Echolution travel data partner, ForwardKeys offers a few tourism predictions for the year ahead. The report can also be downloaded here: Travel Outlook for 2022

At the height of the pandemic in 2020, many wondered if things could get worse for the tourism sector, praying for travellers to return to the skies as soon as possible. In 2021, we enjoyed a brief sensation of travel recovery as Americans took to the skies and flew South, just as many Northern Europeans did over the summer months with Greece, Spain and Turkey showing the most resilience to turbulence. Sadly, the end of the year witnessed the steady increase of new cases, a new variant and new travel bans put into place.

“With the recent wave of flight cancellations, rising covid cases and travel restrictions, it is tempting to be pessimistic about travel recovery this year. At ForwardKeys we still think there are good reasons to be optimistic about the new year. As a matter of fact, just before Omicron hit, we could see that even after almost two years of the pandemic, the fundamentals to rebuilding the tourism economy were still sound,” comments Olivier Ponti, VP of Insights.

For its latest report, ForwardKeys analysts showcase that there are signs to be optimistic about tourism in 2022.

1 Domestic travel, a relevant player in the tourism sector

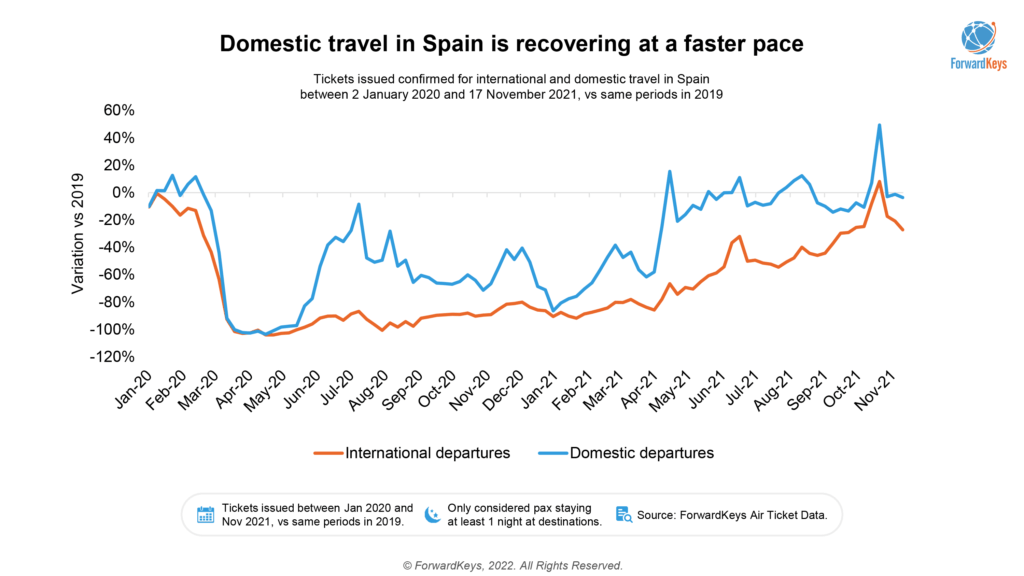

Our first trend has got to do with the strength of domestic travel. “We all know it was the first to rebound and that it helped to keep the travel industry afloat in many countries in 2021,” says Ponti.

Let’s look at what the data says and to make things more tangible, we’ll focus on a destination where recovery is well underway: Spain. It’s a good example because a lot of domestic travel takes place by air due to large distances and the attractiveness of tourist hotspots like the Balearic or the Canary Islands.

Looking at the evolution of domestic travel since the beginning of the pandemic, we can see that it was quick to rebound, as early as the summer of 2020, just after confinement measures were lifted. In April of 2021, with the help of the Easter break, domestic travel reached back pre-Covid levels for the first time. Since then, it’s remained strong, with various periods above 2019 levels, like during the autumn holidays at the end of October.

If we now look at the evolution of international departures from Spain, we realise that it took the Spaniards much longer to resume their trips abroad. It’s only from the spring of 2021 that we can see an acceleration of the recovery.

The important takeaway here is that international travel recovered while domestic travel remained strong, which means that the travel market is getting bigger. And Spain is not an isolated case. We have seen the same pattern in many other countries, starting with the US, which plays a key role in the global recovery.

