Regional travel recovery is gathering pace in Middle East and Africa, while key global airhubs shift rankings.

As both Europe and US regional tourism has gained momentum in H2 2021, travel trends in the Middle East and Africa have also shown resilience, with increased passenger numbers within the region booking trips for longer this winter and with higher spending in premium class showing growth.

According to new travel trends data from ForwardKeys, until recently the main region showcasing international travel recovery was the Americas – especially the Caribbean. However, the company’s latest flights data insights shows that Africa and the Middle East are also catching up and proving to be much more resilient.

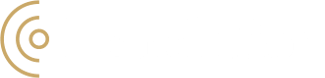

International Arrivals in Africa and the Middle East

While the total global inbound figure for international arrivals as of October 2021 sits at -77%, for Africa and the Middle East this figure is at – 68%. Furthermore, it is Sub-Saharan Africa that is showing the best year to date performance.

“Looking at September to October arrivals, 71% of travellers coming into the region were from Middle Eastern destinations. While for North Africa, the traveller category of Visiting Friends & Relatives (VFR) accounts for 46% and Sub-Saharan Africa accounts for 33%; meanwhile compared to the Middle East, it is only 18%, suggesting that travel here is mainly for leisure,” says Gordon Clark, VP of Business Development for Travel Retail at ForwardKeys.

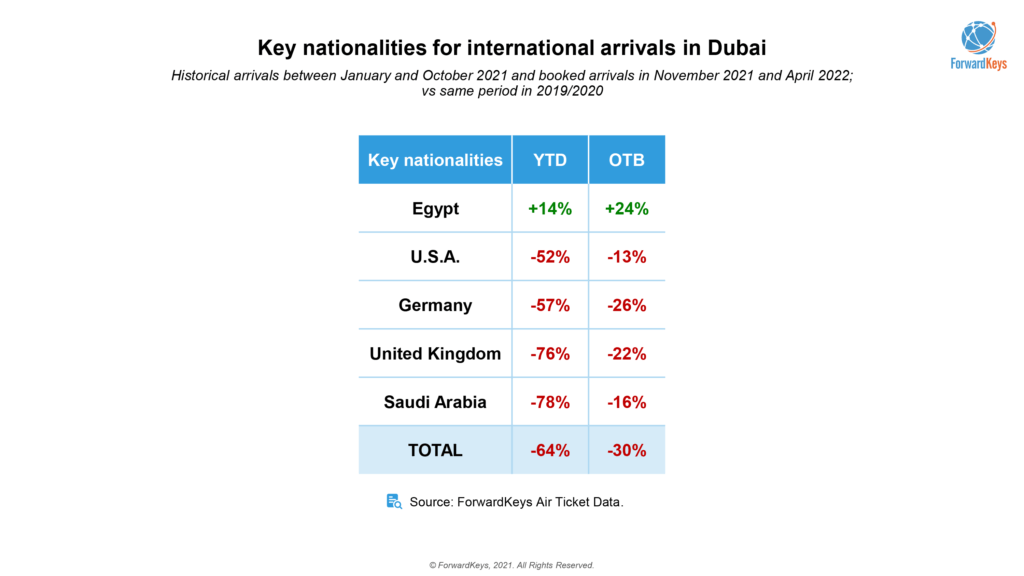

Top nationalities on the move

During this pandemic, the top nationalities travelling outbound in the region were: Saudis. This was then followed by Emiratis and Qataris.

“When comparing to other regional counterparts the top three nationalities all had a much higher vaccination rate, flight connections and easier travel conditions when compared to say, South Africa, which was plagued with new Covid cases and strict lockdown rules,” adds Clark.

