the ETRC lobbies for this change into 2021, it’s clear that a shift to allowing duty and tax free retail on arrival for visitors from third countries, would restore competition for EU airports in line with their international counterparts, and would create much needed revenues for airports still suffering from vastly reduced PAX traffic post-pandemic.

Media spend provides parallel commercial opportunity

Along with allowing EU airports to increase their commercial revenues through arrivals duty free, there is associated commercial opportunity via linking travel retail with increased media spend at airports’ advertising sites.

“With the prospect of arriving travellers in key EU airports, comes spending power and marketing budget. Travel retail brands would be able to target passengers with destination airport campaigns.

“It’s this location-based opportunity to drive more digital ‘call to action’ shopping activities, that could provide a welcome boost for the travel retail marketplace. There is a need for airports to become a much more active ad inventory market,’ says Leacy.

Olivier Jankovec, ACI Europe Director General, says EU airports are currently urgently in need of government support: “Given the unique role that airports play as economic gateways, it is imperative that all steps are taken to keep them open through these difficult times. EU airports are currently losing hundreds of millions of euros of potential commercial income to their non-EU counterparts each year. Arrivals duty and tax free will allow retail sales to be displaced from third countries back to the EU airport of arrival.”

Brexit traffic

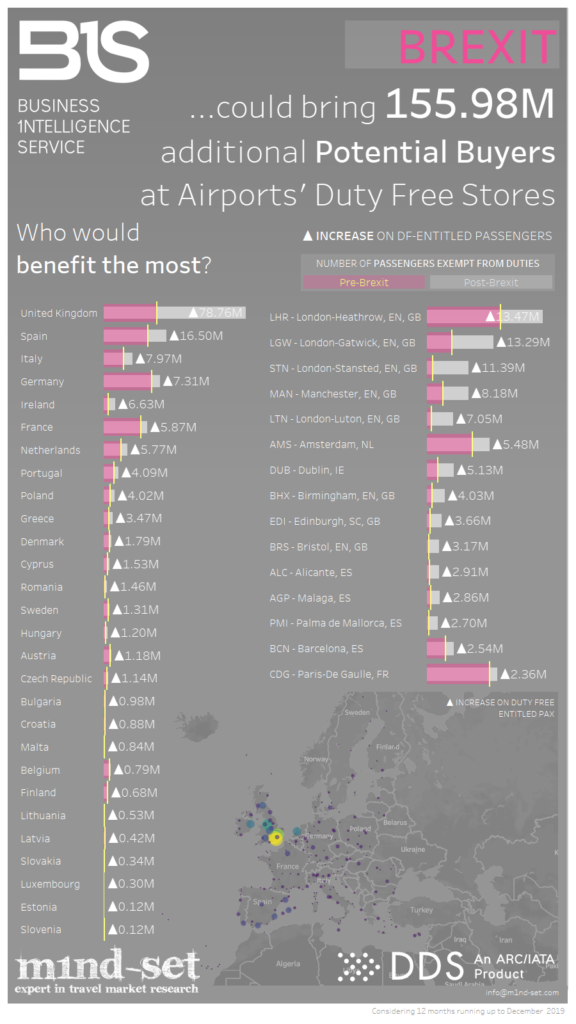

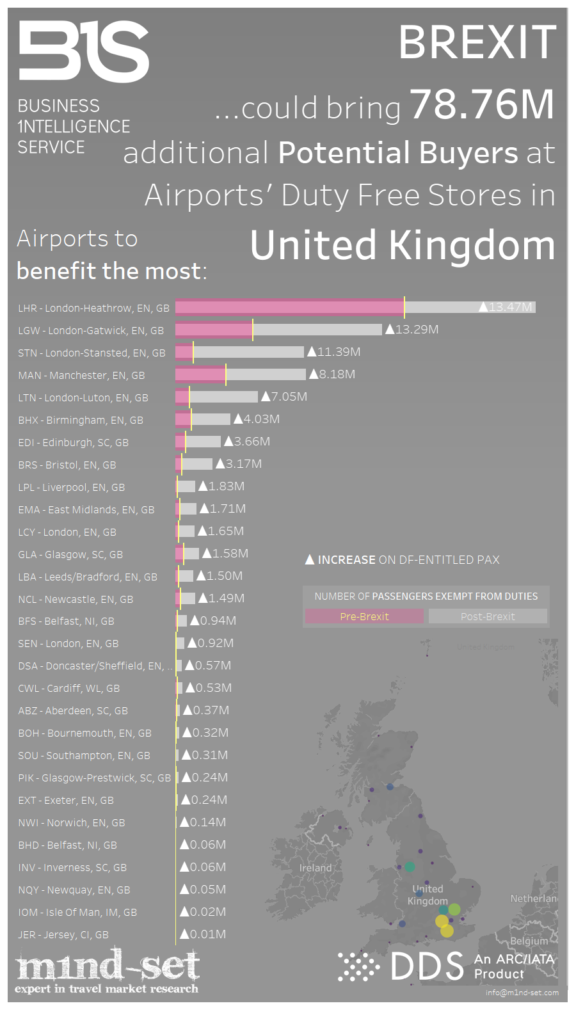

A new era of post-Brexit duty free shopping has launched in the UK and the latest market research from m1nd-set points to a promising opportunity for UK airports and EU travel corridors, that are expected to see a potential increase of 156m eligible customers in transit.

The UK is positioned to benefit the most from the return of duty-free sales across alcohol and tobacco categories, with an additional 78.7m additional eligible travellers in the airport retail channel, according to the research.