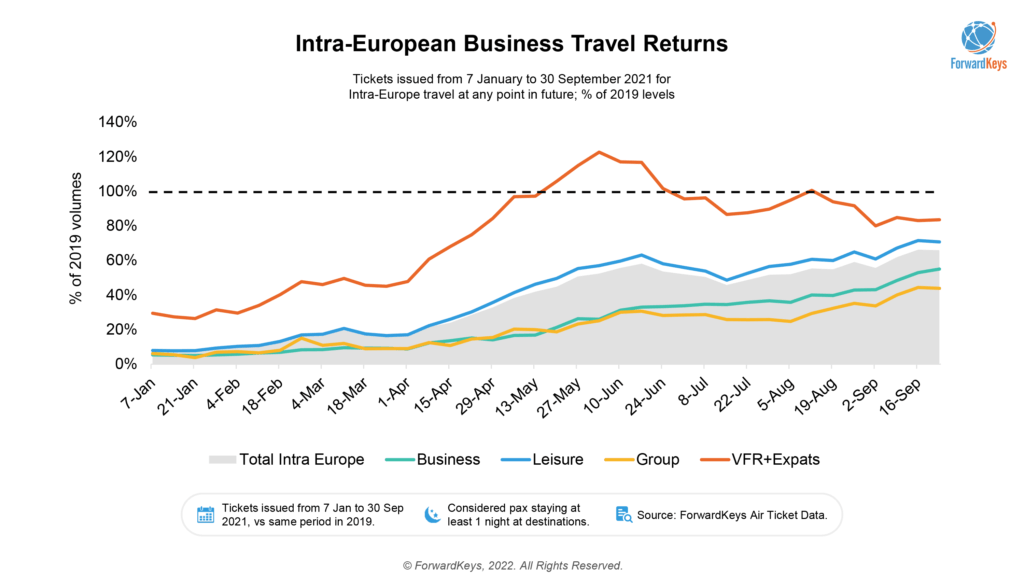

2 Business travel is not dead

One of the great fears of the travel industry since the beginning of the pandemic has been that business travel would never come back. With online conferences, online meetings and reduced budgets from crisis-stricken companies, the odds looked bad for business travel. Yet, it appears that business travel is slowly but surely making a comeback.

