61% of Americas travellers are likely to pre-order online and collect upon boarding/arrivals

New market research on duty free shopper behaviour from m1nd-set shows an uptick in travellers’ attitudes to pre-trip online planning for purchases in travel retail.

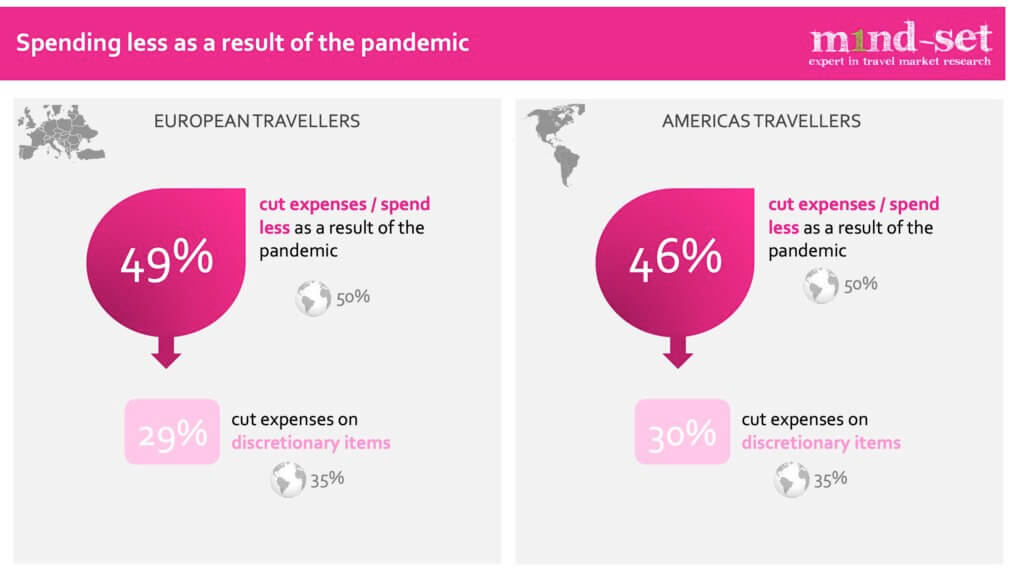

In the second part of the travel retail specialist’s regional analysis on Covid-19 recovery shopping behaviour, research shows for travellers from the Americas and Europe, the impact of the pandemic appears to have been lesser than for the Middle East, Africa and Asia Pacific.

Less than half (48%) of travellers from the Americas and 54% of European travellers said they had been impacted negatively, lower than the global average of 55%, and lower than for travellers from the MEA and Asia Pacific regions.

Around a quarter (24%) of travellers from the Americas said they had been impacted positively compared to only 11% of European travellers significantly lower than the global average 17%. 26% of travellers from the Americas also said that Covid had a positive impact on their household income, compared to 17% of travellers globally and only 11% of Europeans.

Online touch points

mind-set’s latest research continues to feed into a pandemic-fuelled tendency among all shopper segments to shop online, pre-order, click and collect, which has grown significantly. It is interesting and important therefore to monitor the efficacy of online advertising and promotions as well as the brands’ and retailers’ own websites, notes the firm.

While nearly all travellers globally said they saw online promotions and adverts, Americas and European travellers are more sensitive to billboard adverts than travellers from other regions.

The main touch points noticed by European travellers include online adverts (36% vs 30% globally), as well as the websites of the duty free shop, the brand and high street store website. Around one third of travellers from the Americas notice communications about the duty free shop offers while in the process of booking the trip, as well as by looking on the duty free shop website, or via online adverts. One quarter said they saw information on the brand’s official website, while 23% said they saw posts on social media about the duty free shops.

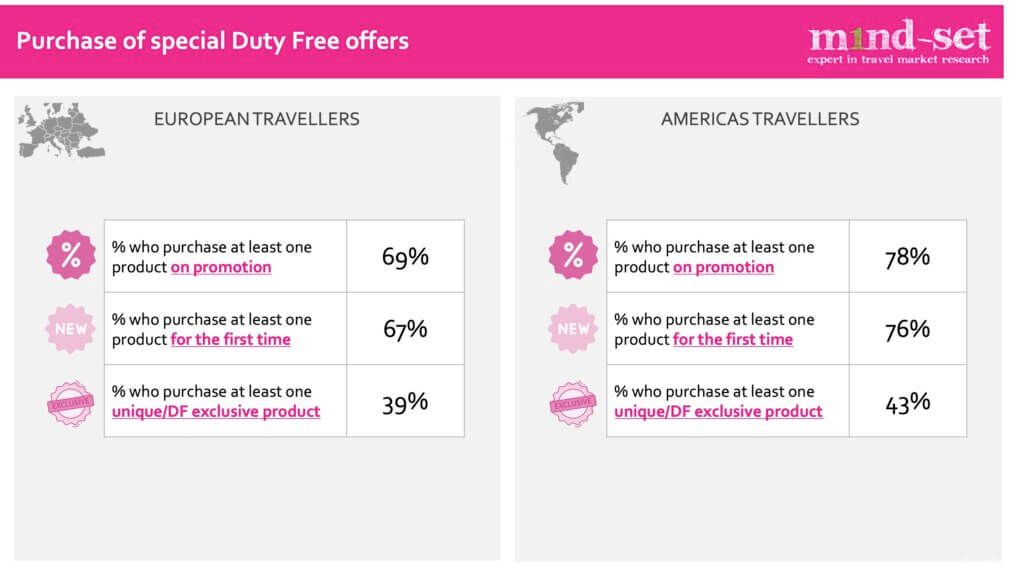

Around three quarters of shoppers from the Americas and just less than two thirds of European shoppers said they compare prices, with just over one fifth of travellers from both regions comparing prices online. Around six out of ten shoppers from both regions said they are likely to shop for duty free products online and collect on arrival or at the departure gate if this service is offered.

Shoppers from the Americas are particularly sensitive to the promotions available with nearly 8 out of 10 shoppers from the region purchasing a promotion, higher than the global average of 73%. Americas shoppers also have above average tendency to purchase products they have never bought before, (76% vs 72% globally). They seem to be less interested in purchasing travel retail exclusives than travellers globally though, as 43% of shoppers from the Americas region purchased a TR exclusive compared to the global average of 45%.

Shopping and spending behaviour

In terms of spend levels – within the duty free store – both the Americas and European travellers tend to spend less than their peers from Asia Pacific and the Middle East and Africa and below the global average of US$168. Shoppers from the Americas tend to spend US$ 163.50 in the duty free shops, while Europeans spend even less: US$150.

In terms of categories visited, shoppers from the Americas have a higher-than-average tendency to visit Fashion & Accessories (28% vs 24%), Skincare (27% vs 25%), Electronics (23% vs 21%) and Jewellery & Watches (22% vs 20%). European travellers have a higher-than-average tendency to visit Perfumes (41% vs 40%), Alcohol (33% vs 30%), Tobacco (27% vs 25%) and Confectionery (27% vs 24%).

Echolution takeout:

With around a quarter (24%) of travellers from the Americas reporting that they have been impacted positively economically by Covid, compared to only 11% of European travellers, the former traveller group represents a significant opportunity for travel retail brands to target them pre-trip.

Combined with progressive attitudes of this traveller group to embrace data-led marketing messages and choose convenience-driven shopping options such as pre-trip booking with click and collect upon arrival, travellers from the Americas are ideal for brands to test out new forms of campaign engagement as part of the traveller purchase journey.