After the UK, the top European market set to benefit from the post-Brexit change in excise rules will be Spain, says m1nd-set. Spain is forecast to attract an extra 16.5m potential eligible duty-free shoppers, with Italy close behind at nearly 8m, Germany following at just over 7.3m and Ireland in excess of 6.6m. As per the infographic, France, Netherlands, Portugal, Greece and Poland round out the top 10 list.

According to a m1nd-set and JCDecaux report in mid 2020, there is strong appetite for a return to travel and we are likely to see ‘revenge spending’ on travel as soon as possible. According to the advertising specialist,79% of 2500 global travellers stated they are willing to fly internationally as soon as restrictions allow. Furthermore, 84% of respondents indicated they will visit duty-free boutiques on future trips and 38% will continue purchasing. One of the key survey takeaways was that airport advertising continues to drive positive perceptions. Moreover, most travellers take action after exposure to airport advertising, which confirms ‘drive-to-store’ action.

JCDecaux is investing in more Digital Out of Home (DOOH) assets in airports both for the data insights and for the engagement opportunities. The firm says there is a fine balance between creativity and data that enables media owners and advertisers to increase brand awareness and ad recall, thanks to content customisation. “The goal is to contextualise the chosen insights, personalise and improve the relevance of the content,” it says. To illustrate, JCDecaux’s digital screens at Brussels Airport broadcast messages to expatriates arriving in Belgium in their mother tongue during a campaign organised with BNP Paribas Fortis bank and Havas Media.

Changes at the top: EU airports

We should consider which European airports are the busiest ,therefore have the biggest potential for EU arrivals duty free.

Recent airport ranking reports have shown movements in the top 10 global airports for 2020 vs 2019, taking into account the impact of Covid-19 on passenger numbers.

