A round-up of this year’s luxury brand marketing activity and latest traveller trends news for the Lunar New Year holiday in travel retail.

Luxury brands have charged their domestic marketing activity for the Year of the Tiger spring holiday with both physical and digital brand engagement techniques – from tiger tail art installations IRL to limited edition NFTs in the metaverse.

DFS, Glenfiddich, Johnnie Walker, Martell, YSL Beauté and L’Oréal Paris are highlight brands for travel retail that are embracing new disruptive technologies, digital shopping interactions or limited-edition artist collaborations to celebrate the courageous Year of the Tiger, as many Chinese travellers stay at home for a third year in a row.

Leading travel retail brands are increasingly facing the challenges of how to reach digital-natives and Gen Z or Millennial consumers that shop online and respond to brands investing in the metaverse.

Metaverse influencers

LVMH-owned travel retail specialist, DFS has made its move into the metaverse with a dedicated virtual influencer campaign, hosted by Reddi and Vila, who help customers celebrate Lunar New Year with gifting ideas Together, DFS says in a statement, they have combined metaverse technology with innovative marketing concepts to become trending influencers, partnering with leading brands in luxury retail.

The retailer invited Reddi and Vila to be DFS Chief Gifting Officers, starring in a digital film inspired by the beauty of Chinese tradition and deeper meaning of gifting. From January through March, the pair of are representing DFS to its customers by making traditional Lunar New Year gift recommendations through Weibo, WeChat, Little Red Book, and sharing innovative digital ways to unlock gifts in store. DFS said that the move “marks the opening of a new digital marketing frontier for DFS, timed to welcome the Year of the Tiger and to introduce DFS customers from around the world to a new era of virtual reality”.

NFT exclusive

Glenfiddich is marking Chinese Lunar New Year with the launch of 200 limited-edition non-fungible tokens (NFTs). Each NFT purchased is linked to a physical bottle of the renowned liquor brand’s 21-year-old Reserva Rum cask single malt Scotch whisky, and serves as a digital receipt verifying ownership and authenticity. The NFTs are rolling out on BlockBar, the world’s first DTC NFT marketplace for wines and spirits.

The Glenfiddich release for Lunar New Year is one of a trilogy designed by renowned illustrator Rlon Wang, reports The Moodie Davitt Report. Wang’s latest design carries a spotlight on the brand’s iconic stag, and the NFTs exclusive to BlockBar feature an extended limited-edition design. Upon purchase, the buyer can also unlock exclusive content including a JPG of the complete artwork from Rlon Wang, individual digital illustrations of the icons that make up the overall design and a Golden Stag GIF that can be used to obtain early access to the next Glenfiddich launch via BlockBar.com.

William Grant & Sons Global Luxury Director Will Peacock commented: “We’re delighted to launch our first ever Chinese New Year NFT with BlockBar.com to help mark the Year of the Tiger. This limited-edition bottle design is inspired by the final of the trilogy series with Rlon Wang which celebrates the endless possibilities for 2022, and we’re pleased to share this sentiment with two hundred lucky customers.”

Limited edition liquor

Martell and Johnnie Walker have also both launched travel retail exclusive products for the premium spirits gifting market this Lunar New Year.

For its Chinese New Year special edition, Pernod Ricard has launched ‘The Audacious Voyage’ Martell Cordon Blue cognac available in Asia’s key airport and downtown duty-free retail locations.

While Diageo-owned Johnnie Walker has partnered with artist Shan Jiang to release a limited-edition Johnnie Walker Blue Label bottle for the Lunar New Year celebrations. Imagery on the blended Scotch whisky label pays homage to the tiger as a symbol of strength and progress, with the mammal showcasing wings to depict a famous Chinese idiom.

Luxury: culture trip

Louis Vuitton’s giant tiger tail art installation at its new flagship maison in Chengdu telegraphs a playful statement for the luxury brand’s commitment to this flagship store – its third in Mainland China. As Jing Daily notes, this is a cultural and community-led marketing move, designed to underscore its focus on the local audience in this important emerging market city destination.

Bottega Veneta has managed to successfully navigate a new era of culturally-led marketing, with its latest Chinese New Year campaign that focuses on the brand’s colour design cues as well as incorporating elements of localism through its art installations – notably its digital takeover of part of the Great Wall of China – the latest in a series of bold marketing statements, that puts the brand ahead of the pack amongst Chinese netizens, according to Jing Daily.

Beauty’s O2O downtown focus

YSL Beauté and L’Oréal Paris both have a laser sharp focus on the power of downtown digital marketing to target travel retail customers for this Lunar New Year, according to specialist agency 2.0 & Partners, that says these powerhouse beauty brands have relied on omnichannel activities in Hainan to celebrate Chinese New Year.

The YSL Beauté and CDFG activation at Haikou Mova Mall is a good example of how brands are increasingly investing in O2O (online + offline) approach to deliver consistent engagement and a desire to drive experiences more than sales. This brand pop-up is a fully-engaging experience for shoppers with “retail expression and brand retailtainment” at its centre. There’s a 3D room with animated greetings courtesy of a digital tiger that takes photo opportunities to the level expected by young digital-savvy shoppers. Elsewhere, a fortune telling game taps into the gaming trend and the livestreamed music show elevates the retail location beyond the realms of a store into something that visitors want to experience for themselves.