Appeal of Dubai

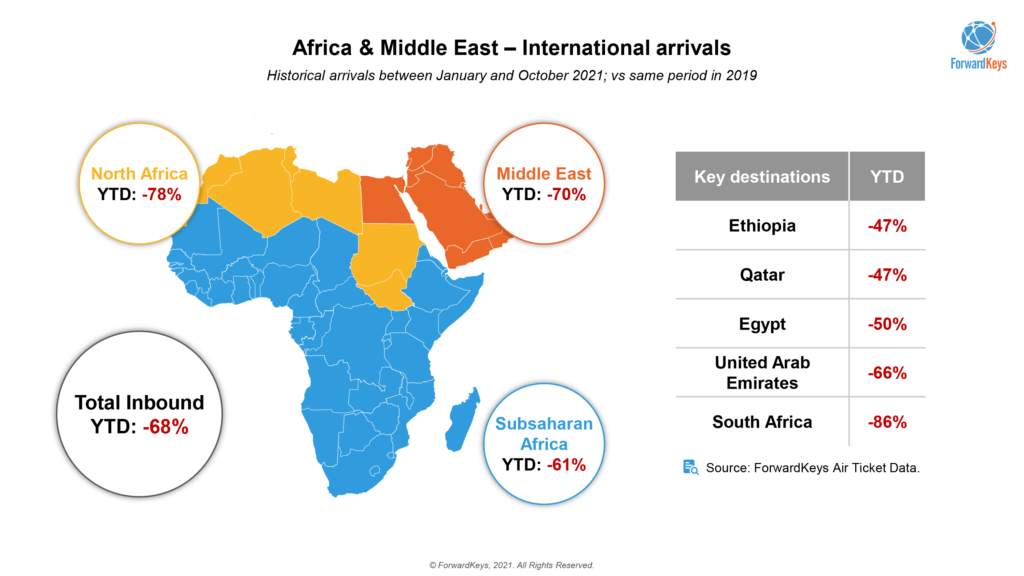

Zeroing in on Dubai, a major player in aviation and long-haul travel, ForwardKeys’ air ticketing data reveals booked arrival figures are down by 64% from November 2021 – April 2022, typically the peak season for international leisure travel.

On the flip side, there has been a marked growth for travel from Egypt to Dubai; and the US On-The-Book (OTB) travel figures are down by just 13% compared to pre-pandemic times. Also, year-to-date the length of stay has doubled, increasing from 7 days to 14 days per booking.

“The other good news to observe is that business travel to the UAE is on a good path to recovery, reaching 75% in the week starting 21 October compared to 2019, supported by live events like the Dubai Expo,” says Clark.

He adds: “In this same period premium cabin classes travel has gained 7% of market share compared to 2019. Singles and couples are the ones travelling the most to this region. After the opening of Dubai Expo in October, travel to UAE increased and was only 35% behind 2019 levels – things are moving in the right direction for Dubai and the region overall.”

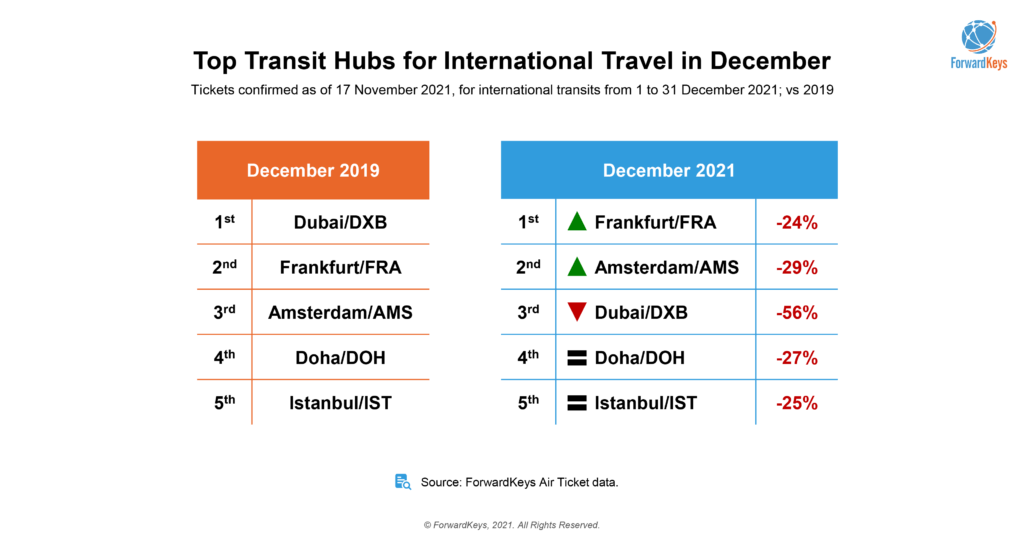

Global airhubs shift rankings: Middle East loses out to European hubs as international travel resumes this winter

The mix of short-haul recovery in Europe and a slower pace of international routes returning to capacity has put Middle East air hubs at a disadvantage, with softer recovery of global passenger numbers, according to new data from ForwardKeys.