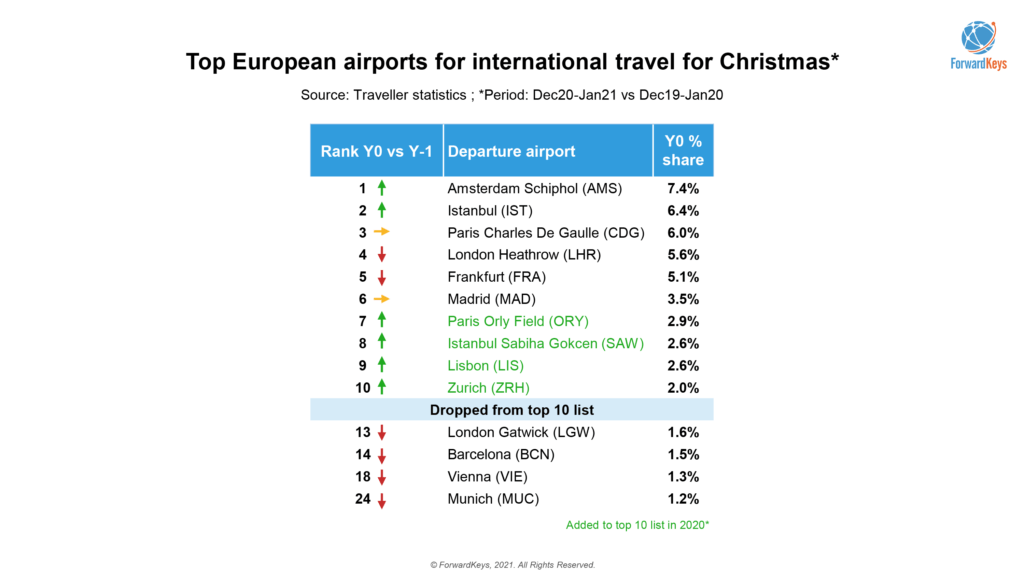

Looking at the performance of European airports against a global picture, there was plenty of change in the Top 10 Airports Global Recovery Dashboard from ForwardKeys. The index (see below) shows Amsterdam Schiphol, Paris Charles de Gaulle, Frankfurt, Istanbul and Madrid-Barajas airports all gaining higher rankings for global passenger traffic January to October 2020 vs the same period in 2019.

ForwardKeys has shared some of its most recent flight data highlights with Echolution. Primarily looking at passenger traffic over the Christmas holiday period, there were some movements in the firm’s top 10 European airport ranking for 2020 vs the previous year.

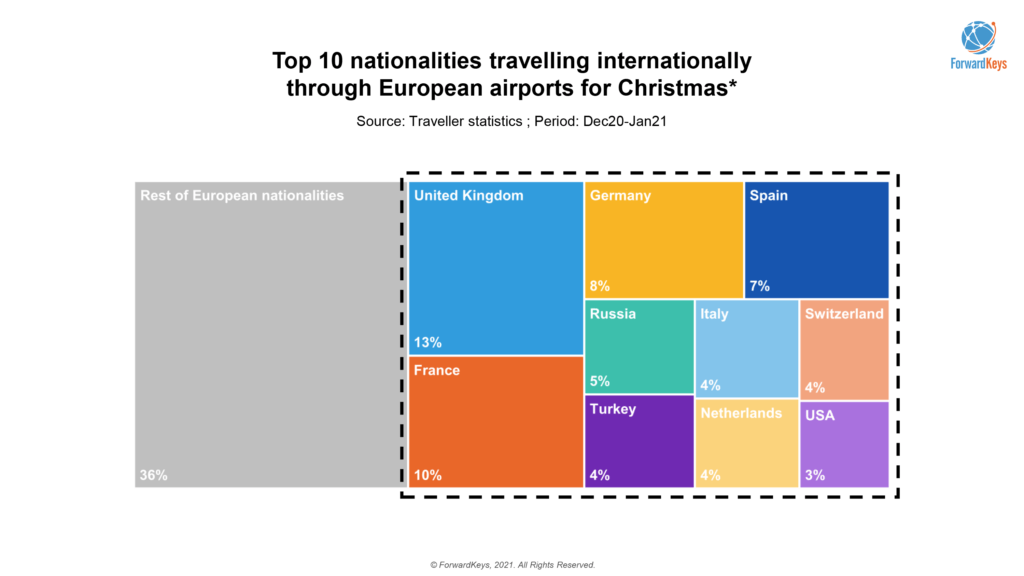

The top nationality was UK (13%) despite lockdown periods between 31 October to 2 December 2020.

Echolution takeaway: If the lobbying activity of the ETRC and ACI Europe works and the EU allow duty and tax free arrivals sales, travel retail stakeholders will quickly need to work out how to target these eligible travellers in the new locations.

Echolution offers marketing products to merchants so they can be at the forefront of travellers’ changing, inter-Covid, digital shopping behaviours. By layering global and regional data sets with branded first-party data as well as known device usage within key locations (aka the ‘datastack’), Echolution can create pre-planned purchase intent among passengers, especially as new markets open up in Europe.

Here, there is a real opportunity for travel retail operators to have a digital-first mindset, to implement a range of omnichannel and frictionless retail technologies, driving new customers into new store locations.