Similarly, in collaboration with China Duty Free Group (CDFG), L’Oréal Paris unveiled a digital-first L’Oréal Paris Maison pop-up in Hainan, featuring the brands’ newly launched Revitalift Serum and designed to coincide with the Lunar New Year holidays. Here, shoppers receive an invite to the pop-up as they arrive on the island, which creates the sort of tailored and exclusive service which modern shoppers desire. The celebration continues at touchpoints across the island, all leading to the butler service at the pop-up itself to create a true experience for guests.

High(er) spirits in Hainan

There is potential for increasing duty-free drinks sales among Chinese residents visiting Hainan if they knew how to buy more, according to new data from specialist market research firm m1nd-set, reports The Drinks Business.

Chinese holidaymakers visiting Hainan who are on the lookout for duty-free drinks could be spending more, including buying up cognacs, if drinks brands were marketed to them before and after their trip, reports market research company m1nd-set, suggesting there is still headroom for further sales in the area.

According to the research, a significant portion of shoppers in Hainan are still not taking advantage of their full duty-free allowance, either on site or following the trip, and could still be using their post-trip online purchasing allowance and home delivery services.

Anna Marchesini, head of business development at m1nd-set says: “When it comes to alcohol specifically, 45% of alcohol buyers used their full alcohol allowance of 1.5L”.

The findings showed that the reason the potential still existed was largely based on how consumers looking at buying drinks tended to be influenced by impulse within duty-free retail and yet footfall could still be boosted online and via delivery options at other times.

Surging cognac sales

Time then for luxury spirits brands to up their premium cognac and whisky game in time for the Lunar New Year gifting opportunity. And just off the back of news that cognac sales surged in China last year, according to industry group BNIC, that reported to Reuters sales rose there by 56%, in the latest sign premium drinks makers such as Pernod Ricard are putting the pandemic behind them.

Pernod Ricard’s Martell has responded with a series of Chinese New Year themed retail activations – first in Hainan in 2021 for the ground breaking Maison Martell pop-up, featuring a host of interactive digital customer engagement touchpoints. This was followed by this year’s L’Atelier Martell Hong Kong boutique, with a modern and immersive take on an historic storytelling brand experience, which is described as pure retail theatre and designed to appeal to Asia’s digitally-savvy and future cognac consumers.

Travel trends

This Lunar New Year has been marked by continued travel restrictions across Chinese provinces and dampened domestic traveller numbers, as the Chinese government remains wary of rising Omicron or Delta variant cases ahead of the Winter Olympics, due to be hosted in Beijing beginning 4 February.

This year, China’s Ministry of Transportation expects 1.18 billion trips to be made during the Lunar New Year travel season, a 35% increase from last year – but still much lower than the 3 billion trips taken in 2019 before the pandemic. According to media reports, such as this CNN news, local authorities are again discouraging residents from traveling to curb the spread of the coronavirus – especially the highly transmissible Omicron variant.

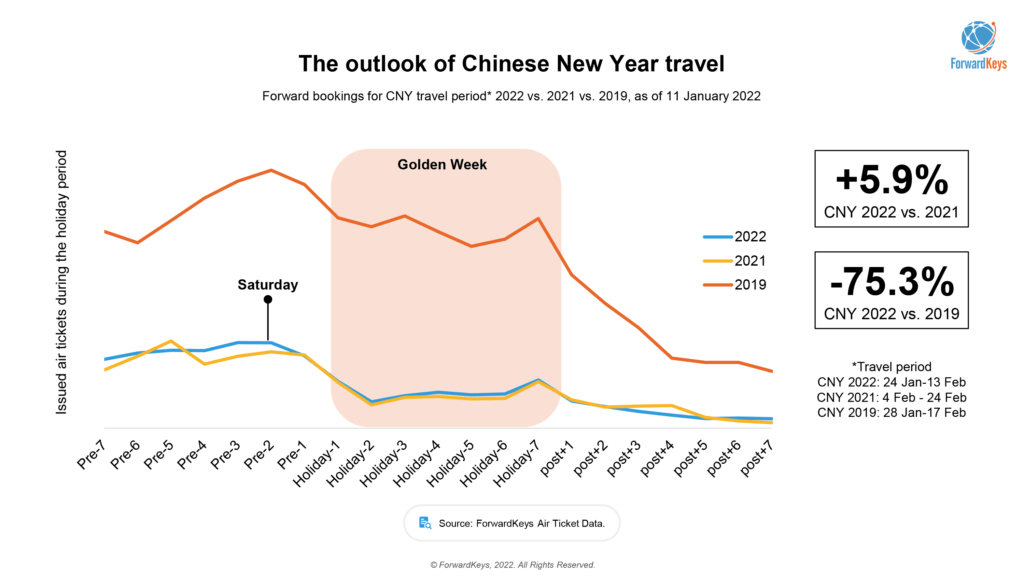

While domestic travel in China has been slowly returning to normal levels, ForwardKeys reveals the recent lockdowns in China have cast a long shadow over Chinese New Year travel plans.

