This year’s Eid al-Fitr festival has seen a regional shift for holiday travel bookings.

Celebrated by millions of Muslims across the globe, Ramadan is observed every year during the ninth month of the Islamic lunar calendar from mid-April to mid-May. For many, the end of Ramadan Eid al-Fitr festival is traditionally celebrated with overseas travel trips. 2021 has seen a more localised travel focus due to pandemic restrictions, but there is pent-up demand for regionalised travel.

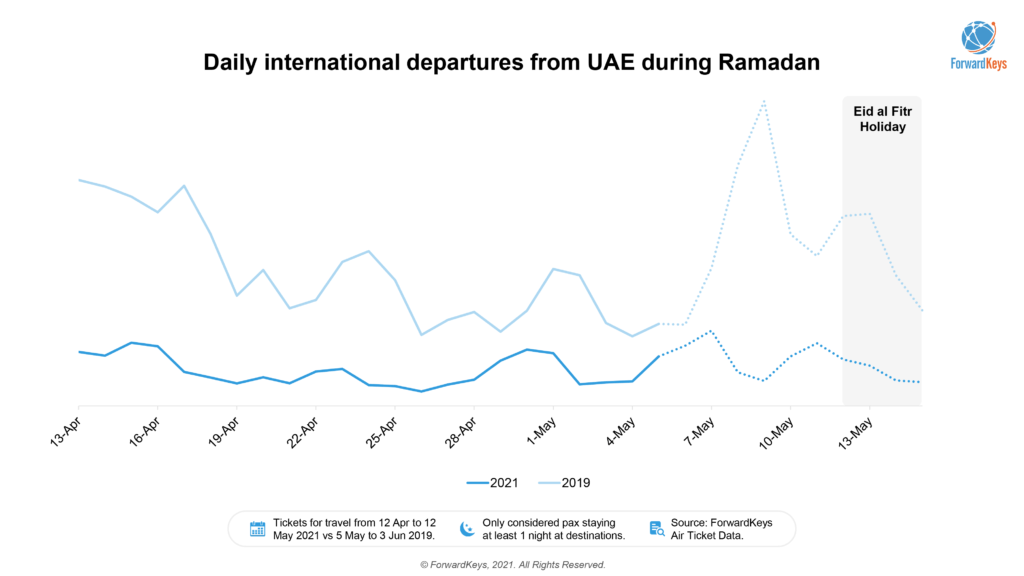

“This year the trend for Ramadan travel from the UAE shows smaller picks of travel at the beginning and towards the end of Eid,” says Juan Gomez, Insights Expert at travel analytics firm, ForwardKeys.

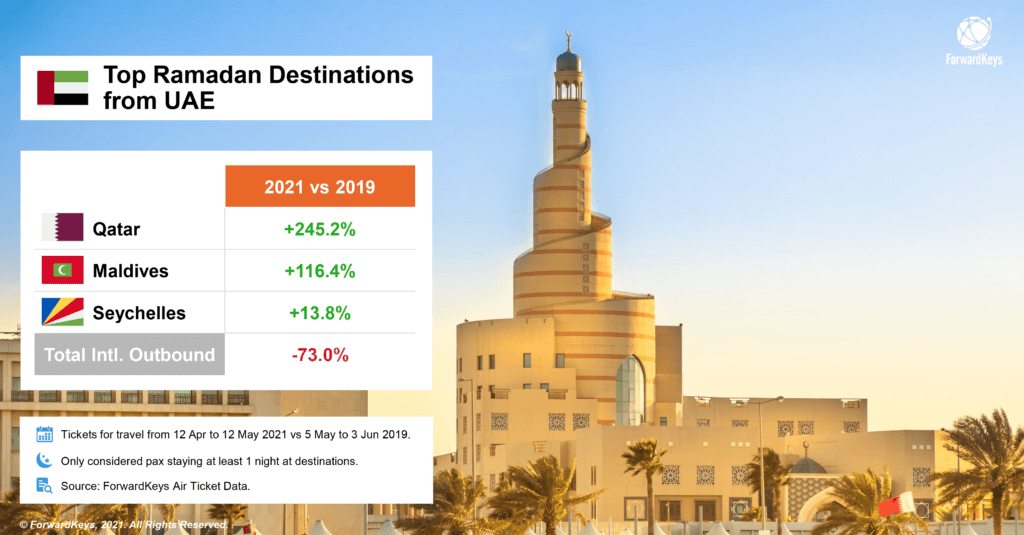

“Traditionally, the beginning and end of Ramadan have the largest number of travellers out from the UAE. The biggest peak is usually just before the Eid al-Fitr holiday. Covid-19 has meant that volumes are much lower than usual, with all international departures from UAE during the month of Ramadan down by 73%, but it has also flattened the usual peaks.”