“At the height of the pandemic, a vast amount of flights in and out of Dubai were suspended whilst competing hubs like Doha and Istanbul largely remained open. The suspension of flights in and out of Dubai meant that the hub also lost its crown as the biggest connecting hub in the world. However, as the UAE has begun to re-open and ease travel restrictions, we can expect to see Dubai attempt to regain its position,” says Juan Gomez Garcia, Head of Market Intelligence at ForwardKeys.

Due to uncertainty regarding travel restrictions and the subsequent slow recovery of long-haul travel, hubs such as Doha, Dubai and Istanbul (which are highly dependent on long-haul travel) have either slipped (in the case of Dubai) or remained stagnant in the ranking compared to November 2019. Frankfurt and Amsterdam not only connect long haul pax but are also major hubs connecting regional pax. Therefore, the strong preference for regional travel has allowed these hubs to leapfrog into the top positions for November 2021.

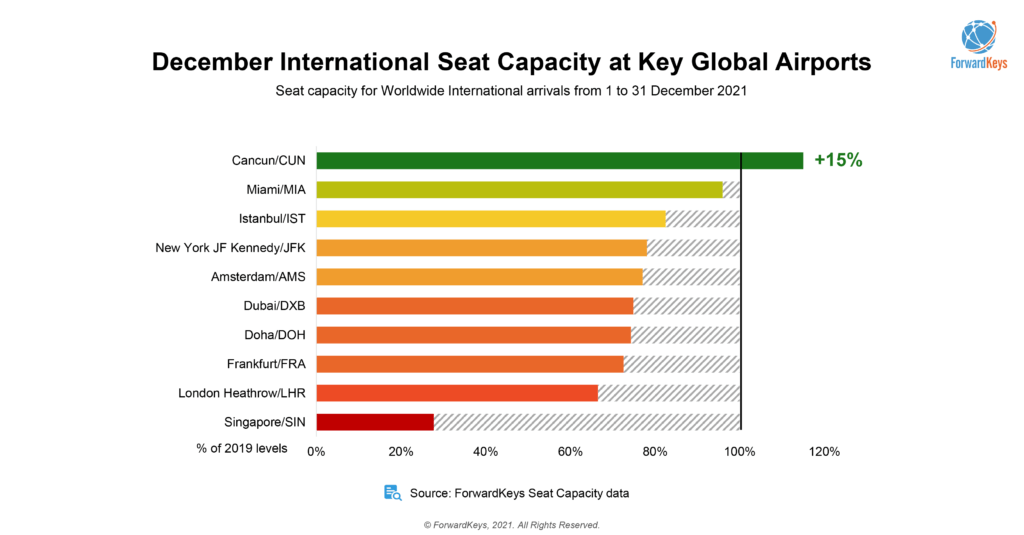

Seat capacity is expected to increase globally between November and December 2021 ahead of the traditional Christmas holidays travel surge, with routes expected to be back up to pre-pandemic levels and up by 15% worldwide.

There is expected to be significant VFR + expat traffic especially in North America and Europe, and airlines are adjusting for this anticipated demand. As uncertainty regarding travel restrictions persists, upward capacity adjustments are being mainly catered to regional travel as opposed to the long haul.

The biggest increase among the ForwardKeys top 10 key global airports list is Miami, which gains +25% from November vs December 2021. This is followed by Cancun, which is expected to exceed 2019 levels by 15%, and is reflective of strong demand from US leisure PAX who are opting to travel regionally for some winter sun.

Key transit hubs including Istanbul (+13%), Doha (+12%) and Dubai (+13%) are also scaling up capacity compared to the previous month, in anticipation of festive season demand for both arrivals and transit pax. However, as these hubs are heavily dependent on long haul traffic to/from Asia, capacity will expectedly be well behind 2019 levels.

Echolution takeout:

It’s time to direct marketing budget towards Middle Eastern regional travellers again. With Echolution’s latest demographic profiling tools, travel retail brands can target HNWI luxury shoppers, digitally-savvy fashion and travel influencers at origin and destination markets.

Through our partnerships with ForwardKeys and other travel bookings platforms, we can pinpoint the trends for where and when travellers are connecting or arriving at global airhubs, while we can also serve advertising via boarding passes, airline trip itineraries or hotel communications etc.

Furthermore, we are now able to activate audience targeting data for marketing, so that brands can:

· Build brand awareness on multiple screens

· Reach target audiences anytime, anywhere

· Activate audience data connected to Mobile Advertising IDs

· Boost brands’ drive-to-store campaigns and increase sales

· Reach users based on their location in the moment of ad impression – in real-time