The latest data (as of 11 January), show flight bookings for the holiday period, 24 January – 13 February, were 75.3% behind pre-pandemic levels but still ahead by 5.9% of last year’s dismally low levels.

Last-minute booking is the new normal

In addition to Omicron-related travel restrictions, government advice on New Year travel has been an influential factor in dampening demand, says ForwardKeys.

Last year, many local authorities advised people to “stay put”. This year, the advice was a little more lenient, with people advised to protect their health while travelling. That allowed people the flexibility to wait and see how things developed and the possibility to make a last-minute booking. The lead time for flight bookings has shortened dramatically during the pandemic, says ForwardKeys – around 60% of bookings on Chinese domestic flights are made under four days of departure, comments the firm, adding that a last-minute surge for Chinese New Year was entirely possible.

“We have seen travel bouncing back strongly, as soon as travellers feel the risk of becoming stranded in an area of infection has receded,” comments Bing Han Kee, VP of Sales (APAC) at ForwardKeys.

Top Chinese New Year destinations

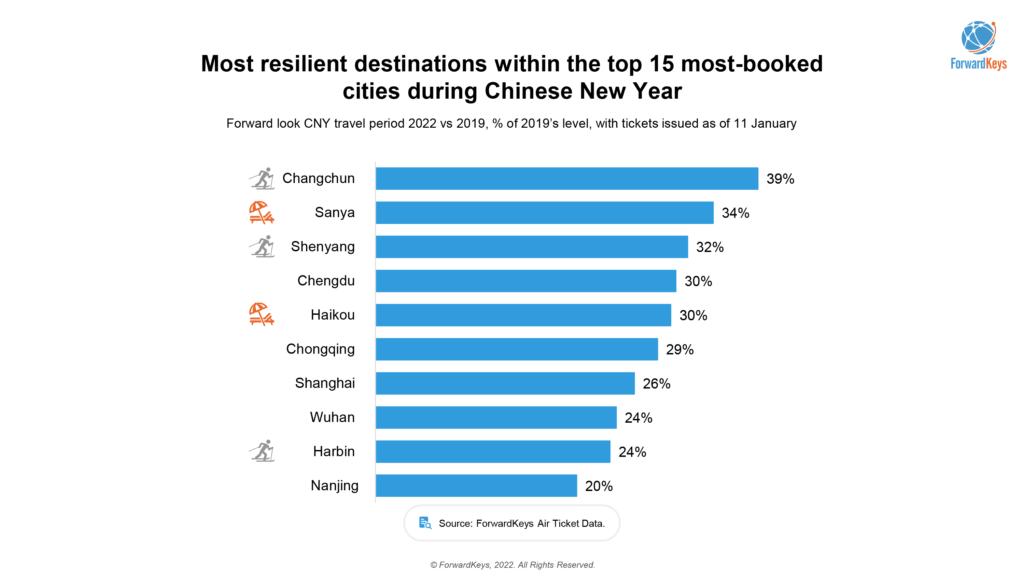

Analysis of the most-booked destinations reveals that leisure travel is the light in what would otherwise be a gloomy outlook.

Among the top 15, the most resilient destinations are Changchun, reaching 39% of pre-pandemic levels; Sanya, 34%; Shenyang, 32%; Chengdu, 30%; Haikou, 30%; Chongqing, 29%; Shanghai, 26%; Wuhan, 24%; Harbin 24% and Nanjing, 20%.

Sanya and Haikou, which are both located on Hainan, have seen consistent growth in popularity throughout the pandemic, fuelled by China’s ban on international travel and special tax treatment on the sale of luxury goods.

Changchun, Shenyang and Harbin contain numerous winter sports resorts – snow holidays have been a major campaign driven by the Chinese authorities ahead of the Beijing Winter Olympics. Harbin is still in the top 15 list even though it was affected by a Covid-19 outbreak in December.

“Throughout 2021, travel bounced back strongly as soon as restrictions were lifted, with shorter lead times. I am also impressed by the strongly growing enthusiasm for winter sports, which I am sure has been encouraged by publicity surrounding the upcoming Winter Olympics in Beijing,” comments Kee.

And just ahead of the 2022 Winter Olympics event, snow tourism was predicted to be a domestic travel highlight during the Chinese New Year week-long holiday break. This trend has been reflected in rising hotel and ski ticket booking numbers according to the Global Times, that reported ski resorts in Zhangjiakou have become sold out as winter sports activities gain popularity.

Echolution takeout:

For luxury, liquor and beauty brands operating in the duty free travel retail marketplace, understanding where and when targeted digital or omnichannel marketing activities should be taking place, will be key to growth as travellers resume travelling – either domestically or internationally.

Lunar New Year marketing in Asia pushes new boundaries and is at the forefront of digitally progressive marketing in the travel retail market. This seasonal activity shows brands that by talking to travellers pre-trip and in market creates higher brand awareness and more likely scenarios for shopper conversion. Using Echolution’s suite of traveller data tools – such as travel bookings courtesy of partner agency ForwardKeys – provides greater niche targeting opportunities.