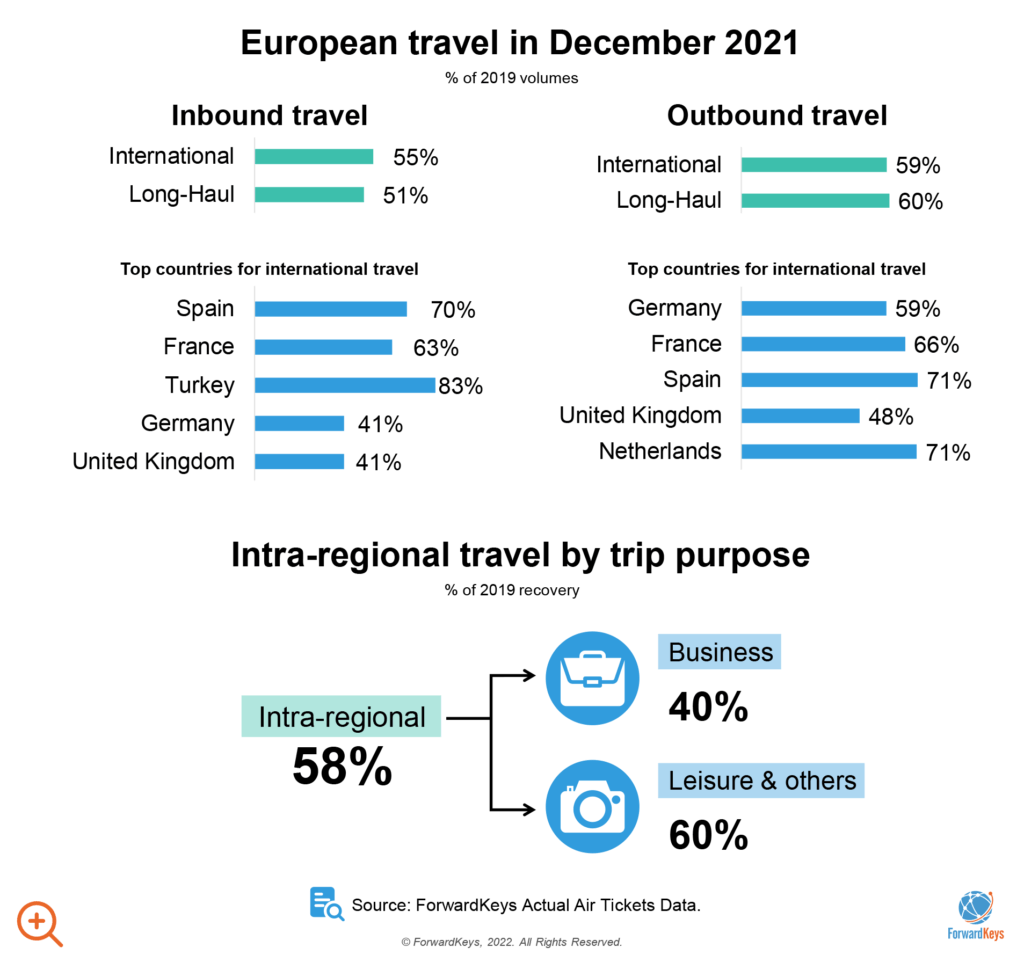

“We could see this very clearly happening in Europe, where intra-European business travel was on a steady rise from April until the new wave of Covid cases last November,” says Ponti. He adds: “Yes, it is recovering more slowly than the leisure segment, and yes, recovery can be a bit bumpy, but all in all, the gap between leisure and business is narrowing, and business travel reached close to 70% of 2019 levels in October.”

The conclusion is that a large part of pre-Covid business travel will eventually come back. In the new normal, there will still be sales representatives meeting their clients in person and people will still meet at conferences to exchange ideas.

3 The APAC region to reopen soon

So far, the one region in the world which has been lagging in terms of travel recovery is the Asia Pacific region. The main reason for this situation is simple: most destinations were not open for business and had travel restrictions in place that made travel cumbersome or next to impossible. The good news is that just before Omicron hit, this situation was changing at a fast pace. The group of countries partially open or who had announced a plan to reopen was much larger and included very popular destinations like India, Australia, Indonesia, Japan, Fiji and Singapore.

There are good reasons to believe that these plans will be put back on track and that this will reactivate regional and even intercontinental travel, following the same pattern as what we’ve seen in other parts of the world, and hopefully go faster in the process. The one big question mark here is China, the world’s biggest outbound market pre-Covid and a giant waiting for awakening.

4 The Pent-Up demand is real

The last of the key recovery trends we wish to focus on is the continuous existence of pent-up demand. When people are not allowed to travel, it is difficult to assess how eager they are to book a trip. One way to get an idea of the scale of the pent-up demand is to look at what happens when travel restrictions are lifted in other parts of the world.

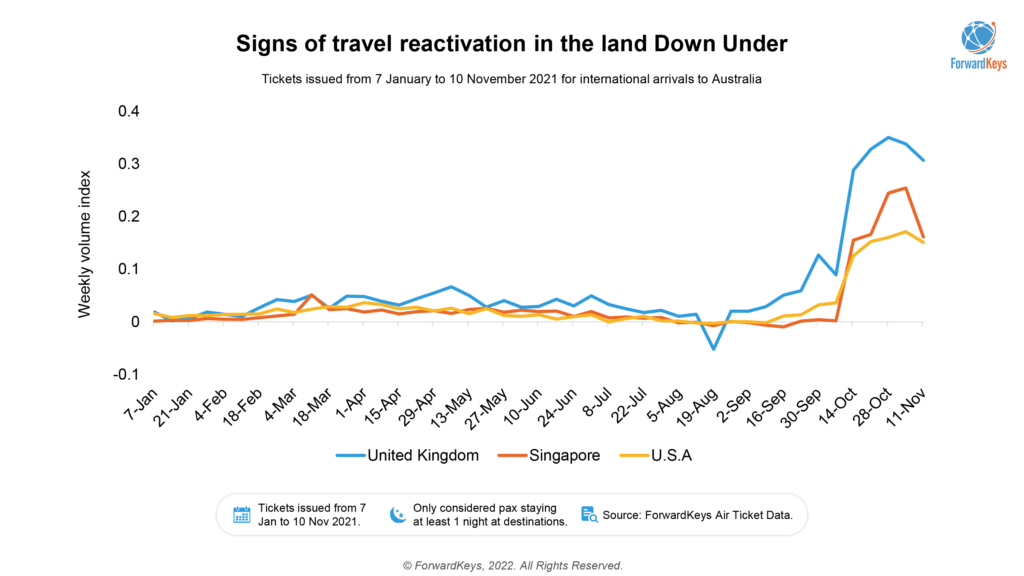

Let’s do this exercise with Australia, a country that has applied very strict travel restrictions until its reopening in November. From the moment the Australian government announced a reopening date, we could see a rapid acceleration of bookings from key source markets like the UK, Singapore, or the US. This shows that pent-up demand was there all along and only waited for a clear signal from the authorities to be released. In the case of Australia, this signal took a long time to come, but in other destinations, it came much faster and this, too, provided us with some precious insights about pent-up demand.