Ramadan travel this year is much closer to home, suggests Gomez, who adds Doha features heavily due to the airport’s ramped-up regional seat capacity.

Meanwhile tropical bliss has been on the agenda for many Emiratis this year, who have been flocking to Seychelles and the Maldives, up by 116% and 14% compared to 2019 Ramadan respectively. Saudi Arabia and other typical destinations do not make a significant appearance in outbound travel this year, according to the latest data from ForwardKeys.

Inter-regional shift

The traditional Ramadan period overseas break for Eid al-Fitr is seeing a regional shift due to the pandemic impact on global travel.

Middle East travel trends are returning at a ‘strong pace’ according to a new report by Skyscanner that has looked at this year’s top destination trends for Eid al-Fitr.

The top searches for UAE and Saudi travellers during the holiday period included Cairo, Amman and Alexandria for families plus Maldives and Mauritius for couples. For UAE travellers, staycations were still a priority, with Abu Dhabi, Fujairah or Ras Al Khaimah proving popular.

“We are seeing bright lights on the horizon for MENA outbound travel, with pent up demand for travel for UAE and Saudi Arabian travellers being particularly prolific,” says Ayoub El Mamoun, Global Travel Expert at Skyscanner. On the travel booking platform, interest in both regional and international flights increased from UAE travellers, with a lift of 23% in searches and from Saudi travellers, where there was an increase of 110% in searches from February to March of this year, according to El Mamoun.

Taking a closer look at domestic travel hotel bookings within the UAE for Eid al-Fitr this year, Dubai retains its top ranking with the highest volume of searches at 66% compared to 58% in 2019, according to traveller data specialist Sojern. One difference to note is that in 2019, Abu Dhabi was the third most popular emirate with regards to domestic travel intent, and has now risen to second place, taking the place of Ra’s al Khaymah.

And looking at travel intent for the Eid al-Fatir period, Sojern found the majority of travellers were also looking for shorter stays this year, with 80% of searches being for a duration of zero to three days in 2021. When comparing to 2019 this is a 21% increase in travel intent for trips of this length. There has been a clear shift in traveller behaviour compared to the trends seen pre-pandemic for this holiday period: domestic travel is in higher demand, comments Sojern, reflecting travel restrictions and local Covid regulations, with Dubai being the most popular emirate for staycations this year.

However, in 2021, travel behaviours have undoubtedly changed. As international travel starts to resume due to global vaccines roll-out, the Middle East is on its way to becoming more of a tourism destination in its own right, due to unprecedented reforms in the region, suggests a report by AlJazeera. This is down to relaxed visa requirements, shifting politics, and new transport connections that promise to draw more visitors to the region, which before the pandemic had the fastest-growing rate of international arrivals and double the global average, according to the United Nations’ World Tourism Organization.

Friends & Relatives

According to aviation analytics firm OAG, traffic patterns for the VFR (Visiting Friends & Relatives) passenger category, provide key indicators of long-haul travel trends in the absence of traditional leisure passengers.

Tracking global diaspora movements, the second largest migrant population is Indians living in the UAE, and there are sizeable populations in Saudi Arabia, Oman, Kuwait and Qatar. While these are not long-haul markets, travel flows between India and these countries have in the past supported the overall business model for the Middle East hub airports such as Dubai (DBX), Abu Dhabi (AUH) and Doha (DOH), and will do so once again.

Currently the Middle East hubs are operating only 50% of the capacity that they were two years ago (DXB -50%, AUH -57%, DOH -43%).

Interestingly, capacity from Dubai in April 2021 to South Asia, which includes India, is currently only 14% below where it was in April 2019 while capacity to destinations within the Middle East is 56% below where it was. This could be another indication of how migrant workers and the need to travel home is able to support air travel markets on the road to recovery for post-pandemic global travel, suggests OAG.

Echolution takeout:

As one of the most important luxury shopper demographics, Middle East travellers are likely to be one of the first to return to international travel based on the region’s early adoption of digital vaccine passports roll-out and high numbers of populations in the region (ie UAE and Israel) receiving a Covid vaccine.

Combined with pent-up demand for global travel as well as increasing appetite for inter-regional travel due to new transport connections and relaxed visa requirements, it’s worth targeting this luxury consumer with a multi-travel touchpoint digital focus.

“Middle Eastern travellers have always responded well to targeted forms of digital advertising. With a post-Covid mindset that is more pro-travel and health-conscious than most, this demographic is open and receptive to geolocation specific marketing that can capitalise on the latest destination trends as they emerge,” says Eamonn Leacy, founder of Echolution.