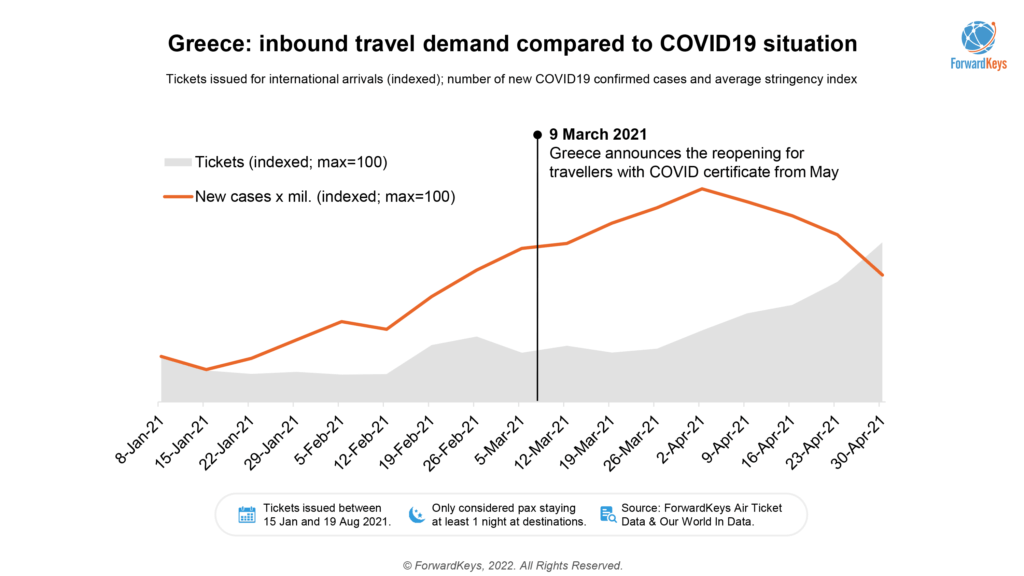

Take Greece, for example. Last March, the Greek government announced a reopening of the country to travellers with a Covid certificate. At the very same time, the number of covid cases in Greece was rising at an alarming rate. Given that this rebound of the pandemic was all over the news in Greece’s key source markets, it is fair to assume that people knew about this situation and yet, the number of international tickets to the country grew at a very fast pace, which made Greece one of the success stories of last summer.

What this teaches us is that even when the Covid situation is getting worse, people still want to travel. What stops them is how governments react to the evolution of the pandemic. If they make sure that their country is open for business, the strength of travel demand is such that they will see travellers flying their way.

European performance overview Winter 2021/22

Based on December’s intra-European traveller data, winter 22 tourism is in for a bumpy ride.

While the recovery numbers for December are higher than in November 2021, it changed gears amid the rapid spread of Covid in many countries and the concerns over the Omicron variant.Many countries re-introduced restrictive travel measures like pre-testing requirements, limiting the potential travel for the Christmas and New Year holiday period. Airlines have been scaling down their schedules for the winter season, which will surely affect January’s results. The end of 2021 (and the wide spread Omicron variant) reminds us that vaccines are not the end of the crisis, but just another step towards recovery.

Echolution takeouts:

Travel retail brands can look ahead, plan and forecast their seasonal campaigns with the benefit of traveller profiling tools, plus data courtesy of ForwardKeys.

Despite the Omicron variant’s impact on travel plans in the last month of the year, winter 2022 will see pent-up demand return as the new year unfolds. As more countries open up and reduce travel restrictions, traveller confidence is likely to grow, resulting in airlines scaling up once again with new schedules for the spring and summer holiday periods.

Combined with a range of demographic insights and traveller profiling tools, more effective marketing is possible for brands eager to plan campaigns for the major travel trends emerging strong for 2022: domestic travel, business travel returning, popular tourism destinations in APAC and consumer confidence in the market due to pent-up demand.